Period: Monday June 30 – Friday July 5

Focus: US Independence Day (July 4), NY Market Closure Impact

🟢1. Price Action Context

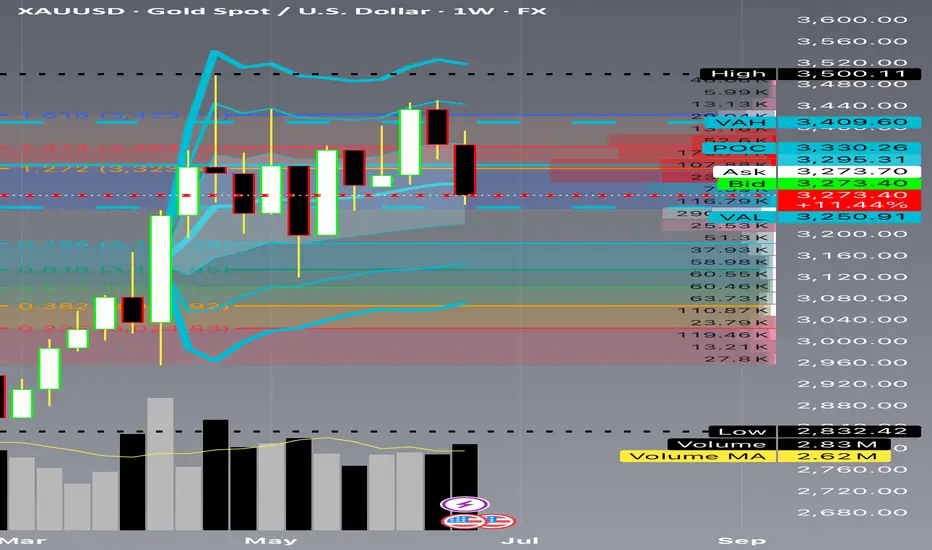

Last Week (ending June 28):

Weekly bearish engulfing closed near the lows (~3,250 area).

Series of failed rallies above 3,330.

Price compressed in a tight lower range—distribution, not accumulation.

Monday June 30 – Friday July 5:

Market begins in a low-confidence, low-volume environment.

Tuesday–Wednesday: traders will be positioning ahead of July 4 closure.

Thursday (July 4): NY market closed—no COMEX metals futures settlement.

Friday (July 5): NY market reopens—liquidity and volume surge back in.

🟡 2. Range, Support & Resistance

Composite Volume Profile:

VAH: ~3,410

POC: ~3,330 (where the heaviest volume has been transacted)

VAL: ~3,250 (final defense)

Support:

3,250: major structural shelf

3,200: next key liquidity target

Resistance:

3,330–3,350: loaded supply zone

3,390–3,420: overhead liquidity from prior weeks

Interpretation:

Price under POC, hugging VAL, is bearish.

Acceptance under 3,250 sets up a vacuum to 3,180–3,200.

🔵 3. Volume Footprint and Delta

Footprint Characteristics:

Strong negative delta (-21K) as price approached 3,250.

Buyers unable to lift offers at 3,300+.

Repeated ask dominance = supply persistence.

Institutional Read:

They’re selling into every bounce, and liquidity thinness around July 4 increases stop-hunt potential.

🟣 4. Trend and Wave Structure

Weekly trend: bearish

Daily trend: bearish with lower highs and lower lows

Wave count:

Wave 1: 3,500 ➡ 3,273

Wave 2: retrace ~3,330

Wave 3: active—projected target 3,180

🟤 5. Stop Hunt Zones

Above:

3,330–3,350: obvious short stops and breakout buy stops. Below:

3,250: stop cluster from dip buyers and trapped longs.

Expected Behavior:

Institutions use Wednesday and low liquidity Thursday to spike stops before the real move on Friday.

Stop Hunt Scenario:

July 3–4: quick liquidity sweep above 3,330.

July 5 (Friday): NY reopen—supply steps in, drives price back down.

🟢 6. Market Closure & Liquidity Impact

NY Market Closure Schedule:

July 4 (Thursday):

NY COMEX metals closed for Independence Day.

Forex open but liquidity ~40% of normal.

Price can move erratically with minimal volume.

July 3 (Wednesday):

Early close in many US desks.

Position squaring—thin books.

July 5 (Friday):

Liquidity flood back in—true directional follow-through likely.

Implications:

Avoid heavy positioning during July 4 closure.

Expect false breakouts and “ghost candles”.

Major moves likely Friday July 5 during NY session.

🟠 7. Psychological Dynamics

Retail:

FOMO if price spikes above 3,330 on low liquidity.

Fear if price knifes under 3,250 without volume confirmation.

Institutions:

Use the holiday to:

- Clear out stops.

- Create liquidity pools.

- Accumulate positions for Friday’s push.

🔴

8. Tangible Day-Trader Scenarios

🟢 Scenario A: Pre-Holiday Stop Hunt Trap

When: July 3–4

Price spikes over 3,330 on low volume.

Footprint shows negative delta quickly after.

Execution:

Sell limit ~3,340.

SL: 3,375.

TP: 3,200.

Note: Keep size reduced—thin conditions are volatile.

🟣 Scenario B: Post-Holiday Breakdown

When: Friday July 5

NY opens, volume returns.

Price fails to reclaim 3,250 after test.

Execution:

Sell stop 3,249.

SL: 3,310.

TP: 3,180.

Scale in as confirmation strengthens.

🟠 Scenario C: Holiday Range

When: July 4–early July 5 pre-NY

Price likely ranges 3,250–3,330.

Avoid entries unless volatility contraction ends with volume breakout.

🟡 9. Hypothetical Institutional Trade Plan

✅ Order Type: Sell Stop

✅ Entry: 3,249

✅ Stop Loss: 3,310

✅ Take Profit: 3,180

✅ Position Size: Max 0.5–1% account risk

✅ Trigger: NY session reopens Friday with volume confirmation

✅ Confidence: 85% (post-holiday breakdowns historically have high follow-through)

🟢 10. The Executive Recap

✅ Timeframe:June 30–July 5

✅ Trend:Weekly/Daily bearish

✅ Volume:Negative delta clusters

✅ Stop Hunts:

3,330–3,350 (trap)

3,250 (flush)

✅ Liquidity Event:July 4 closure reduces liquidity by ~60%

False moves likely

Major move probable Friday NY session

✅ Execution:

Low liquidity: reduced size

Confirmation: delta + volume

No chasing pre-closure

#GoldTrading #XAUUSD #ForexTrader #PriceActionTrading #TechnicalAnalysis #VolumeProfile #FootprintAnalysis #InstitutionalTrading #DayTrading #MarketAnalysis #ForexSignals #ComexGold #TradingStrategy #MarketPsychology #LiquidityTraps #StopHunt #NYMarketClosure #July4Trading #MetalsMarket #TrendAnalysis #WaveAnalysis #SupplyAndDemand #SmartMoney #ForexEducation #CMEGroup #TradingMindset #RiskManagement

⚠️ Disclaimer : This is a purely educational scenario. You are the only one responsible for your risk.

Mohamed

THE Ichimoku MAN on the Nile

#traders4traders

you are welcome to join my Telegram channel, Ichimokuonthenile.

for GOLD follow this link: t.me/GOLDontheNILE

youtube youtube.com/@ICHIMOKUontheNILE

THE Ichimoku MAN on the Nile

#traders4traders

you are welcome to join my Telegram channel, Ichimokuonthenile.

for GOLD follow this link: t.me/GOLDontheNILE

youtube youtube.com/@ICHIMOKUontheNILE

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Mohamed

THE Ichimoku MAN on the Nile

#traders4traders

you are welcome to join my Telegram channel, Ichimokuonthenile.

for GOLD follow this link: t.me/GOLDontheNILE

youtube youtube.com/@ICHIMOKUontheNILE

THE Ichimoku MAN on the Nile

#traders4traders

you are welcome to join my Telegram channel, Ichimokuonthenile.

for GOLD follow this link: t.me/GOLDontheNILE

youtube youtube.com/@ICHIMOKUontheNILE

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.