On Wednesday, the New York International Trade Court of the United States stopped Trump's planned tariff policy; it ruled that Trump's act of imposing comprehensive tariffs on countries that export more to the United States than imports without the authorization of Congress was an overstep. This means that most of Trump's tariffs will be suspended.

After the news came out, gold fell rapidly, hitting a low of $3,245. It has now adjusted back and maintained around 3,270 for consolidation. From the current point of view, most traders with short strategies have taken profits around 3,250.

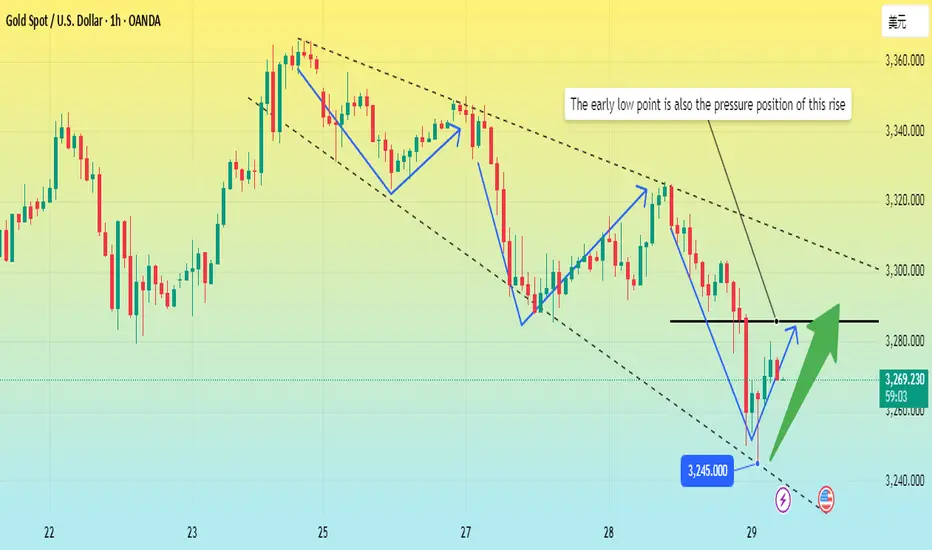

From the hourly chart, gold has started to pull back from $3,265 this week, and as of the current low of $3,245, it is a three-wave downward trend. The first wave fell to $3,225, and then rebounded to $3,350. The second wave fell from $3350 to $3285, and then rebounded to $3325.

The third wave of decline has been completed. According to the early decline and then the rise, the current rebound from $3245 is likely to test around $3300.

However, considering that $3285 is the previous low point, $3285 is also the upward pressure position this time.

Therefore, we should pay close attention to the pressure range of $3285-3295. If it can stabilize below $3295, then we can rely on the $3295-3285 range for short operations.

On the contrary, if the rebound is stabilized above 3300, it is necessary to stop loss in time.

After the news came out, gold fell rapidly, hitting a low of $3,245. It has now adjusted back and maintained around 3,270 for consolidation. From the current point of view, most traders with short strategies have taken profits around 3,250.

From the hourly chart, gold has started to pull back from $3,265 this week, and as of the current low of $3,245, it is a three-wave downward trend. The first wave fell to $3,225, and then rebounded to $3,350. The second wave fell from $3350 to $3285, and then rebounded to $3325.

The third wave of decline has been completed. According to the early decline and then the rise, the current rebound from $3245 is likely to test around $3300.

However, considering that $3285 is the previous low point, $3285 is also the upward pressure position this time.

Therefore, we should pay close attention to the pressure range of $3285-3295. If it can stabilize below $3295, then we can rely on the $3295-3285 range for short operations.

On the contrary, if the rebound is stabilized above 3300, it is necessary to stop loss in time.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.