Today (Tuesday, July 15), in the Asian market, the spot  XAUUSD maintained a slight recovery trend, currently at around 3,360 USD/ounce.

XAUUSD maintained a slight recovery trend, currently at around 3,360 USD/ounce.

The spot XAUUSD rose to a 3-week high on Monday, but quickly fell back and finally closed lower. Trump's open attitude towards trade negotiations has improved the market's risk-on sentiment and negatively impacted gold, a safe-haven asset. But gold still has a lot of potential risks for price increases, and personally, the fundamental trend for gold has not changed.

XAUUSD rose to a 3-week high on Monday, but quickly fell back and finally closed lower. Trump's open attitude towards trade negotiations has improved the market's risk-on sentiment and negatively impacted gold, a safe-haven asset. But gold still has a lot of potential risks for price increases, and personally, the fundamental trend for gold has not changed.

The US Bureau of Labor Statistics will release its June Consumer Price Index (CPI) report today (Tuesday).

According to a Reuters survey, economists expect the US CPI to increase year-on-year in June to 2.7% from 2.4% the previous month, while the core CPI is expected to increase year-on-year to 3% from 2.8%.

The survey also showed that the US CPI is expected to increase 0.3% month-on-month in June, and the core CPI is also expected to increase 0.3% month-on-month.

According to the Chicago Mercantile Exchange's "FedWatch Tool", the market believes that the Fed is unlikely to cut interest rates in July and the probability of keeping interest rates unchanged in September is about 30%.

If the US core CPI rises by 0.4% or more in June, this could prompt market participants to reassess the possibility of a rate cut in September. In this case, the US Dollar could hold steady and push gold prices lower. On the other hand, if the data is lower than expected, gold will become more attractive while a weaker Dollar will be positive for gold prices.

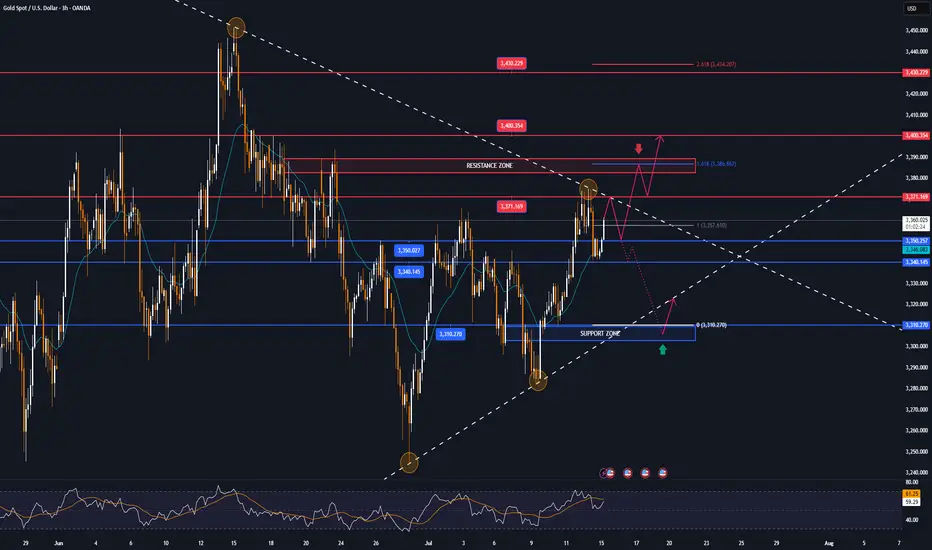

Technical Outlook Analysis XAUUSD

XAUUSD

After gold reached the resistance target of attention to readers in the weekly publication at 3,371 USD, which is the location of the 0.236% Fibonacci retracement, it fell slightly but is now recovering positively.

Currently, gold is trading in the range of 3,360 USD, the price action above the lower edge of the long-term rising price channel with support from the EMA21, gold is now likely to continue to retest the 0.236% Fibonacci retracement level.

If gold breaks above $3,371 it will be eligible for a new bullish cycle, with the target then being around $3,400 in the short term, more so than $3,430.

On the other hand, the RSI is pointing up, maintaining activity above 50, and this should be considered a positive signal in terms of momentum. It shows that there is still a lot of room for growth ahead.

However, as of now, gold is still neutral in terms of trend, with conditions gradually tilting towards the possibility of price increase.

Along with that, the notable positions will be listed as follows.

Support: $3,350 – $3,340 – $3,310

Resistance: $3,371 – $3,400 – $3,430

SELL XAUUSD PRICE 3390 - 3388⚡️

↠↠ Stop Loss 3394

→Take Profit 1 3382

↨

→Take Profit 2 3376

BUY XAUUSD PRICE 3304 - 3306⚡️

↠↠ Stop Loss 3300

→Take Profit 1 3312

↨

→Take Profit 2 3318

The spot

The US Bureau of Labor Statistics will release its June Consumer Price Index (CPI) report today (Tuesday).

According to a Reuters survey, economists expect the US CPI to increase year-on-year in June to 2.7% from 2.4% the previous month, while the core CPI is expected to increase year-on-year to 3% from 2.8%.

The survey also showed that the US CPI is expected to increase 0.3% month-on-month in June, and the core CPI is also expected to increase 0.3% month-on-month.

According to the Chicago Mercantile Exchange's "FedWatch Tool", the market believes that the Fed is unlikely to cut interest rates in July and the probability of keeping interest rates unchanged in September is about 30%.

If the US core CPI rises by 0.4% or more in June, this could prompt market participants to reassess the possibility of a rate cut in September. In this case, the US Dollar could hold steady and push gold prices lower. On the other hand, if the data is lower than expected, gold will become more attractive while a weaker Dollar will be positive for gold prices.

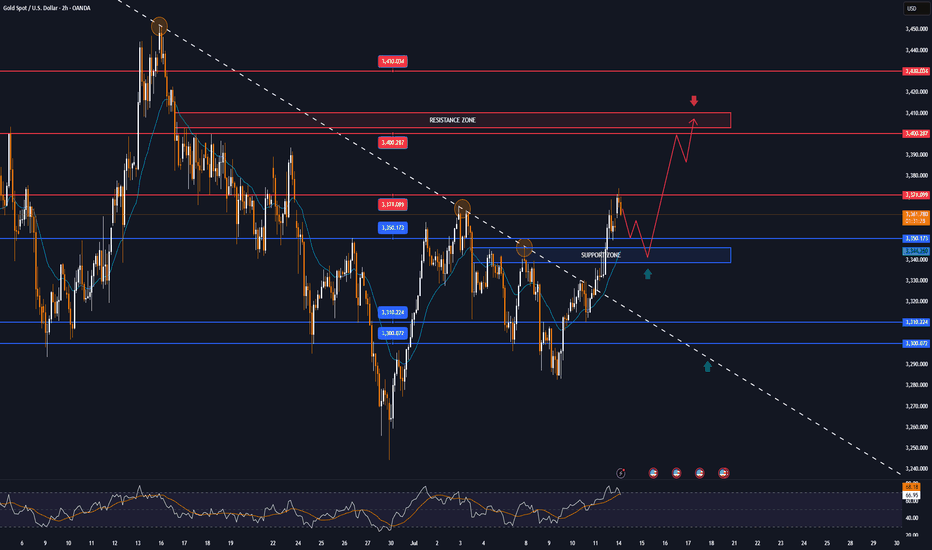

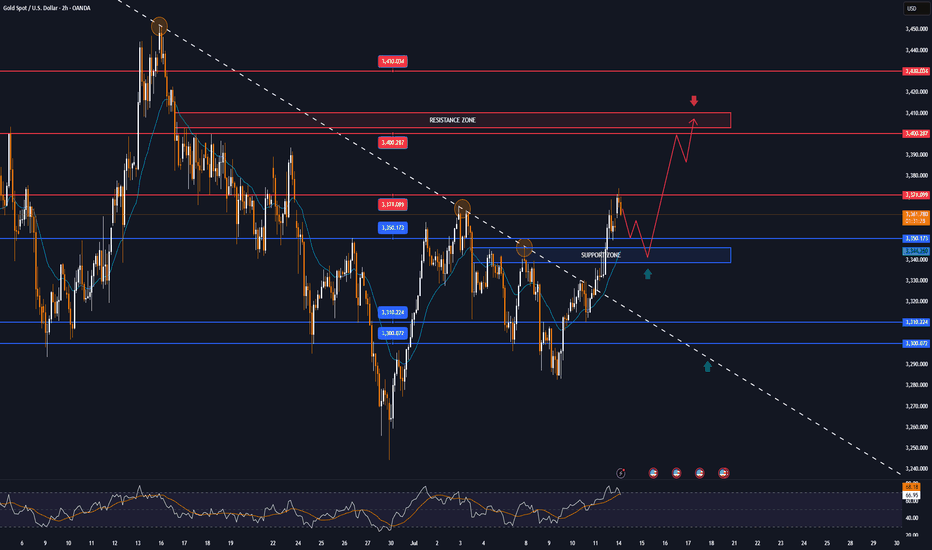

Technical Outlook Analysis

After gold reached the resistance target of attention to readers in the weekly publication at 3,371 USD, which is the location of the 0.236% Fibonacci retracement, it fell slightly but is now recovering positively.

Currently, gold is trading in the range of 3,360 USD, the price action above the lower edge of the long-term rising price channel with support from the EMA21, gold is now likely to continue to retest the 0.236% Fibonacci retracement level.

If gold breaks above $3,371 it will be eligible for a new bullish cycle, with the target then being around $3,400 in the short term, more so than $3,430.

On the other hand, the RSI is pointing up, maintaining activity above 50, and this should be considered a positive signal in terms of momentum. It shows that there is still a lot of room for growth ahead.

However, as of now, gold is still neutral in terms of trend, with conditions gradually tilting towards the possibility of price increase.

Along with that, the notable positions will be listed as follows.

Support: $3,350 – $3,340 – $3,310

Resistance: $3,371 – $3,400 – $3,430

SELL XAUUSD PRICE 3390 - 3388⚡️

↠↠ Stop Loss 3394

→Take Profit 1 3382

↨

→Take Profit 2 3376

BUY XAUUSD PRICE 3304 - 3306⚡️

↠↠ Stop Loss 3300

→Take Profit 1 3312

↨

→Take Profit 2 3318

Note

On July 16, gold prices traded around $3,330/oz, holding steady above the 55-day moving average despite falling 0.5% the day before due to the strongest increase in US CPI data since January, pushing the USD and bond yields up, putting pressure on gold.Note

Gold prices experienced a "roller coaster" of more than $50 when Trump was rumored to want to fire Fed Chairman Powell, causing investors to panic and seek shelter, pushing gold prices to skyrocket.Note

🔴Spot gold lost the $3,330/ounce mark, down 0.53% on the day.Note

Gold prices fell sharply on July 24, partly due to optimism about global trade and positive economic data from the U.S. The U.S.-Japan trade deal, along with progress in negotiations with the European Union, reduced demand for gold as a safe-haven asset.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.