📉 Gold Holds Steady: Prices are hovering around $3,310–$3,330/oz, restrained by mild USD strength and U.S.–China trade optimism.

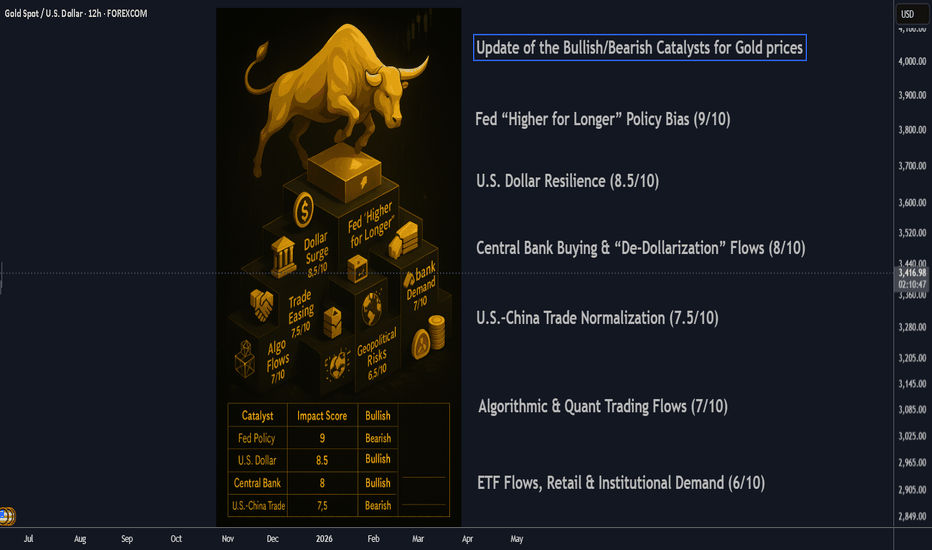

🤝 Trade Talks Influence: Rising optimism ahead of U.S.–China discussions has reduced safe-haven demand, keeping gold subdued.

📊 Technical Watch: Gold is testing the $3,300 mark, with support around the 20‑day SMA—failure to hold could spark a dip toward $3,265.

🔮 Resistance Challenge: Bulls face a tough fight near $3,350–$3,377; a breakout above this could clear the path to $3,500.

💼 U.S. Labor Data: Recent strong jobs numbers (May +139k) have tempered expectations of early rate cuts, supporting the USD and pressuring gold.

💰 ETF & Investment Trends: ETF inflows remain firm; a recent Kitco survey shows mainstream and retail investors growing more bullish.

🌍 Safe‑Haven Sentiment: Geopolitical and economic uncertainties (e.g., trade, weak U.S. data) continue to lend underlying support to gold.

⚖ Range-Bound Near Term: Expect consolidation between $3,300–$3,350 as markets await U.S. CPI and further trade news.

📉 Bearish Short‑Term Bias: Syndicate notes a neutral-to-bearish setup—momentum indicators like RSI and stochastics remain soft.

🏠 Med-Term Outlook Bullish: Despite near-term volatility, fundamentals and technical trends favor a gradual climb toward $3,500+ this year.

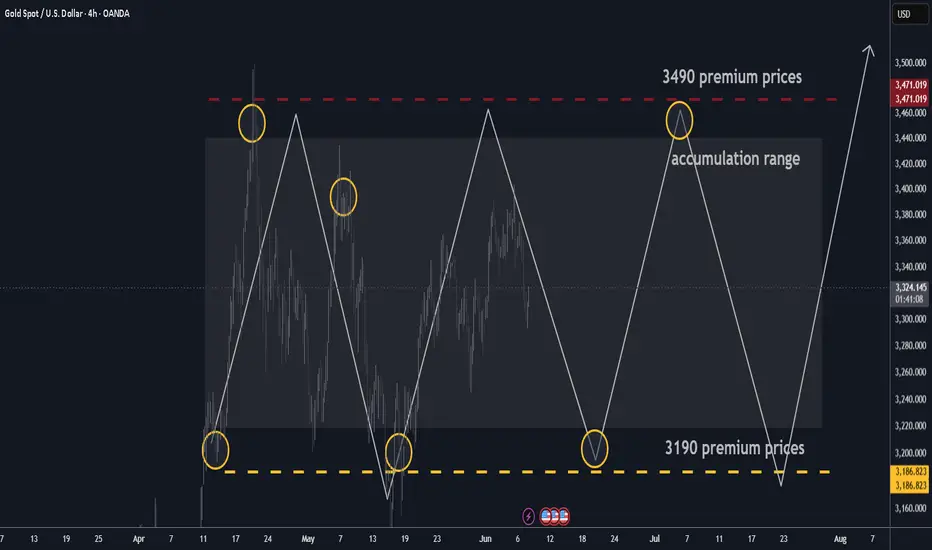

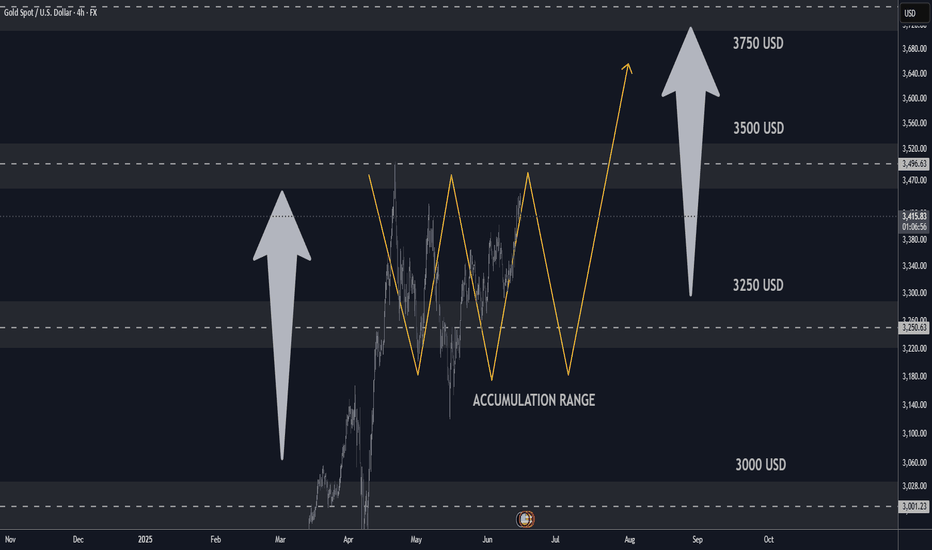

📊 Technical Outlook Update

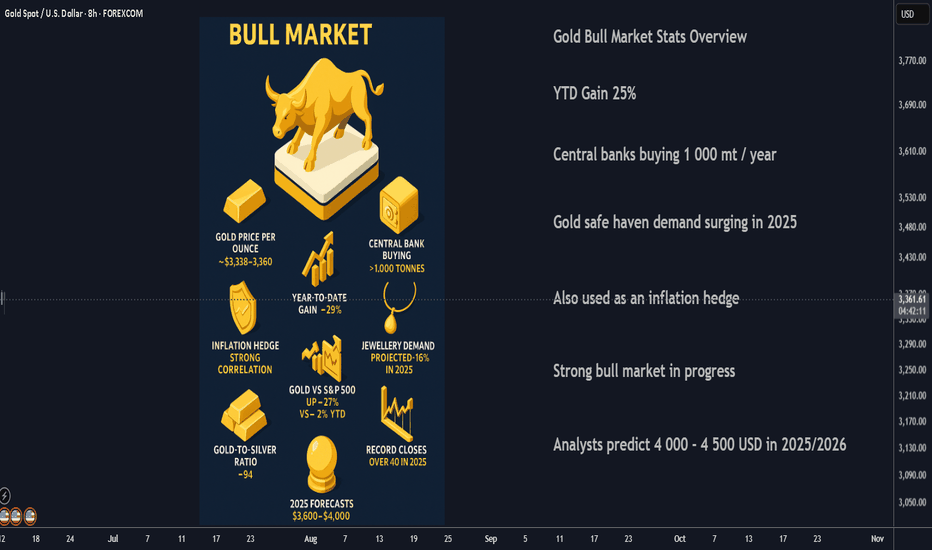

🏆 Bull Market Overview

▪️pullback in progress currently

▪️3500 USD heavy resistance

▪️Re-accumulation in progress now

▪️focus on buying low selling high

▪️Expect re-accumulation into June

▪️Downside capped by 3 200 USD

▪️short-term expecting range action

▪️Bulls still maintain strategic control

⭐️Recommended strategy

▪️Accumulate in range

▪️Closer to 3.2K S/R zone

▪️Bears focus on selling high

🤝 Trade Talks Influence: Rising optimism ahead of U.S.–China discussions has reduced safe-haven demand, keeping gold subdued.

📊 Technical Watch: Gold is testing the $3,300 mark, with support around the 20‑day SMA—failure to hold could spark a dip toward $3,265.

🔮 Resistance Challenge: Bulls face a tough fight near $3,350–$3,377; a breakout above this could clear the path to $3,500.

💼 U.S. Labor Data: Recent strong jobs numbers (May +139k) have tempered expectations of early rate cuts, supporting the USD and pressuring gold.

💰 ETF & Investment Trends: ETF inflows remain firm; a recent Kitco survey shows mainstream and retail investors growing more bullish.

🌍 Safe‑Haven Sentiment: Geopolitical and economic uncertainties (e.g., trade, weak U.S. data) continue to lend underlying support to gold.

⚖ Range-Bound Near Term: Expect consolidation between $3,300–$3,350 as markets await U.S. CPI and further trade news.

📉 Bearish Short‑Term Bias: Syndicate notes a neutral-to-bearish setup—momentum indicators like RSI and stochastics remain soft.

🏠 Med-Term Outlook Bullish: Despite near-term volatility, fundamentals and technical trends favor a gradual climb toward $3,500+ this year.

📊 Technical Outlook Update

🏆 Bull Market Overview

▪️pullback in progress currently

▪️3500 USD heavy resistance

▪️Re-accumulation in progress now

▪️focus on buying low selling high

▪️Expect re-accumulation into June

▪️Downside capped by 3 200 USD

▪️short-term expecting range action

▪️Bulls still maintain strategic control

⭐️Recommended strategy

▪️Accumulate in range

▪️Closer to 3.2K S/R zone

▪️Bears focus on selling high

Note

🚨 Market Alert: Israel-Iran Conflict Impact Forecast 📈🔴 Worst-Case Scenario: Regional War + U.S. Military Involvement

🚢 Oil (Brent): Soars to $150–$200+ if Strait of Hormuz closes

🥇 Gold: Skyrockets to $4,500–$5,000 (safe-haven rush)

₿ Bitcoin: Initial volatility; settles at $80k–$100k

📉 SPX: Crashes to 4,000–4,500

💻 NDX: Drops sharply to 15,000–16,000

🟠 Base-Case Scenario: Protracted Tension, No Major Disruption

🛢 Oil: Stabilizes at elevated $75–$95, occasional spikes

🥇 Gold: Moves higher, trading $3,500–$3,800

₿ Bitcoin: Trades steady, $90k–$110k range

📊 SPX: Pullback moderate, around 5,200–5,500

💻 NDX: Moderately lower, 18,000–19,000 range

🟢 Best-Case Scenario: Diplomatic De-Escalation

🌊 Oil: Eases down to $65–$75

🥇 Gold: Mild decline, holds at $3,300–$3,500

₿ Bitcoin: Positive sentiment, lifts to $100k–$120k

📈 SPX: Slight dip; stays strong near 5,800–6,200

💻 NDX: Minor correction, remains high at 20,000–22,000

taplink.cc/black001

💎Syndicate Black

⚡️Gold/Forex auto-trading bot

📕MyFXBOOK verified 500%+ gains

💎GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate free gold signals

t.me/syndicategold001

💎Syndicate Black

⚡️Gold/Forex auto-trading bot

📕MyFXBOOK verified 500%+ gains

💎GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate free gold signals

t.me/syndicategold001

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

taplink.cc/black001

💎Syndicate Black

⚡️Gold/Forex auto-trading bot

📕MyFXBOOK verified 500%+ gains

💎GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate free gold signals

t.me/syndicategold001

💎Syndicate Black

⚡️Gold/Forex auto-trading bot

📕MyFXBOOK verified 500%+ gains

💎GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate free gold signals

t.me/syndicategold001

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.