On Wednesday, Trump called Powell “terrible” and said he was considering three or four candidates to replace him. Meanwhile, the Wall Street Journal reported that Trump was even considering announcing a potential successor as early as September or October.

The current market narrative is that once Trump nominates a new Fed chair, market expectations will tend to favor a more “dovish” Fed. This could lead to a weaker US dollar, higher long-term US Treasury yields and higher stock prices.

Forexlive points out that this story may be more an emotional reaction than a result of objective and rational thinking. The policy of the FOMC (Federal Open Market Committee) is decided not only by the Fed Chairman but also by a majority vote of the 12 voting members (including 7 directors and 5 regional Fed presidents). The Fed Chairman does have a lot of influence, but he does not have absolute control over monetary policy. The Fed was originally designed to be independent of political pressure.

Moreover, even if Trump nominates the next chairman, there is no guarantee that this will automatically lead to a rate cut. In fact, Powell was also nominated by Trump, but his monetary policy decisions are still based on professional judgment rather than serving Trump's wishes.

So, in the worst case, the market could face policy uncertainty as differences between FOMC members increase and more disagreements emerge. Currently, there are fewer moderate members on the committee, while neutral or hawkish members dominate.

Markets are now focused on personal consumption expenditure (PCE) data due later today (Friday) for further clues on whether the Federal Reserve will cut interest rates.

On the geopolitical front, a ceasefire between Israel and Iran appeared to be in place on Wednesday after Trump hailed a swift end to the 12-day conflict at the NATO summit and said he would seek a commitment from Iran to abandon its nuclear ambitions in talks next week.

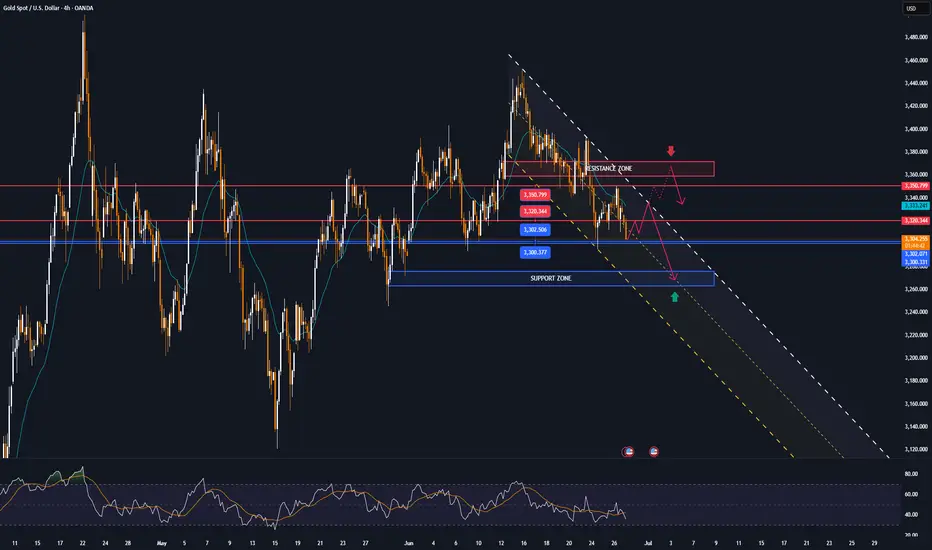

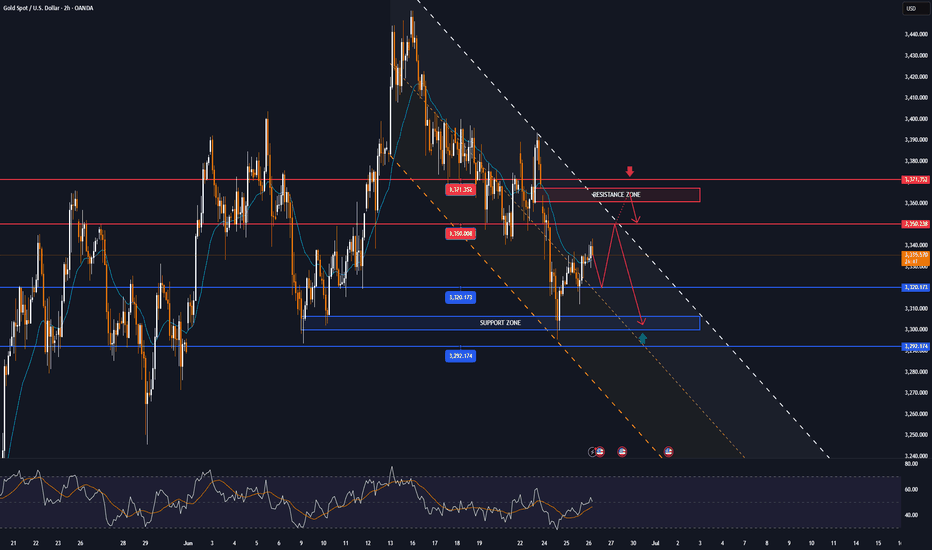

Technical Outlook Analysis

On the daily chart, after gold recovered and reached the initial target at 3,350 USD, the nearest resistance is also the price point of the EMA21 noted for readers in the previous publication.

However, the recovery momentum is currently weakening, specifically at the time of writing, the gold price is falling below 3,320 USD. Gold falling below 3,320 USD provides conditions for a possible decline with the next target around 3,302 - 3,300 USD, which is the area of the 0.382% Fibonacci retracement confluence with the lower edge of the price channel.

In terms of momentum, the RSI is heading down and breaking below 50, which should be considered an initial bearish signal.

Overall, gold does not have a clear long-term trend as the uptrend is still the main trend, while the momentum is showing signs of decline.

But personally, I am still leaning towards the uptrend, and continue to look for positions to buy.

Finally, the notable positions will be listed as follows.

Support: 3,302 – 3,300 USD

Resistance: 3,320 – 3,350 – 3,371 USD

SELL XAUUSD PRICE 3367 - 3365⚡️

↠↠ Stop Loss 3371

→Take Profit 1 3359

↨

→Take Profit 2 3353

BUY XAUUSD PRICE 3272 - 3274⚡️

↠↠ Stop Loss 3268

→Take Profit 1 3280

↨

→Take Profit 2 3286

Trade closed: target reached

Plan BUY HIT TP1 +80pips. Heading to TP2 😵😵😵Note

🔴Spot gold hits $3,310On July 7, spot gold continued to fall, down to $3,310/ounce, down 0.83% on the day.

Note

Spot gold has reached the important position of 3331-3336, which is easy to attract great attention from funds, and can pay attention to the contentious situation here.Note

🔴 Spot gold falls below $3,290 Spot gold touched $3,290 an ounce, down 0.35% on the day.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.