Jackson Hole 2025:

Here’s what to expect from the 2025 Jackson Hole Economic Policy Symposium, held August 21–23 in Jackson Hole, Wyoming:

Event Overview & Theme

• The 48th annual symposium is hosted by the Federal Reserve Bank of Kansas City from August 21 to 23, 2025.

• The theme is “Labour Markets in Transition: Demographics, Productivity, and Macroeconomic Policy.” It focuses on structural changes like aging populations, fertility declines, declining labour mobility, and the evolving role of AI in labour markets.

• The full agenda will be released on Thursday evening, August 21, with Federal Reserve Chair Jerome Powell’s speech scheduled for Friday morning (U.S. time): 10 a.m. EDT / 8 a.m. MDT.

Key Participants & Format

• A select group of around 120 invitees will attend, including central bankers, policymakers, academics, and journalists.

• Formats include research paper presentations, panels, Q&As, and the keynote address. All presentations and transcripts will be published online during and after the event

What to Watch For

1. Powell’s Speech & Policy Signals

Powell’s keynote—titled "Economic Outlook and Framework Review"—is expected to outline possible interest-rate decisions, update the Federal Reserve’s policy framework, and respond to critiques that its 2020 approach delayed necessary responses to inflation.

This is likely one of his most consequential speeches, delivered amid mounting political pressure, internal Fed disagreements, and a contested labour market environment.

2. Global Central Bankers & International Engagement

Notable international participants include ECB President Christine Lagarde and likely the Bank of England’s Andrew Bailey, expected to join panels on Saturday.

Their contributions will underscore the symposium’s global reach and offer comparative perspectives on monetary policy challenges.

3. Market Expectations & Reactions

Markets anticipate a 25 basis-point rate cut in September, with several sources placing the probability at ~85%.

Simultaneously, investor caution is elevated due to geopolitical tensions—especially around Trump’s influence, Ukraine talks, and tech policy developments.

4. Broader Economic Context

The symposium takes place amid mixed U.S. data: weak job growth and rising producer prices raise concerns about both slowing labour markets and persistent inflation.

Retail earnings (e.g. Target, Walmart, Home Depot) and recent CPI data also add to the backdrop, offering clues on consumer resilience and inflation trends.

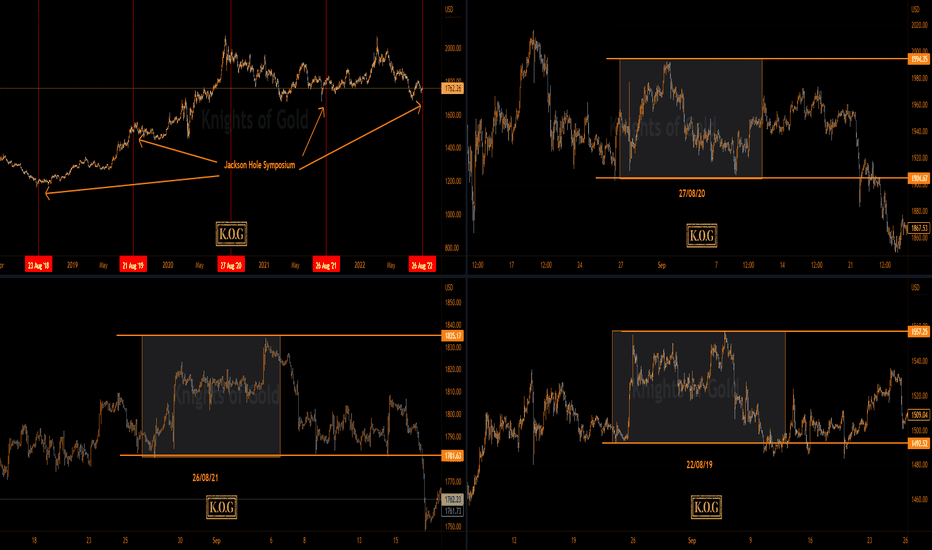

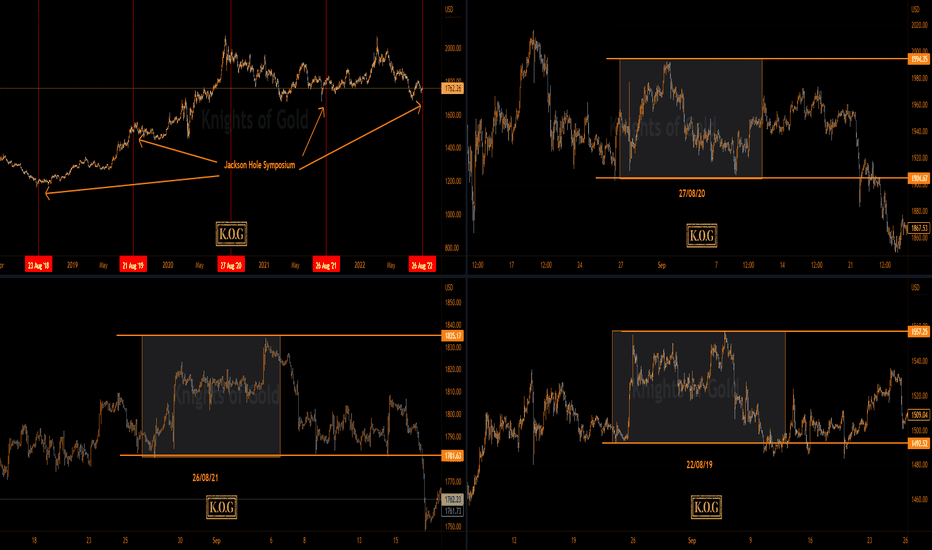

GOLD:

Based on the back test of the event they tend to test the low of the range which in this scenario is around the 3280-90 region, however, if we look at the structure we do have a reversal in play here with the support level being the 3330-25 level. Above 3330 we have that extension of the move we spoke about last week 3360-65 which is still untouched. So, if we that in mind and they support that lower level in the coming session, there is a possibility they take us up into that region sitting around 3360-75 due to the volume that is expected, and if rejected they correct that move downside to again attempt to break through the 3300 level. The key level in this scenario is 3375 which needs to be broken to go higher taking us above 3400.

On the flip. 3330-20 breaks forcefully, in this scenario there is possibility that for price to attempt the range low sitting around the 3280 level which needs to hold in order to go back up. Please note, an aggressive swing here can break through that level resulting in a move all the way back down into the 3230-50 levels before then exhausting.

The range is huge and where we’ve seen 500-700pip movement over the years, we’re seeing over a couple of days lately, so we need to exaggerate every move and only look at the extreme levels.

RED BOX TARGETS:

Break above 3350 for 3360, 3365, 3374, 3390 and 3420 in extension of the move

Break below 3335 for 3320, 3310, 3305, 3297, 3280 and 3265 in extension of the move

What we’re trying to show you here is that its going to be a very difficult event to trade for new traders. Its going to be choppy, its going to be volatile, its going to whipsaw and its likely to move. If you’re caught the wrong side of it its going to kill your account. Best practice here is to let the market make the moves it wants to, wait for the price to settle in whatever level they want to drive it to, once this has happened then look for the setup to get in to the trade.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

The link below will take you to the previous report on this event:

Here’s what to expect from the 2025 Jackson Hole Economic Policy Symposium, held August 21–23 in Jackson Hole, Wyoming:

Event Overview & Theme

• The 48th annual symposium is hosted by the Federal Reserve Bank of Kansas City from August 21 to 23, 2025.

• The theme is “Labour Markets in Transition: Demographics, Productivity, and Macroeconomic Policy.” It focuses on structural changes like aging populations, fertility declines, declining labour mobility, and the evolving role of AI in labour markets.

• The full agenda will be released on Thursday evening, August 21, with Federal Reserve Chair Jerome Powell’s speech scheduled for Friday morning (U.S. time): 10 a.m. EDT / 8 a.m. MDT.

Key Participants & Format

• A select group of around 120 invitees will attend, including central bankers, policymakers, academics, and journalists.

• Formats include research paper presentations, panels, Q&As, and the keynote address. All presentations and transcripts will be published online during and after the event

What to Watch For

1. Powell’s Speech & Policy Signals

Powell’s keynote—titled "Economic Outlook and Framework Review"—is expected to outline possible interest-rate decisions, update the Federal Reserve’s policy framework, and respond to critiques that its 2020 approach delayed necessary responses to inflation.

This is likely one of his most consequential speeches, delivered amid mounting political pressure, internal Fed disagreements, and a contested labour market environment.

2. Global Central Bankers & International Engagement

Notable international participants include ECB President Christine Lagarde and likely the Bank of England’s Andrew Bailey, expected to join panels on Saturday.

Their contributions will underscore the symposium’s global reach and offer comparative perspectives on monetary policy challenges.

3. Market Expectations & Reactions

Markets anticipate a 25 basis-point rate cut in September, with several sources placing the probability at ~85%.

Simultaneously, investor caution is elevated due to geopolitical tensions—especially around Trump’s influence, Ukraine talks, and tech policy developments.

4. Broader Economic Context

The symposium takes place amid mixed U.S. data: weak job growth and rising producer prices raise concerns about both slowing labour markets and persistent inflation.

Retail earnings (e.g. Target, Walmart, Home Depot) and recent CPI data also add to the backdrop, offering clues on consumer resilience and inflation trends.

GOLD:

Based on the back test of the event they tend to test the low of the range which in this scenario is around the 3280-90 region, however, if we look at the structure we do have a reversal in play here with the support level being the 3330-25 level. Above 3330 we have that extension of the move we spoke about last week 3360-65 which is still untouched. So, if we that in mind and they support that lower level in the coming session, there is a possibility they take us up into that region sitting around 3360-75 due to the volume that is expected, and if rejected they correct that move downside to again attempt to break through the 3300 level. The key level in this scenario is 3375 which needs to be broken to go higher taking us above 3400.

On the flip. 3330-20 breaks forcefully, in this scenario there is possibility that for price to attempt the range low sitting around the 3280 level which needs to hold in order to go back up. Please note, an aggressive swing here can break through that level resulting in a move all the way back down into the 3230-50 levels before then exhausting.

The range is huge and where we’ve seen 500-700pip movement over the years, we’re seeing over a couple of days lately, so we need to exaggerate every move and only look at the extreme levels.

RED BOX TARGETS:

Break above 3350 for 3360, 3365, 3374, 3390 and 3420 in extension of the move

Break below 3335 for 3320, 3310, 3305, 3297, 3280 and 3265 in extension of the move

What we’re trying to show you here is that its going to be a very difficult event to trade for new traders. Its going to be choppy, its going to be volatile, its going to whipsaw and its likely to move. If you’re caught the wrong side of it its going to kill your account. Best practice here is to let the market make the moves it wants to, wait for the price to settle in whatever level they want to drive it to, once this has happened then look for the setup to get in to the trade.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

The link below will take you to the previous report on this event:

🔵 FREE TELEGRAM CHANNEL: t.me/KnightsofGold

🔴 TWITTER: twitter.com/knightsofgold2

🟢 INSTAGRAM: instagram.com/knights_of_gold/

🟡 Disclaimer: Not financial advice. For educational purposes only.

🔴 TWITTER: twitter.com/knightsofgold2

🟢 INSTAGRAM: instagram.com/knights_of_gold/

🟡 Disclaimer: Not financial advice. For educational purposes only.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔵 FREE TELEGRAM CHANNEL: t.me/KnightsofGold

🔴 TWITTER: twitter.com/knightsofgold2

🟢 INSTAGRAM: instagram.com/knights_of_gold/

🟡 Disclaimer: Not financial advice. For educational purposes only.

🔴 TWITTER: twitter.com/knightsofgold2

🟢 INSTAGRAM: instagram.com/knights_of_gold/

🟡 Disclaimer: Not financial advice. For educational purposes only.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.