Recently, under the background of frequent tariff policies, which should be bearish for the US dollar, the US dollar unexpectedly rebounded and showed signs of turning bullish on the technical side. This may be because the Federal Reserve maintains high interest rates to prevent capital outflows, and at the same time increases the supply of US dollars by means such as issuing bonds. The US tax increase restricts the access of other countries to US dollars, while market demand has not decreased, prompting the rise of the US dollar. This trend is not good for precious metals, but gold has special safe-haven properties. In the long run, macro factors support gold, and in the short term, pay attention to the impact of the US dollar. Recently, it has been deployed at a low level.

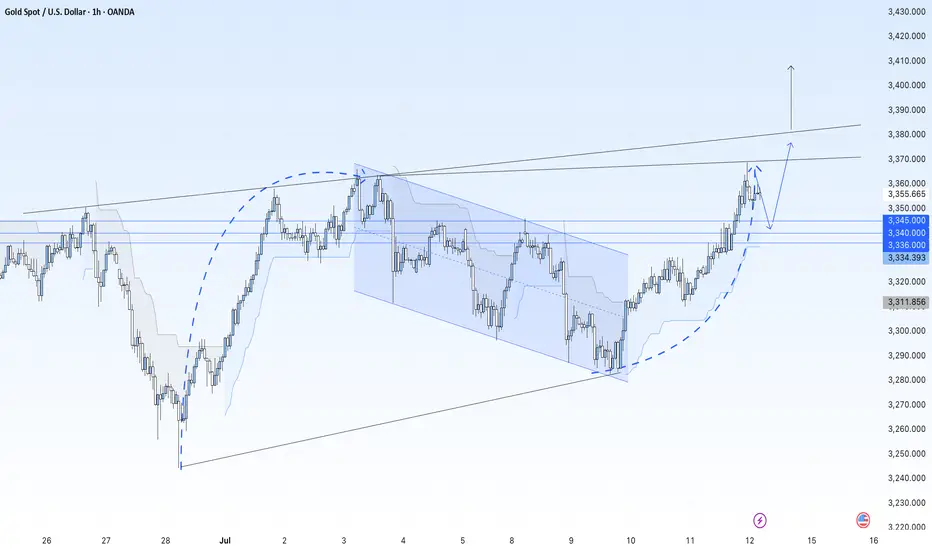

Looking back at the gold market, the previous high point near 3,500 points was mainly due to the safe-haven frenzy caused by Trump's tariff measures, and the influx of funds pushed the gold price to the top quickly. As the tariff negotiations progress, the impact of the news fades, and the gold price returns to the dominance of the technical side, and has been in a narrow range of fluctuations in the past two months. Extending the time dimension, the volatility characteristics of gold change, the volatility narrows, but the long-short conversion becomes more frequent. This week, gold stabilized and rebounded near 3,282. On the weekly chart, 3336 is a support level, which is also a key dividing line between long and short positions. 3393 is a resistance level, and after an effective breakthrough, it is expected to move towards the 3400-3410 area. The upper resistance is 3368-3373, and the lower support is 3345-3340.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.