1. Market Overview

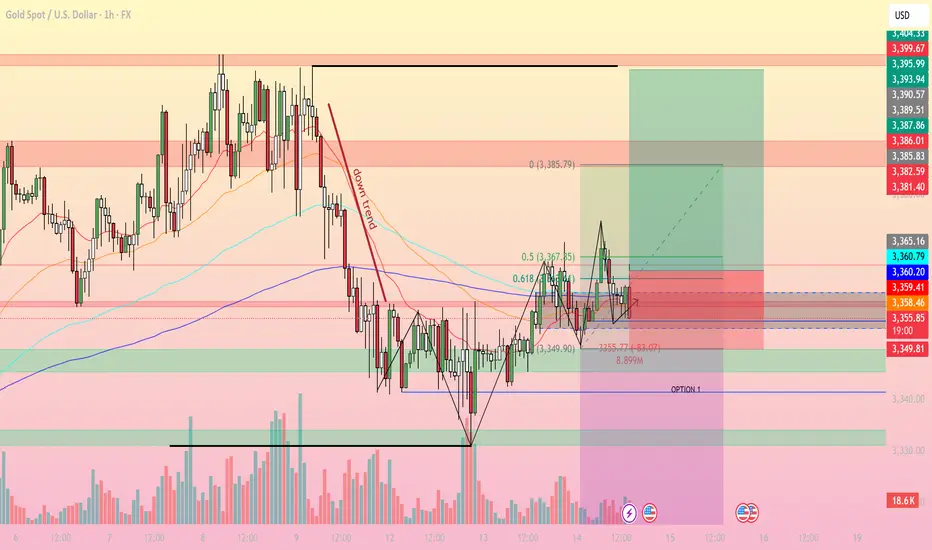

On the H1 timeframe, XAUUSD has broken out of the recent short-term downtrend and is forming a new bullish structure with higher lows. Price is currently trading around 3,357 – 3,360 USD, sitting near both the EMA50 and EMA200, signaling a tug-of-war between buyers and sellers.

2. Technical Analysis

Fibonacci Retracement: After a strong rally from 3,349.90 to 3,367.85, price is now reacting around the 0.618 retracement zone (3,354 – 3,356), which acts as a key support area.

EMA: The EMA50 is crossing above the EMA200, a potential bullish signal, but confirmation is needed with a breakout above 3,367 – 3,370.

RSI: Hovering around 50–55, showing neutral momentum, leaving room for movement in both directions.

Volume: Increased buying volume at support zones indicates strong demand when price dips.

3. Key Support & Resistance Levels

Resistance: 3,367 – 3,370 (Fibo 0.5 & recent swing high), 3,385 – 3,386 (Fibo 0.0), 3,393 – 3,399 (major H1-H4 resistance).

Support: 3,354 – 3,356 (Fibo 0.618), 3,349.8 (psychological level), 3,340 (strong support zone).

4. Trading Strategies

Buy Scenario:

Wait for price to hold above 3,354 – 3,356 with bullish reversal candlestick patterns (e.g., bullish engulfing, pin bar).

Target 1: 3,367 – 3,370.

Target 2: 3,385 – 3,386.

Stop-loss: Below 3,349.

Sell Scenario:

If price breaks below 3,349 and closes an H1 candle under this level, consider selling toward 3,340 – 3,330.

Stop-loss: Above 3,356.

5. Conclusion

XAUUSD is currently consolidating after breaking the previous downtrend. The 3,354 – 3,356 zone will be the short-term deciding level. Traders should wait for price action confirmation to optimize the risk-to-reward ratio.

Follow for more high-quality gold trading strategies in the upcoming sessions.

On the H1 timeframe, XAUUSD has broken out of the recent short-term downtrend and is forming a new bullish structure with higher lows. Price is currently trading around 3,357 – 3,360 USD, sitting near both the EMA50 and EMA200, signaling a tug-of-war between buyers and sellers.

2. Technical Analysis

Fibonacci Retracement: After a strong rally from 3,349.90 to 3,367.85, price is now reacting around the 0.618 retracement zone (3,354 – 3,356), which acts as a key support area.

EMA: The EMA50 is crossing above the EMA200, a potential bullish signal, but confirmation is needed with a breakout above 3,367 – 3,370.

RSI: Hovering around 50–55, showing neutral momentum, leaving room for movement in both directions.

Volume: Increased buying volume at support zones indicates strong demand when price dips.

3. Key Support & Resistance Levels

Resistance: 3,367 – 3,370 (Fibo 0.5 & recent swing high), 3,385 – 3,386 (Fibo 0.0), 3,393 – 3,399 (major H1-H4 resistance).

Support: 3,354 – 3,356 (Fibo 0.618), 3,349.8 (psychological level), 3,340 (strong support zone).

4. Trading Strategies

Buy Scenario:

Wait for price to hold above 3,354 – 3,356 with bullish reversal candlestick patterns (e.g., bullish engulfing, pin bar).

Target 1: 3,367 – 3,370.

Target 2: 3,385 – 3,386.

Stop-loss: Below 3,349.

Sell Scenario:

If price breaks below 3,349 and closes an H1 candle under this level, consider selling toward 3,340 – 3,330.

Stop-loss: Above 3,356.

5. Conclusion

XAUUSD is currently consolidating after breaking the previous downtrend. The 3,354 – 3,356 zone will be the short-term deciding level. Traders should wait for price action confirmation to optimize the risk-to-reward ratio.

Follow for more high-quality gold trading strategies in the upcoming sessions.

🪙 JOIN OUR FREE TELEGRAM GROUP 🪙

t.me/dnaprofits

Join the community group to get support and share knowledge!

️🥇 Exchange and learn market knowledge

️🥇 Support free trading signals

t.me/dnaprofits

Join the community group to get support and share knowledge!

️🥇 Exchange and learn market knowledge

️🥇 Support free trading signals

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🪙 JOIN OUR FREE TELEGRAM GROUP 🪙

t.me/dnaprofits

Join the community group to get support and share knowledge!

️🥇 Exchange and learn market knowledge

️🥇 Support free trading signals

t.me/dnaprofits

Join the community group to get support and share knowledge!

️🥇 Exchange and learn market knowledge

️🥇 Support free trading signals

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.