1. Technical Overview (15m timeframe):

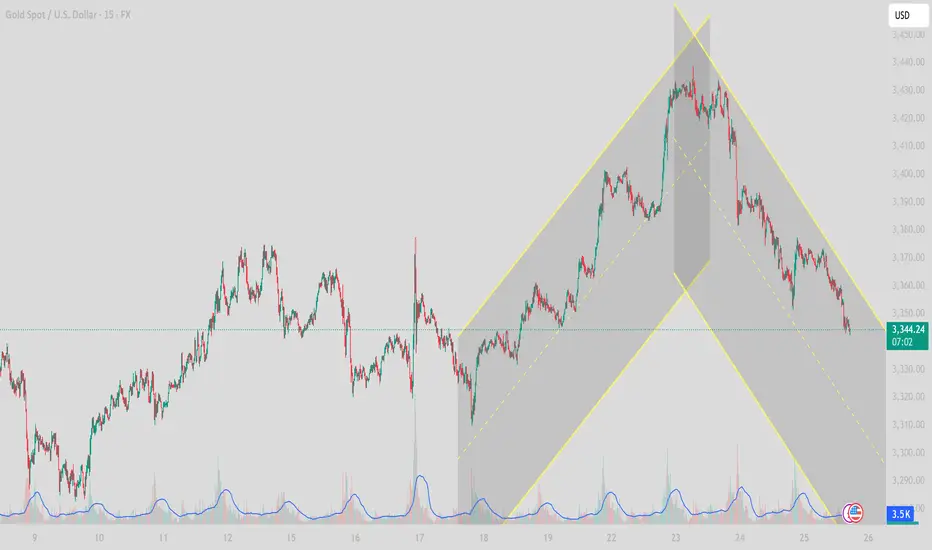

Gold (XAUUSD) is currently trading around 3,342.80, showing signs of continued downward momentum after forming a bearish reversal pattern from the 3,404–3,410 USD resistance area. The price action has now developed into a clear descending channel, with lower highs and lower lows forming in a structured manner.

2. Key Price Levels to Watch:

Immediate Support Zone:

🔹 3,335 – 3,330 USD – This zone aligns with previous structure and the lower bound of the descending channel. A break below this area could accelerate selling pressure toward deeper Fibonacci zones.

Next Major Support (Medium-term):

🔹 3,310 USD – A critical zone where price reacted strongly during the last pullback. A breakdown here would shift sentiment fully bearish in the short-term.

Resistance Levels:

🔹 3,358 – 3,360 USD: Minor intraday resistance near the upper bound of the descending channel.

🔹 3,375 USD: EMA21 and previous structure level.

🔹 3,404 – 3,410 USD: Major confluence resistance from recent highs.

3. Price Action and Indicators:

Descending Channel: Price is respecting the upper and lower trendlines of the bearish channel. No bullish breakout signal confirmed.

Volume: Decreasing on the bounce, rising on the decline – a bearish volume structure.

RSI: Near oversold (not shown, but implied from price exhaustion), could suggest a bounce, but no divergence confirmation yet.

EMA Trend: EMA21 and EMA50 (not shown but assumed from price slope) are likely crossing downward on higher timeframes, reinforcing bearish pressure.

4. Strategy Suggestion – Scenarios for Intraday Traders:

🔻 Scenario A – Continuation Short (Sell on Retracement)

Entry: Around 3,358–3,360 (upper bound of descending channel).

SL: Above 3,365.

TP1: 3,335

TP2: 3,310

Confirmation: Look for bearish engulfing or pin bar rejections on the 5m–15m timeframe.

🔺 Scenario B – Countertrend Long (Bounce from Channel Base)

Entry: Near 3,330–3,335 (support zone).

SL: Below 3,325.

TP1: 3,350

TP2: 3,360

Note: This is a riskier trade and should only be taken with bullish reversal confirmation (hammer, bullish divergence on RSI, or break of structure on LTF).

5. Summary:

Gold is currently in a short-term bearish correction, respecting a well-defined descending channel. Price is approaching a critical support zone (3,330–3,335), where a potential intraday bounce may occur, but trend remains bearish unless a clear break

Gold (XAUUSD) is currently trading around 3,342.80, showing signs of continued downward momentum after forming a bearish reversal pattern from the 3,404–3,410 USD resistance area. The price action has now developed into a clear descending channel, with lower highs and lower lows forming in a structured manner.

2. Key Price Levels to Watch:

Immediate Support Zone:

🔹 3,335 – 3,330 USD – This zone aligns with previous structure and the lower bound of the descending channel. A break below this area could accelerate selling pressure toward deeper Fibonacci zones.

Next Major Support (Medium-term):

🔹 3,310 USD – A critical zone where price reacted strongly during the last pullback. A breakdown here would shift sentiment fully bearish in the short-term.

Resistance Levels:

🔹 3,358 – 3,360 USD: Minor intraday resistance near the upper bound of the descending channel.

🔹 3,375 USD: EMA21 and previous structure level.

🔹 3,404 – 3,410 USD: Major confluence resistance from recent highs.

3. Price Action and Indicators:

Descending Channel: Price is respecting the upper and lower trendlines of the bearish channel. No bullish breakout signal confirmed.

Volume: Decreasing on the bounce, rising on the decline – a bearish volume structure.

RSI: Near oversold (not shown, but implied from price exhaustion), could suggest a bounce, but no divergence confirmation yet.

EMA Trend: EMA21 and EMA50 (not shown but assumed from price slope) are likely crossing downward on higher timeframes, reinforcing bearish pressure.

4. Strategy Suggestion – Scenarios for Intraday Traders:

🔻 Scenario A – Continuation Short (Sell on Retracement)

Entry: Around 3,358–3,360 (upper bound of descending channel).

SL: Above 3,365.

TP1: 3,335

TP2: 3,310

Confirmation: Look for bearish engulfing or pin bar rejections on the 5m–15m timeframe.

🔺 Scenario B – Countertrend Long (Bounce from Channel Base)

Entry: Near 3,330–3,335 (support zone).

SL: Below 3,325.

TP1: 3,350

TP2: 3,360

Note: This is a riskier trade and should only be taken with bullish reversal confirmation (hammer, bullish divergence on RSI, or break of structure on LTF).

5. Summary:

Gold is currently in a short-term bearish correction, respecting a well-defined descending channel. Price is approaching a critical support zone (3,330–3,335), where a potential intraday bounce may occur, but trend remains bearish unless a clear break

🪙 JOIN OUR FREE TELEGRAM GROUP 🪙

t.me/dnaprofits

Join the community group to get support and share knowledge!

️🥇 Exchange and learn market knowledge

️🥇 Support free trading signals

t.me/dnaprofits

Join the community group to get support and share knowledge!

️🥇 Exchange and learn market knowledge

️🥇 Support free trading signals

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🪙 JOIN OUR FREE TELEGRAM GROUP 🪙

t.me/dnaprofits

Join the community group to get support and share knowledge!

️🥇 Exchange and learn market knowledge

️🥇 Support free trading signals

t.me/dnaprofits

Join the community group to get support and share knowledge!

️🥇 Exchange and learn market knowledge

️🥇 Support free trading signals

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.