Core driving factors

Trump tariff revocation: US court ruled that "Liberation Day tariffs" were overreaching, trade policy uncertainty decreased, market risk aversion cooled, and gold was under pressure.

Expectations of Fed rate cuts weakened: The Fed was cautious about rate cuts, the US dollar strengthened briefly, but weak economic data (such as employment and PMI) limited the dollar's gains, and gold bottomed out and rebounded.

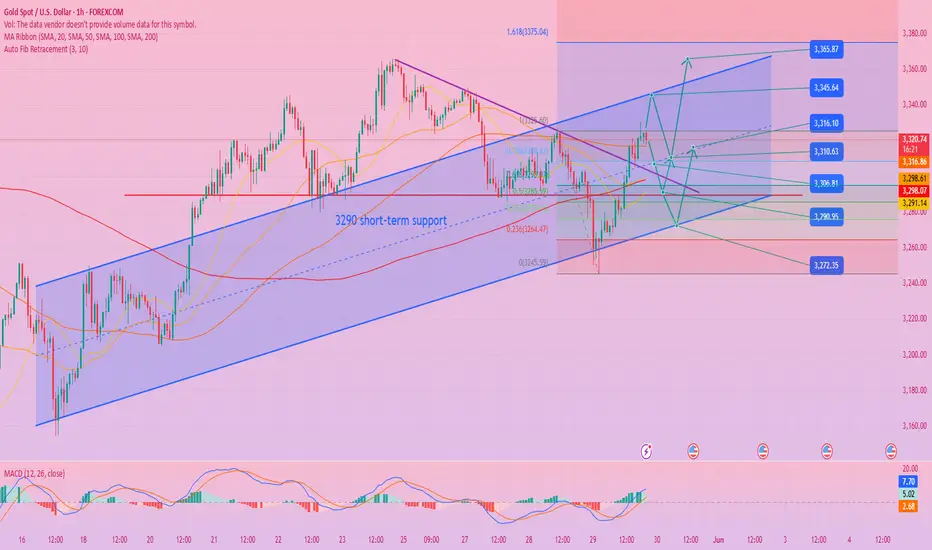

Technical oversold rebound: Gold prices fell to 3245 support and then quickly rebounded. Short-term bullish momentum is strong, but we need to be wary of overbought callback risks.

Key points

Resistance:

3335-3340 (key pressure zone, breaking through will open upside space)

3350-3360 (previous high resistance, strong pressure level)

Support:

3305-3310 (short-term long-short boundary, long position if stable)

3280-3270 (strong support if callback, weak if broken)

Technical signal analysis

Bollinger channel: 1-hour level opens upward, price runs along the upper track, short-term strong, but overbought risk increases.

Moving average system:

Short-term moving averages are arranged in a bullish pattern, supporting gold prices.

If it pulls back to 3305-3310 (near the 20-day moving average), it can be regarded as a low-long opportunity.

RSI indicator: close to the 70 overbought area, if there is a top divergence, be alert to the callback.

Operation strategy

1. Long strategy (main idea)

Entry conditions:

Price falls back to 3305-3310 and stabilizes (combined with K-line patterns such as hammer lines).

Or break through 3340 and then step back to confirm (light position to chase long).

Target: 3335-3340 (first target), 3350-3360 (second target).

Stop loss: below 3295 (to prevent false breakthrough).

2. Short strategy (auxiliary idea)

Entry conditions:

Price touches 3340-3350 stagflation (such as long upper shadow, RSI overbought).

Target: 3320, 3305.

Stop loss: above 3355.

Breakthrough response:

If it breaks through 3350 strongly, stop loss for short orders and wait and see whether the trend reverses.

If it falls below 3270, long orders will leave the market and look down to 3245 support.

Summary

Short-term trend: oversold rebound continues, but facing strong pressure at 3340, be wary of highs and falls.

Operation priority:

Mainly long at low levels (3305-3310 support area).

Short selling at high levels is auxiliary (3340-3350 pressure zone).

Position management: single transaction ≤5%, stop loss is strictly enforced to avoid chasing up and selling down.

Trade active

Latest gold trend analysis strategy:

Core influencing factors

Dollar trend: The rebound of the US dollar index suppresses gold prices, but if the PCE data is lower than expected, the US dollar may fall back and provide support for gold.

Fed policy expectations: The market's expectations of interest rate cuts this year (currently priced at about 2 times) may limit the downward space of gold prices, but we need to be wary of hawkish rhetoric disturbances.

Risk aversion: Trade situation and geopolitical uncertainty may intermittently boost gold demand.

Technical key positions: $3300-3310 is a strong resistance zone, and $3260-3250 is short-term support.

Market outlook

Bearish signal:

The daily level failed to stand firm at the 3300 mark, and the 1-hour moving average turned downward, with short-term momentum biased to the bearish side.

If the US dollar continues to rebound or the PCE data is stronger than expected, the gold price may fall to the 3260-3250 support range.

Bullish signal:

If PCE data is weak or risk aversion heats up, gold prices may test the 3300-3315 resistance zone again.

Under the wide range of fluctuations at the monthly level, the buying support below 3260 may be strong.

Operation strategy

Short-term trading:

Short-term opportunity: When the rebound to the 3305-3315 range is under pressure, short with a light position, stop loss above 3320, target 3280-3265.

Long order opportunities: If it pulls back to the 3260-3250 area and stabilizes (such as the K-line shrinks or a hammer line appears), you can try long orders with a stop loss of 3240 and a target of 3280-3300.

Mid-term layout:

If it effectively falls below 3250 at the beginning of next week, it may open up the downward space to 3220-3200; on the contrary, if it stands firm at 3315, it will look up to 3340-3360.

Risk warning:

Market volatility may increase after Friday's PCE data, so be alert to rapid reversals.

Avoid chasing ups and downs, and pay attention to changes in volume near key positions.

Key points

Resistance: 3305-3315 (strong if broken), 3340 (previous high)

Support: 3280 (intraday), 3260-3250 (strong and weak boundary), 3220 (medium term)

Summary: Gold is short-term technically bearish, but fundamental support is still there. It is recommended to treat it with a volatile mindset, focus on the breakthrough direction of the 3300-3260 range, and be cautious in holding positions before and after the data.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.