Gold is walking on a tightrope today — and below it is a pit full of retail stops. With a full lineup of high-impact USD news and price tapping into key supply zones, you already know:

The first move is bait. The second pays the sniper.

🧨 FUNDAMENTAL MINEFIELD – MAY 22

Today is packed with market-moving data — every piece adds fuel to the fire:

🕒 15:30 – Unemployment Claims

230K forecast vs. 229K previous

👀 A miss = USD weakness, gold spike

🧨 A beat = potential pressure on gold

🛠️ 16:45 – Flash PMIs (Manufacturing & Services)

Manufacturing: 49.9 → contraction

Services: 51.0 → weak expansion

💥 This is the real bias decider. Two beats = gold down. Two misses = gold up. One of each = chop zone.

🌍 G7 Meetings – All Day

Geopolitical tension brewing? That’s the stealth trigger gold always loves.

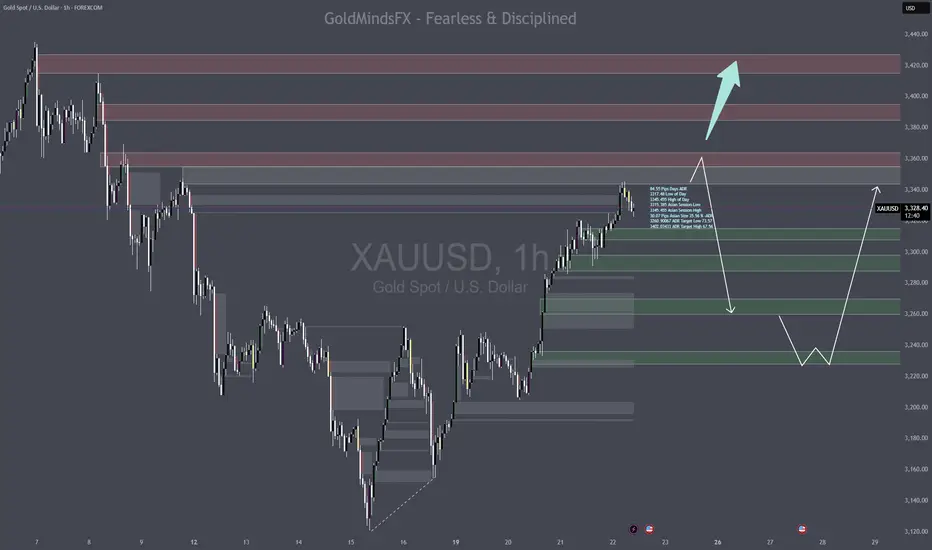

🧠 MACRO STRUCTURE OUTLOOK

• HTF still shows price moving inside key supply

• D1/H4 momentum looks bullish but stretched

• No clean HTF BOS, and no new structural dominance post-May 21 sell setup

⚠️ Translation: Rally looks strong but smells like trap. NY session will expose the truth.

🗺 GOLDMINDSFX SNIPER ZONE MAP ✅

🔴 SUPPLY / SHORT BIAS ZONES

• 3355–3364

→ H1/H4 supply + internal sweep zone

→ Primary area for fakeouts/premium fades

• 3385–3395

→ Old POI + unmitigated H4 OB

→ Algo zone for stop-hunt before dump

• 3418–3427

→ Daily imbalance extension

→ Low-touch, high-R:R trap — news only

🟢 DEMAND / LONG BIAS ZONES

• 3315–3308

→ H1 OB + micro break zone

→ Must hold for bullish continuation

• 3298–3288

→ Post-CHoCH FVG + OB = sniper buy zone

→ High-prob bounce zone

• 3270–3260

→ H4 breaker + old demand

→ Key flip zone — if lost, bears take control

• 3236–3228

→ D1 OB + FVG tail

→ Only valid in a meltdown. Deep liquidity final boss.

🎯 CONTROL ZONE: 3315–3308

→ Holds = bulls stay in the game

→ Breaks = we open the door to 3288–3260 slides

⚔️ PLAYBOOK

✅ BULLISH SCENARIO

News comes in weak → price sweeps 3308 or 3288 → reclaims on M15

→ Enter on confirmation

❌ BEARISH SCENARIO

USD data strong → gold nukes 3308 → flips it to resistance

→ Short confirmed rejection at 3355 or 3385

⚠️ TRAP SCENARIO

Expect first move post-news to be fake. Spike above 3355 or below 3308 is bait.

→ Real sniper entry = the second move, after reclaim or rejection with structure

🎯 FINAL WORD

No confirmation = no entry.

The market doesn’t care how you feel. It only respects execution.

“Structure is the setup. News is the trap. Your job is to wait.”

If this helps you stay clear and deadly — drop a 🚀 and follow for sniper-grade clarity daily.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

The first move is bait. The second pays the sniper.

🧨 FUNDAMENTAL MINEFIELD – MAY 22

Today is packed with market-moving data — every piece adds fuel to the fire:

🕒 15:30 – Unemployment Claims

230K forecast vs. 229K previous

👀 A miss = USD weakness, gold spike

🧨 A beat = potential pressure on gold

🛠️ 16:45 – Flash PMIs (Manufacturing & Services)

Manufacturing: 49.9 → contraction

Services: 51.0 → weak expansion

💥 This is the real bias decider. Two beats = gold down. Two misses = gold up. One of each = chop zone.

🌍 G7 Meetings – All Day

Geopolitical tension brewing? That’s the stealth trigger gold always loves.

🧠 MACRO STRUCTURE OUTLOOK

• HTF still shows price moving inside key supply

• D1/H4 momentum looks bullish but stretched

• No clean HTF BOS, and no new structural dominance post-May 21 sell setup

⚠️ Translation: Rally looks strong but smells like trap. NY session will expose the truth.

🗺 GOLDMINDSFX SNIPER ZONE MAP ✅

🔴 SUPPLY / SHORT BIAS ZONES

• 3355–3364

→ H1/H4 supply + internal sweep zone

→ Primary area for fakeouts/premium fades

• 3385–3395

→ Old POI + unmitigated H4 OB

→ Algo zone for stop-hunt before dump

• 3418–3427

→ Daily imbalance extension

→ Low-touch, high-R:R trap — news only

🟢 DEMAND / LONG BIAS ZONES

• 3315–3308

→ H1 OB + micro break zone

→ Must hold for bullish continuation

• 3298–3288

→ Post-CHoCH FVG + OB = sniper buy zone

→ High-prob bounce zone

• 3270–3260

→ H4 breaker + old demand

→ Key flip zone — if lost, bears take control

• 3236–3228

→ D1 OB + FVG tail

→ Only valid in a meltdown. Deep liquidity final boss.

🎯 CONTROL ZONE: 3315–3308

→ Holds = bulls stay in the game

→ Breaks = we open the door to 3288–3260 slides

⚔️ PLAYBOOK

✅ BULLISH SCENARIO

News comes in weak → price sweeps 3308 or 3288 → reclaims on M15

→ Enter on confirmation

❌ BEARISH SCENARIO

USD data strong → gold nukes 3308 → flips it to resistance

→ Short confirmed rejection at 3355 or 3385

⚠️ TRAP SCENARIO

Expect first move post-news to be fake. Spike above 3355 or below 3308 is bait.

→ Real sniper entry = the second move, after reclaim or rejection with structure

🎯 FINAL WORD

No confirmation = no entry.

The market doesn’t care how you feel. It only respects execution.

“Structure is the setup. News is the trap. Your job is to wait.”

If this helps you stay clear and deadly — drop a 🚀 and follow for sniper-grade clarity daily.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

Telegram t.me/GoldMindsFX_AI ⭐

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Telegram t.me/GoldMindsFX_AI ⭐

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.