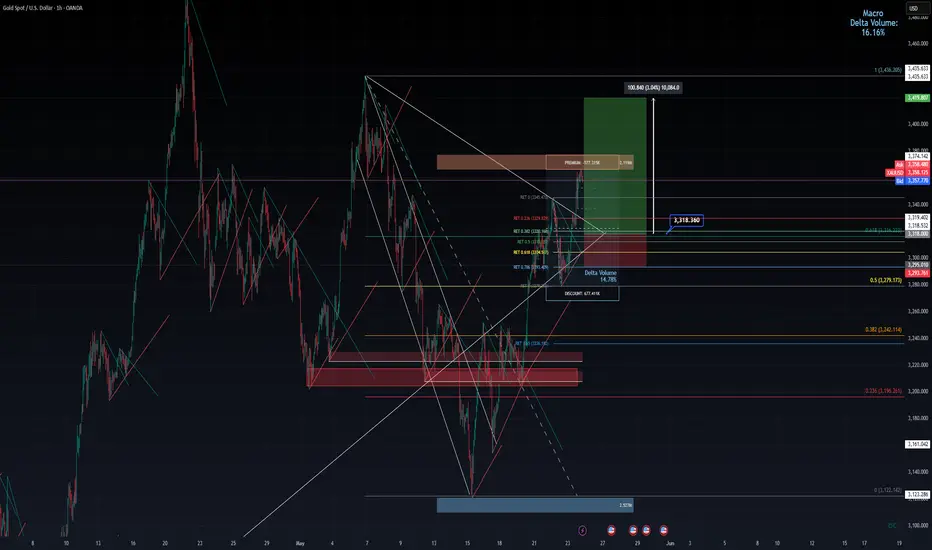

* **Pair**: XAUUSD

* **Timeframe**: 1H (1 Hour)

* **Platform**: TradingView (OANDA feed)

* **Trade Type**: Long (Buy)

* **Entry**: 3,318.36

* **TP (Take Profit)**: \~3,419.30

* **SL (Stop Loss)**: Likely in the 3,290–3,295 range (based on visual zone)

---

## 🔍 Trade Breakdown

### ✅ **1. Pattern Recognition: Symmetrical Triangle Breakout**

* The white converging trendlines form a **symmetrical triangle** — classic continuation or reversal structure.

* **Breakout occurred to the upside**, triggering the long entry at 3,318.

* **Volume Delta Box** just below shows accumulation, suggesting smart money positioning pre-breakout.

---

### 🧠 **2. Confluence Zone for Entry**

* **Entry** level (3318.36) is:

* **Just above 0.618 Fibonacci retracement**

* Sits at the **triangle apex breakout retest**

* Inside a high **delta volume node** (buyers outpaced sellers)

This suggests **institutional accumulation** and a **"discounted" long entry** relative to prior range.

---

### 🔁 **3. Fibonacci Levels**

* The chart includes multiple Fib retracement overlays:

* From most recent **impulse wave down** and **overall swing**

* 0.5 and 0.618 retracement zones align with:

* **Rejection-to-support flip**

* Breakout confirmation levels

* This is a classic **smart money technique**: wait for structure break, enter on retrace to equilibrium (0.618/0.5).

---

### 📦 **4. Order Blocks and Imbalance Zones**

* Several **red and orange blocks** highlight prior **liquidity zones**:

* The large red zone below entry (around 3,295) was swept, likely inducing stop hunts → now **demand zone**

* Entry avoids this volatility and lands **just above reaccumulation zone**

* Also a visible **imbalance fill area** around 3,318, now tested and held — supporting bullish case.

---

### 🧮 **5. Risk-Reward and Positioning**

* **TP** at \~3,419.30 (just below 3,435 structure high) gives **R\:R over 3:1**, possibly even 4:1.

* SL is **tight under recent minor low** and under discount zone, which is key.

* Clear definition of:

* **Premium pricing** (target)

* **Discount pricing** (entry)

* Fits within a **smart money concept (SMC)** framework.

---

### 💡 Summary of the Method Used

| Element | Technique Used | Notes |

| ---------------- | --------------------------- | ---------------------------------------- |

| **Structure** | Symmetrical Triangle | Breakout to upside confirmed |

| **Volume** | Delta Volume & Order Blocks | Accumulation below breakout |

| **Fib Tools** | Multi-layered retracements | Entry at 0.618 area, TP at Fib extension |

| **SMC Concepts** | Discount/Premium Zones | Entry in discount, targeting premium |

| **Risk-Reward** | \~3:1 to 4:1 | SL tight, TP near major structure high |

---

### 🟢 Professional Verdict

This trade setup is **technically sound** and based on **smart money concepts**, **volume profile**, and **price structure breakout**. It uses:

* Entry at value (post-breakout retest)

* Strong confluences (Fib, trendlines, volume delta)

* Defined risk, clean target

* Logical narrative: **accumulation → breakout → retest → expansion**

If price holds above 3318 and momentum continues, the **3419–3435 zone is very reachable**.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.