Gold Market Update: Bulls Still in Control?

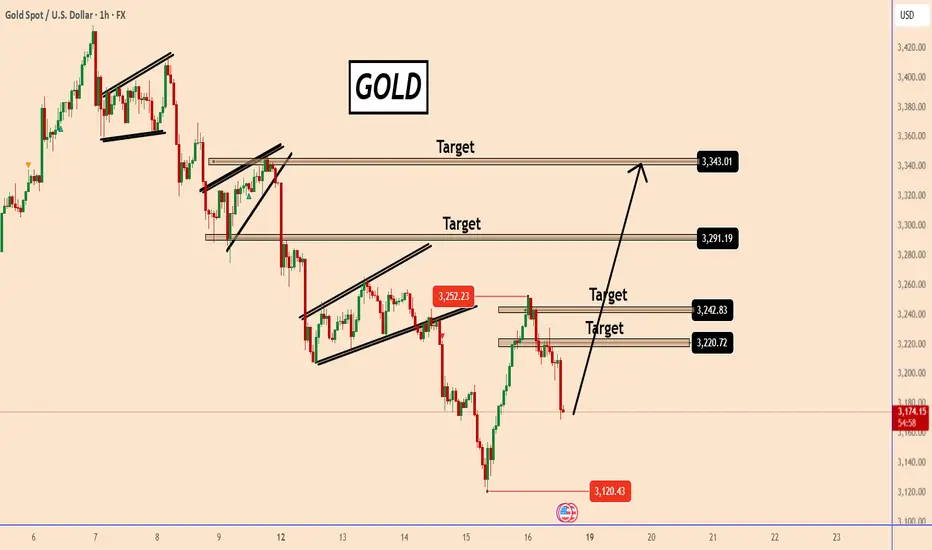

Gold has been volatile, requiring close attention. Following our previous analysis, gold declined from its last bearish pattern, dropping from 3230 to 3120.

However, yesterday it rebounded sharply, surging from 3120 to 3251 despite the absence of any news—an indication that bullish momentum remains strong.

The predominant trend is solid, but heavy manipulation and the substantial holdings by central banks and hedge funds continue to prevent a deeper decline.

The chances remain high that this movement is part of a bearish correction. While it may look unstable, but another rise could still be possible.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Gold has been volatile, requiring close attention. Following our previous analysis, gold declined from its last bearish pattern, dropping from 3230 to 3120.

However, yesterday it rebounded sharply, surging from 3120 to 3251 despite the absence of any news—an indication that bullish momentum remains strong.

The predominant trend is solid, but heavy manipulation and the substantial holdings by central banks and hedge funds continue to prevent a deeper decline.

The chances remain high that this movement is part of a bearish correction. While it may look unstable, but another rise could still be possible.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Trade active

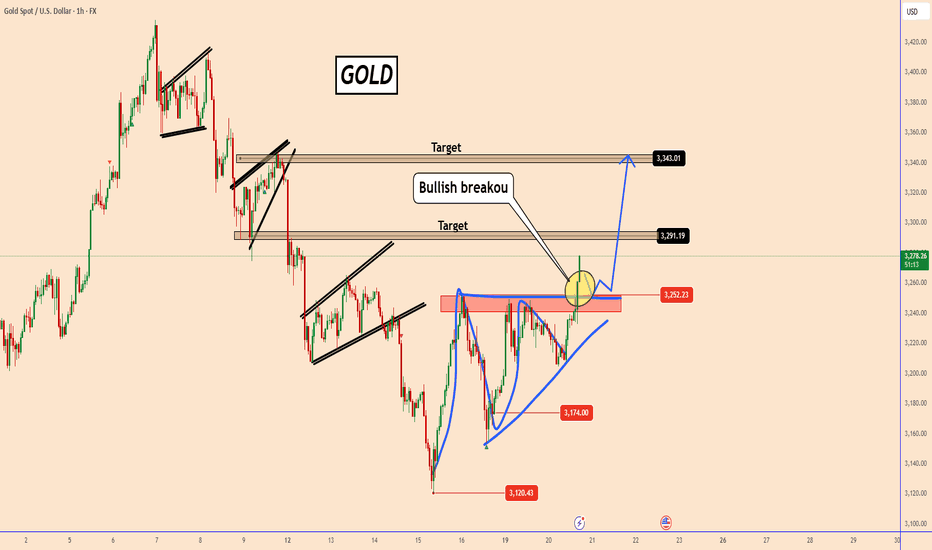

GOLD : Bullish Outlook - Nothing Changed

From our previous analysis, gold rose by almost +0.9% from 3174 to 3202.80

This price reaction confirmed again that gold is probably on the verge of rising to resume the prevailing trend, despite the market not providing clear reasons.

The Ukraine-Russia deal is an old topic and I don't think it has much significance for the gold price. The US discussed this several times with good and bad deals and we didn't see gold following the news. In my opinion, gold should continue to rise more during the next week, as shown in the chart.

Targets remain the same 3220, 3242, 3291 and 3343

Note

From 3174 to 3243 :)Note

📣Gold’s Rally Continues – Strong Trend Amid Global Uncertainty 🎯Target Reached -> Since yesterday, gold has increased by nearly +1.53% from 3170 to 3320, maintaining its strong upward trend.

✅This rise isn't driven by the usual reasons, but several global problems are supporting gold’s strength:

1️⃣No progress in Ukraine-Russia peace talks.

2️⃣Israel’s threats of further escalation in Gaza, along with restrictions on humanitarian aid.

3️⃣Israel may strike Iranian nuclear sites, raising concerns about a larger conflict.

4️⃣Moody’s downgraded US debt due to rising interest costs and unsustainable debt growth.

Given these developments, gold could continue rising, possibly reaching 3400. However, caution is necessary in this volatile environment.

✅MY Free Signals

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅MY Free Signals

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.