Powell hints at a 0.25% rate cut in September (86% probability per CME FedWatch)!

Gold rises in a low-interest-rate environment, but PCE data on August 29 (projected core inflation at 2.9%) could shift the game.

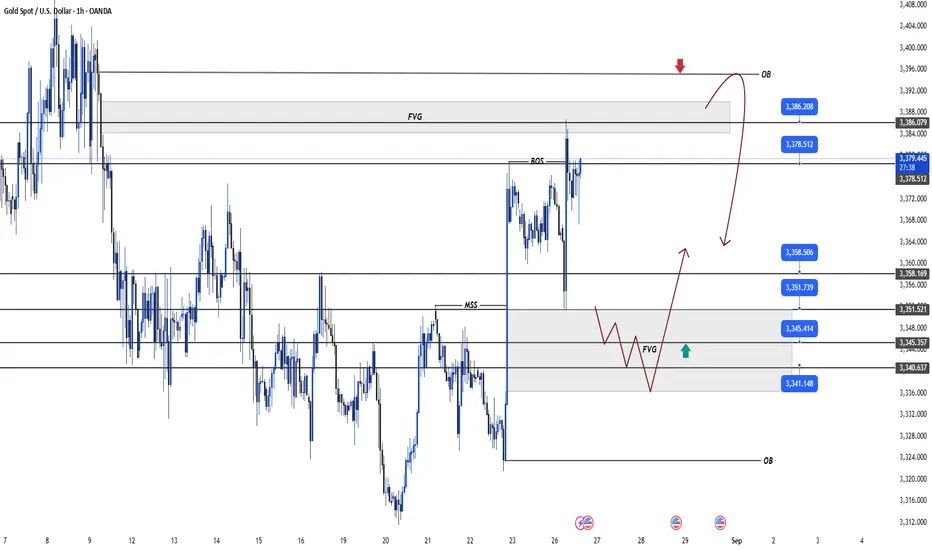

Gold just swept the FVG and is back in range—BUY or SELL?

📈 Technical Analysis:

After a long accumulation phase, gold dropped sharply to 336x, then rallied quickly, breaking the 3378 support. The FVG sweep signals Smart Money manipulation!

Currently, prioritize BUY, but optimize entries at key FVG zones.

💡 Key Price Levels:

Resistance: 3379, 3386, 3395

Support: 3358, 3351, 3345, 3341

🔥 Trading Strategies:

BUY Scalp: 3358-3356,

SL 3353

TP 3364-3374-3385

BUY Zone: 3345-3343,

SL: 3335

TP: 3358-3368-3386-3394

SELL Zone: 3394-3396,

SL: 3400

TP: 3386-3378-3369-3358

#GoldTrading #TradingView #XAUUSD #ForexSignals #FedRateCut #PCEData #DailyPlan

Gold rises in a low-interest-rate environment, but PCE data on August 29 (projected core inflation at 2.9%) could shift the game.

Gold just swept the FVG and is back in range—BUY or SELL?

📈 Technical Analysis:

After a long accumulation phase, gold dropped sharply to 336x, then rallied quickly, breaking the 3378 support. The FVG sweep signals Smart Money manipulation!

Currently, prioritize BUY, but optimize entries at key FVG zones.

💡 Key Price Levels:

Resistance: 3379, 3386, 3395

Support: 3358, 3351, 3345, 3341

🔥 Trading Strategies:

BUY Scalp: 3358-3356,

SL 3353

TP 3364-3374-3385

BUY Zone: 3345-3343,

SL: 3335

TP: 3358-3368-3386-3394

SELL Zone: 3394-3396,

SL: 3400

TP: 3386-3378-3369-3358

#GoldTrading #TradingView #XAUUSD #ForexSignals #FedRateCut #PCEData #DailyPlan

🔥 Ready to Elevate Your Trading Game?

t.me/+1aSqbdspbEdkYjU9

✅ Dive into in-depth technical & fundamental analysis

✅ Master risk management tips to safeguard your capital

📩 Join our TradingView community now!

t.me/+1aSqbdspbEdkYjU9

t.me/+1aSqbdspbEdkYjU9

✅ Dive into in-depth technical & fundamental analysis

✅ Master risk management tips to safeguard your capital

📩 Join our TradingView community now!

t.me/+1aSqbdspbEdkYjU9

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔥 Ready to Elevate Your Trading Game?

t.me/+1aSqbdspbEdkYjU9

✅ Dive into in-depth technical & fundamental analysis

✅ Master risk management tips to safeguard your capital

📩 Join our TradingView community now!

t.me/+1aSqbdspbEdkYjU9

t.me/+1aSqbdspbEdkYjU9

✅ Dive into in-depth technical & fundamental analysis

✅ Master risk management tips to safeguard your capital

📩 Join our TradingView community now!

t.me/+1aSqbdspbEdkYjU9

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.