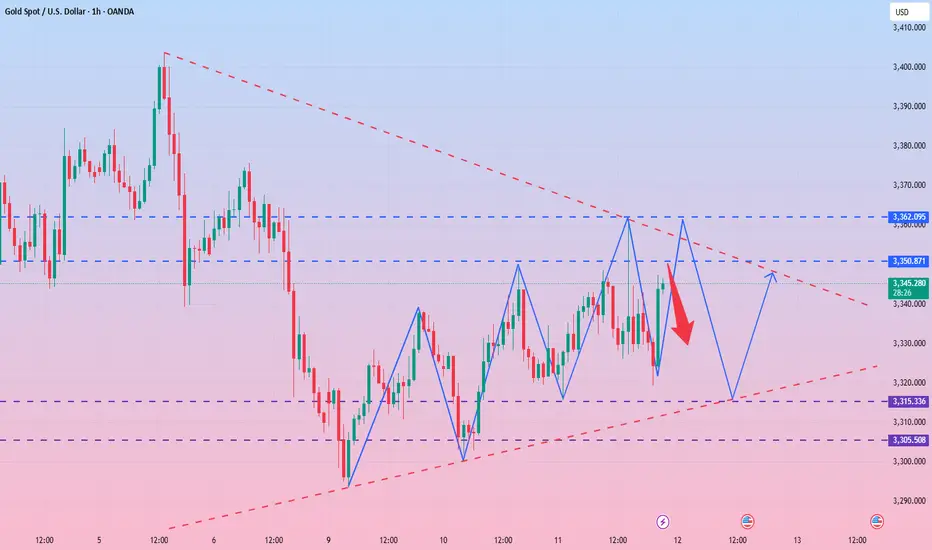

The recent trend of gold is consistent with my expectations. Overall, the rebound is mainly based on fluctuating downward, and the rhythm of the oscillation between long and short positions is perfectly grasped. The upper resistance is still strong, and gold can still be shorted if the rebound is not broken.

From the current analysis of the gold trend, the lower support focuses on the area around 3315-3305. If it falls back to this position range, continue to look at the continuation of the rebound upward; the upper resistance focuses on the area around 3350-3362. The overall rhythm of the high-altitude and low-multiple range is still maintained, and the strategy is mainly to participate in the range back and forth.

[Gold Operation Strategy]

1. Go long when gold falls back to 3315-3305, and the target is 3330-3340;

2. Go short when gold rebounds to 3350-3360, and the target is 3340-3330.

From the current analysis of the gold trend, the lower support focuses on the area around 3315-3305. If it falls back to this position range, continue to look at the continuation of the rebound upward; the upper resistance focuses on the area around 3350-3362. The overall rhythm of the high-altitude and low-multiple range is still maintained, and the strategy is mainly to participate in the range back and forth.

[Gold Operation Strategy]

1. Go long when gold falls back to 3315-3305, and the target is 3330-3340;

2. Go short when gold rebounds to 3350-3360, and the target is 3340-3330.

Trade active

After the opening of the gold market, it hit 3373 in the short term, and then fell back. Our short position at 3360 is facing pressure test, and the stop loss is strictly set at 3375. The risk is controllable and implemented in place. The short-term rise is a normal fluctuation. If 3375 is effectively broken, the stop loss will be decisively stopped to ensure the safety of funds and controllable risks. Trading relies on systems and discipline. Not blindly chasing ups and downs, and sticking to stop losses are the basic qualities of mature traders. Market opportunities still exist, and steady operations are the way to win in the long run.Trade closed: target reached

Gold opened at a short-term high of around 3373, and then fell back. Our 3360 short position was under certain pressure, but we strictly implemented the stop loss strategy, and the stop loss position was set at 3375, and the risk was always under control. As the price fell back to the safe area, we notified the copycat brothers in time to stop profit and leave the market, and steadily locked in a small profit.During the periodic callback process, some brothers quickly responded, and I assisted in withdrawing the order as soon as possible. Due to the rapid change in rhythm, I failed to leave the market in time, and the short position hit the stop loss as planned. Stop loss is not a failure, but an indispensable line of defense in the trading system, and a manifestation of being responsible for the account. The market is volatile, and only by strictly implementing risk management can long-term profits be ensured.

Trading is not about how much you win on a single deal, but about plan execution and risk management. Only by sticking to the bottom line can you have the last laugh.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.