📊 Market Developments:

Gold prices continued to decline on May 29, reaching weekly lows below $3,250/oz. The primary driver is the strong recovery of the US Dollar following a US court's decision on tariffs and cautious FOMC minutes indicating the Fed remains vigilant about inflation, reducing gold's appeal as a safe-haven asset.

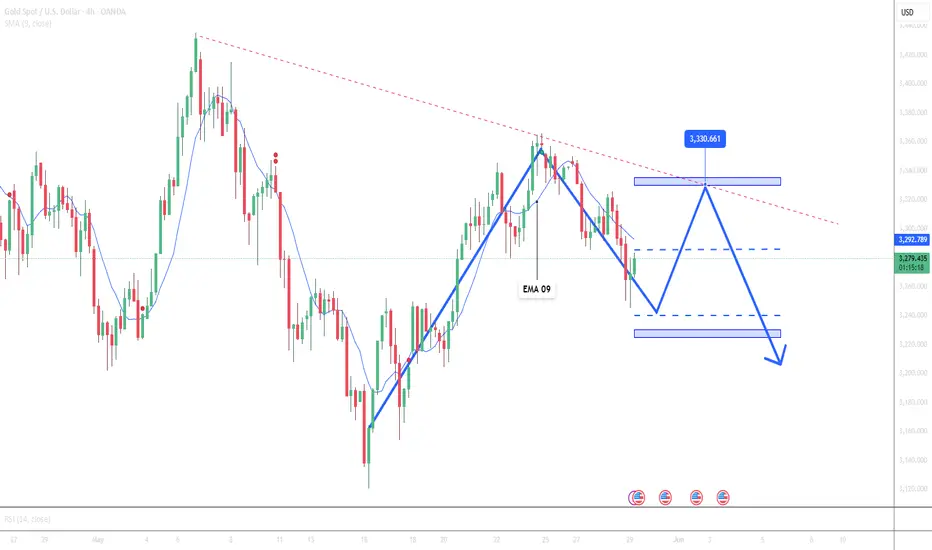

📉 Technical Analysis:

• Key Resistance: $3,285 – $3,300

• Nearest Support: $3,240 – $3,230

• EMA: Price is below the 09 EMA, indicating a short-term downtrend.

• Candlestick Patterns / Volume / Momentum: Price has broken below a short-term ascending trendline and is retesting the resistance area, confirming bearish signals.

📌 Outlook:

Gold may continue to decline in the short term if the USD maintains its recovery and the price fails to break above the $3,285 – $3,300 resistance zone.

________________________________________

💡 Suggested Trading Strategy:

SELL XAU/USD at: $3,275 – $3,285

o 🎯 TP: $3,240

o ❌ SL: $3,305

BUY XAU/USD at: $3,230

o 🎯 TP: $3,270

o ❌ SL: $3,215

Gold prices continued to decline on May 29, reaching weekly lows below $3,250/oz. The primary driver is the strong recovery of the US Dollar following a US court's decision on tariffs and cautious FOMC minutes indicating the Fed remains vigilant about inflation, reducing gold's appeal as a safe-haven asset.

📉 Technical Analysis:

• Key Resistance: $3,285 – $3,300

• Nearest Support: $3,240 – $3,230

• EMA: Price is below the 09 EMA, indicating a short-term downtrend.

• Candlestick Patterns / Volume / Momentum: Price has broken below a short-term ascending trendline and is retesting the resistance area, confirming bearish signals.

📌 Outlook:

Gold may continue to decline in the short term if the USD maintains its recovery and the price fails to break above the $3,285 – $3,300 resistance zone.

________________________________________

💡 Suggested Trading Strategy:

SELL XAU/USD at: $3,275 – $3,285

o 🎯 TP: $3,240

o ❌ SL: $3,305

BUY XAU/USD at: $3,230

o 🎯 TP: $3,270

o ❌ SL: $3,215

📊 Forex | Gold | Crypto Market Insights & Signals

📰 Real-time news updates & expert analysis

📈 Daily Buy/Sell signals for investors

💡 Technical breakdowns & market outlooks

🔗 Join our free group: t.me/+DmS-dVFJMm40MDM9

📰 Real-time news updates & expert analysis

📈 Daily Buy/Sell signals for investors

💡 Technical breakdowns & market outlooks

🔗 Join our free group: t.me/+DmS-dVFJMm40MDM9

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📊 Forex | Gold | Crypto Market Insights & Signals

📰 Real-time news updates & expert analysis

📈 Daily Buy/Sell signals for investors

💡 Technical breakdowns & market outlooks

🔗 Join our free group: t.me/+DmS-dVFJMm40MDM9

📰 Real-time news updates & expert analysis

📈 Daily Buy/Sell signals for investors

💡 Technical breakdowns & market outlooks

🔗 Join our free group: t.me/+DmS-dVFJMm40MDM9

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.