In the early trading session this morning (May 21), the spot  XAUUSD suddenly skyrocketed in the short term, surpassing the $3,300/ounce mark for the first time since May 9. In addition, the price of WTI crude oil also skyrocketed, at one point increasing by 3%. US media reported that US intelligence agencies had detected that Israel was preparing to attack Iran's nuclear facilities.

XAUUSD suddenly skyrocketed in the short term, surpassing the $3,300/ounce mark for the first time since May 9. In addition, the price of WTI crude oil also skyrocketed, at one point increasing by 3%. US media reported that US intelligence agencies had detected that Israel was preparing to attack Iran's nuclear facilities.

After the price increase on the previous trading day, the gold price continued to skyrocket to $3,304.18/ounce in the early trading session on Wednesday in Asia. Because gold is considered a safe asset in times of geopolitical and economic uncertainty, new signs of geopolitical instability once again supported the increase in gold prices.

CNN reported Tuesday local time that several US officials told CNN that new information obtained by the US shows that Israel is preparing to attack Iran's nuclear facilities even as the Trump administration seeks a diplomatic deal with Tehran.

Such an attack would be a clear break with President Donald Trump, U.S. officials said. It could also spark a broader conflict in the Middle East, something the United States has tried to avoid since the 2023 Gaza war ratcheted up tensions.

The growing concern stems not only from messages from senior Israeli officials, both public and private, that Israel is considering such a move, but also from intercepted Israeli communications and observations of Israeli military activity that could indicate an Israeli strike is imminent, multiple sources familiar with the intelligence said.

Geopolitical factors also played a role in pushing gold higher, as the failure to reach a ceasefire between Russia and Ukraine and rising tensions in the Middle East could prompt investors to hold onto gold.

The dollar weakened on Tuesday after Moody's downgraded the United States' top triple-A credit rating. Fed officials were also cautious about the economic outlook, hurt by the downgrade. A weaker US dollar means gold becomes more attractive.

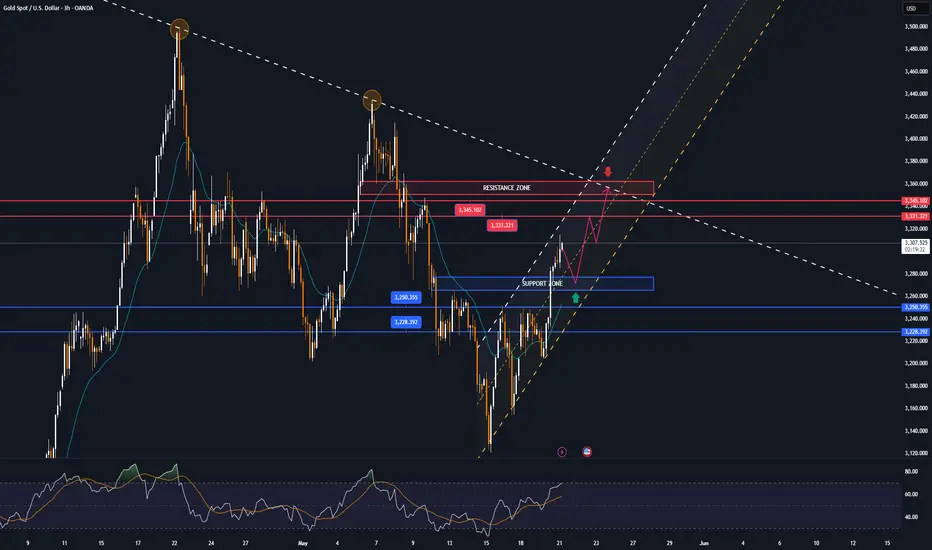

Analysis of the technical outlook for XAUUSD

XAUUSD

On the daily chart, gold surged to a technical confluence of key resistance formed by the location of the 0.382% Fibonacci retracement and the 21-day EMA. At this point, gold has not completely broken out of the price action around the $3,300 base point. If gold breaks above and sustains above the $3,300 base point, it will be in a position to continue to rise with a target of around $3,371 in the short term.

On the other hand, a sell-off below the 0.382% Fibonacci retracement would open the door for a retest of the $3,250 technical level followed by the 0.50% Fibonacci retracement.

Currently, the active position is not yet in line for a new bullish cycle. Therefore, the technical outlook for gold for the day is a retest of $3,250 in the short term, followed by $3,228.

The notable positions for intraday downside correction expectations are listed below.

Support: $3,250 – $3,228

Resistance: $3,331 – $3,345

SELL XAUUSD PRICE 3356 - 3354⚡️

↠↠ Stop Loss 3360

→Take Profit 1 3348

↨

→Take Profit 2 3342

BUY XAUUSD PRICE 3270 - 3272⚡️

↠↠ Stop Loss 3266

→Take Profit 1 3278

↨

→Take Profit 2 3284

After the price increase on the previous trading day, the gold price continued to skyrocket to $3,304.18/ounce in the early trading session on Wednesday in Asia. Because gold is considered a safe asset in times of geopolitical and economic uncertainty, new signs of geopolitical instability once again supported the increase in gold prices.

CNN reported Tuesday local time that several US officials told CNN that new information obtained by the US shows that Israel is preparing to attack Iran's nuclear facilities even as the Trump administration seeks a diplomatic deal with Tehran.

Such an attack would be a clear break with President Donald Trump, U.S. officials said. It could also spark a broader conflict in the Middle East, something the United States has tried to avoid since the 2023 Gaza war ratcheted up tensions.

The growing concern stems not only from messages from senior Israeli officials, both public and private, that Israel is considering such a move, but also from intercepted Israeli communications and observations of Israeli military activity that could indicate an Israeli strike is imminent, multiple sources familiar with the intelligence said.

Geopolitical factors also played a role in pushing gold higher, as the failure to reach a ceasefire between Russia and Ukraine and rising tensions in the Middle East could prompt investors to hold onto gold.

The dollar weakened on Tuesday after Moody's downgraded the United States' top triple-A credit rating. Fed officials were also cautious about the economic outlook, hurt by the downgrade. A weaker US dollar means gold becomes more attractive.

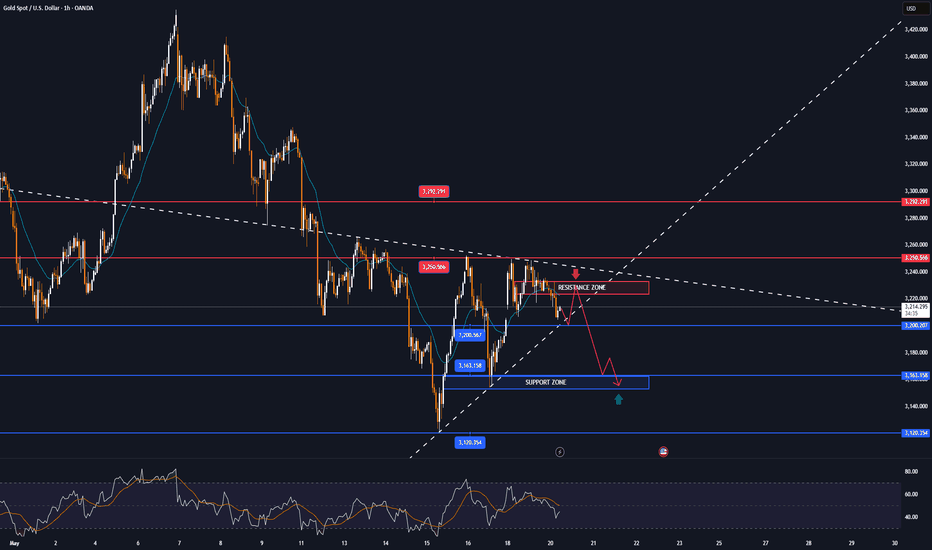

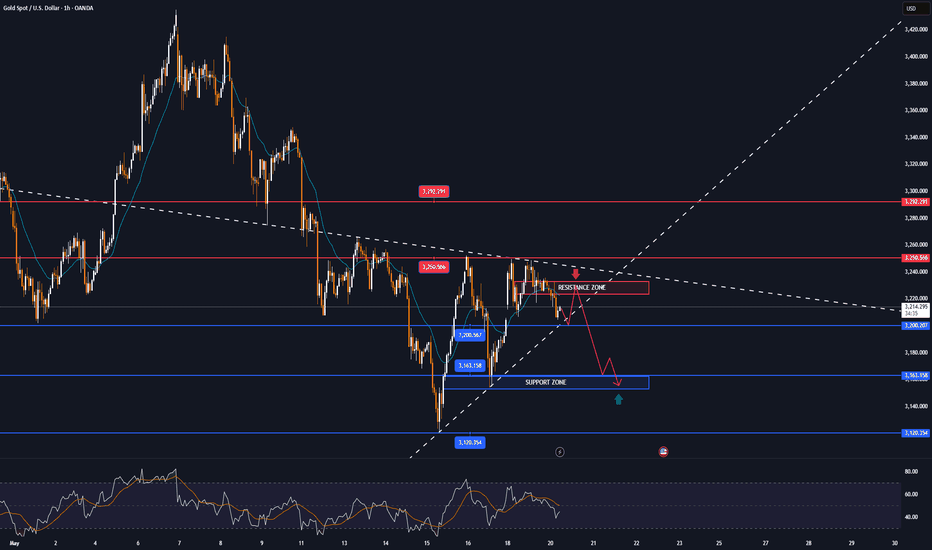

Analysis of the technical outlook for

On the daily chart, gold surged to a technical confluence of key resistance formed by the location of the 0.382% Fibonacci retracement and the 21-day EMA. At this point, gold has not completely broken out of the price action around the $3,300 base point. If gold breaks above and sustains above the $3,300 base point, it will be in a position to continue to rise with a target of around $3,371 in the short term.

On the other hand, a sell-off below the 0.382% Fibonacci retracement would open the door for a retest of the $3,250 technical level followed by the 0.50% Fibonacci retracement.

Currently, the active position is not yet in line for a new bullish cycle. Therefore, the technical outlook for gold for the day is a retest of $3,250 in the short term, followed by $3,228.

The notable positions for intraday downside correction expectations are listed below.

Support: $3,250 – $3,228

Resistance: $3,331 – $3,345

SELL XAUUSD PRICE 3356 - 3354⚡️

↠↠ Stop Loss 3360

→Take Profit 1 3348

↨

→Take Profit 2 3342

BUY XAUUSD PRICE 3270 - 3272⚡️

↠↠ Stop Loss 3266

→Take Profit 1 3278

↨

→Take Profit 2 3284

Note

Gold prices hover above $3,300/ozNote

According to technical analysis, gold is on the rise with the next resistance levels being 3,350 – 3,400 – 3,438 and could head towards the historical peak of 3,500 USD/oz if it does not fall below the support level of 3,300 USD.Note

Gold price turns down to below 3,310 USD/ozNote

▫️ Spot gold fell more than $16 in 15 minutes, back below $3,290 an ounce, down 0.14% on the day.Note

Gold price continues to increase strongly to nearly 3,330 USD/ozNote

* World gold prices turned around and increased sharply after Mr. Trump threatened to impose new import taxes.Note

Spot gold prices continued to fall, down $5 in the short term to $3,340 an ounce.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.