________________________________________

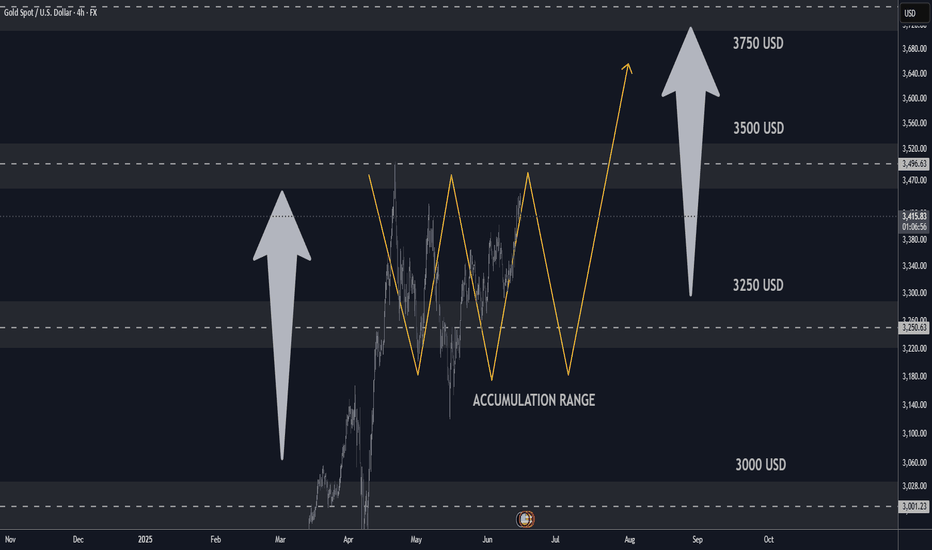

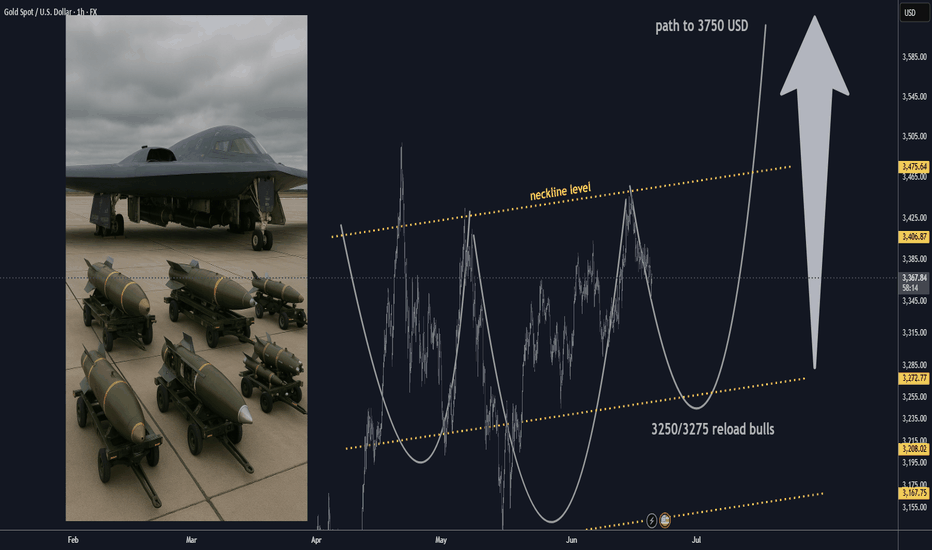

⚡️ Gold’s Pullback: A Reset, Not the End

After peaking above $3,500/oz in April, gold’s slide back toward $3,210 marks a sharp—but not unusual—correction. What’s changed in the gold narrative? The rapid unwinding of panic bids as the Fed stays hawkish, the dollar flexes, and risk appetite returns. But beneath the surface, multiple structural drivers—old and new—are shaping gold’s next act.

________________________________________

1. Fed “Higher for Longer” Policy Bias (9/10)

Still the #1 driver.

With inflation sticky and the U.S. labor market robust, the Federal Reserve’s reluctance to cut rates (4.25–4.50%) is pinning real yields near multi-year highs. This erodes the appeal of non-yielding assets like gold, particularly for Western investors.

🦅 Watch for any dovish shift—a single Fed pivot could reignite gold fast.

________________________________________

2. U.S. Dollar Resilience (8.5/10)

The DXY recently surged above 101, buoyed by relative U.S. growth outperformance and ongoing EM weakness. Since gold is dollar-priced, a strong greenback makes gold more expensive for non-dollar buyers, crimping global demand.

💵 Sustained dollar strength could push gold closer to $3,100 unless countered by inflation or new geopolitical stress.

________________________________________

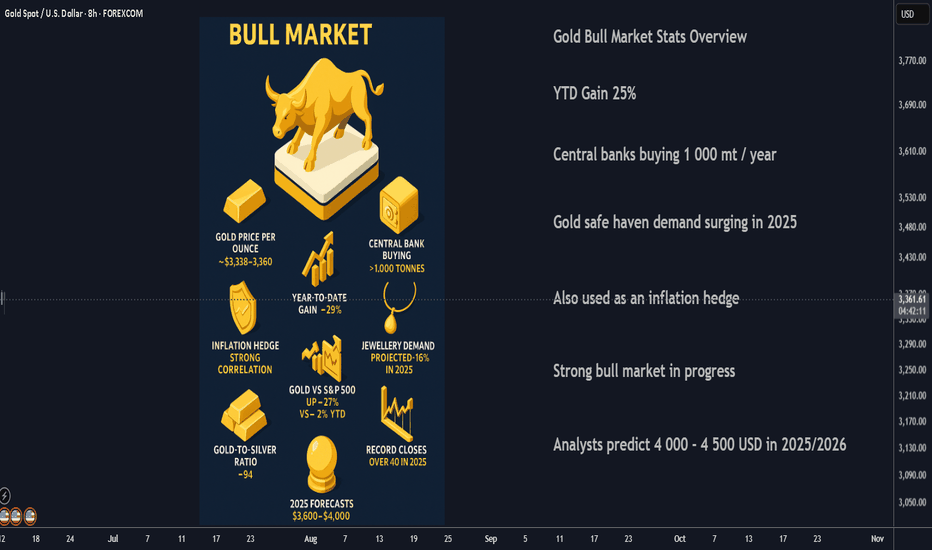

3. Central Bank Buying & “De-Dollarization” Flows (8/10)

This is the new wild card.

Countries like China, India, Turkey, and Russia are accelerating gold reserves accumulation—partly to hedge against dollar-centric sanctions and diversify away from U.S. Treasuries. Q2 2025 data shows a 35% jump in net central bank purchases year-on-year.

🏦 This bid underpins the gold market even when ETFs and retail are sellers.

________________________________________

4. U.S.–China Trade Normalization (7.5/10)

The May 2025 Geneva agreement was a big de-risking event. While tariffs haven’t vanished, steady progress on tech and agriculture reduces tail risk for global trade, putting downward pressure on gold’s safe-haven premium.

🌏 Any breakdown or tariff surprise could quickly reverse this.

________________________________________

5. Algorithmic & Quant Trading Flows (7/10)

Gold’s volatility is now heavily influenced by systematic funds. CTA (commodity trading advisor) and quant-driven selling accelerated the recent drop once $3,300 was breached. This non-fundamental selling creates overshoots—but also sharp reversals on technical bounces.

🤖 Expect snapbacks when positioning reaches extremes.

________________________________________

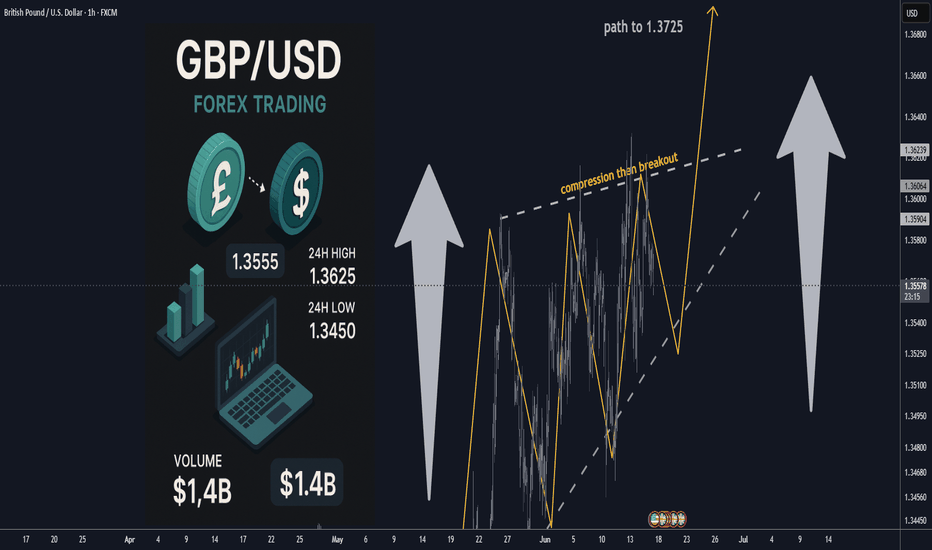

6. U.S.–U.K. & EU Trade Deals (6.5/10)

Both deals have reduced the global uncertainty premium. While the economic impact is moderate, improved global relations have pushed capital into equities and away from gold.

🇬🇧 Keep an eye on political risk, especially if new tariffs or Brexit-related shocks re-emerge.

________________________________________

7. India–Pakistan and Middle East Geopolitical Risks (6.5/10)

Tensions have cooled, but remain a latent driver. The India–Pakistan border saw restraint in May; Iran–U.S. talks are “cautiously positive.” Any surprise flare-up, especially involving oil, can quickly restore gold’s safe-haven bid.

🕊️ Event-driven spikes likely, but not sustained unless escalation persists.

________________________________________

8. ETF Flows, Retail & Institutional Demand (6/10)

ETF inflows have slowed sharply in 2025, but central bank and Asian buying partly offset this. U.S. retail interest has faded due to higher Treasury yields, but any sign of real rates rolling over could spark new inflows.

📈 ETF demand is now more a symptom than a cause of price moves.

________________________________________

9. Technological Demand & Jewelry Trends (5.5/10)

Longer-term, gold’s use in electronics, EVs, and green tech is rising modestly (up ~3% YoY). Indian and Chinese jewelry demand—seasonally soft now—could rebound late 2025 if income and sentiment recover.

📿 Not a short-term driver, but a steady tailwind in the background.

________________________________________

10. Fiscal Risk & U.S. Debt Sustainability (5.5/10)

Rising concerns about the U.S. debt trajectory, especially if deficits widen or the U.S. nears a shutdown or downgrade, can trigger flight-to-quality bids for gold. This is not the main driver now, but is a key “black swan” risk if Treasury auctions stumble.

💣 Could move up the list rapidly on negative headlines.

________________________________________

🌐 Other Catalysts to Watch:

• Israel – Iran tensions in the Middle East – limited impact on gold prices.

• Crypto Market Volatility (5/10): Periods of sharp crypto drawdowns have triggered some rotation into gold, but the correlation is inconsistent.

• Chinese Real Estate Stress (5/10): Signs of further slowdown or crisis (e.g., major developer defaults) could boost gold as a defensive play in Asia.

• Physical Supply Disruptions (4/10): Mine strikes, export restrictions, or transport bottlenecks can create localized price spikes, but rarely move the global market for long.

________________________________________

🏆 2025 Gold Catalyst Rankings (with Impact Scores)

Rank Catalyst Strength/10 Current Impact Direction Notes

1 Fed “Higher for Longer” Policy 9.0 Very High Bearish Key yield driver

2 U.S. Dollar Resilience 8.5 Very High Bearish Hurts non-USD demand

3 Central Bank & “De-Dollarization” Buying 8.0 High Bullish Structural support

4 U.S.–China Trade Normalization 7.5 High Bearish De-risks global trade

5 Algorithmic/Quant Trading Flows 7.0 High Bearish Magnifies volatility

6 U.S.–U.K./EU Trade Deals 6.5 Moderate Bearish Risk appetite rising

7 India–Pakistan/Mideast Geopolitics 6.5 Moderate Neutral Event risk

8 ETF, Retail & Institutional Flows 6.0 Moderate Bearish Trend follower

9 Tech/Jewelry Physical Demand 5.5 Low Bullish Seasonal uptick possible

10 U.S. Debt/Fiscal Sustainability 5.5 Low Bullish Potential tail risk

11 Crypto Market Volatility 5.0 Low Bullish Risk-off flows (sometimes)

12 China Property Crisis 5.0 Low Bullish Asian safe-haven buying

13 Physical Supply Disruptions 4.0 Very Low Bullish Rare but possible

________________________________________

🚦Where Next for Gold?

• Current price: ~$3,210/oz

• Key support: $3,150/oz

• Key upside triggers: A dovish Fed surprise, sharp dollar reversal, sudden geopolitical event, or central bank “buying spree.”

• Risks: Extended strong dollar, yield spike, no escalation of global risks.

________________________________________

Summary Table: 2025 Gold Price Catalysts Comparison

Catalyst 2024 Score 2025 Score Change Impact Direction (2025) Commentary

Fed Rate Policy 9 9 – Bearish Unchanged, still dominant

U.S. Dollar 8 8.5 ↑ Bearish Gained in strength

Central Bank Buying 7 8 ↑ Bullish Grown in importance, especially in Asia

U.S.-China Trade 7.5 7.5 – Bearish Still relevant, deal holding for now

Algorithmic/Quant Flows 6 7 ↑ Bearish Systematic trading influence is rising

Geopolitics (excl. Russia/Ukraine) 6 6.5 ↑ Neutral Slight increase, mostly latent risks

ETF/Institutional Flows 5 6 ↑ Bearish Slower, but still influential

Jewelry/Tech Demand 4.5 5.5 ↑ Bullish Tech/jewelry more important now

U.S. Debt/Fiscal Risk 5 5.5 ↑ Bullish Gaining attention with deficit concerns

Crypto Market Volatility 4 5 ↑ Bullish Correlation growing, but inconsistent

China Property Risk N/A 5 NEW Bullish Added due to emerging Asian risk

Physical Supply Disruption 3.5 4 ↑ Bullish Minor, only spikes on rare events

________________________________________

🥇 Bottom Line:

Gold’s retreat reflects a rebalancing of risk and yield, but the stage is set for sudden moves—especially if the Fed blinks, the dollar falters, or new shocks emerge. The top three catalysts (Fed, Dollar, Central Bank buying) are especially worth watching as we head into the second half of 2025.

⚡️ Gold’s Pullback: A Reset, Not the End

After peaking above $3,500/oz in April, gold’s slide back toward $3,210 marks a sharp—but not unusual—correction. What’s changed in the gold narrative? The rapid unwinding of panic bids as the Fed stays hawkish, the dollar flexes, and risk appetite returns. But beneath the surface, multiple structural drivers—old and new—are shaping gold’s next act.

________________________________________

1. Fed “Higher for Longer” Policy Bias (9/10)

Still the #1 driver.

With inflation sticky and the U.S. labor market robust, the Federal Reserve’s reluctance to cut rates (4.25–4.50%) is pinning real yields near multi-year highs. This erodes the appeal of non-yielding assets like gold, particularly for Western investors.

🦅 Watch for any dovish shift—a single Fed pivot could reignite gold fast.

________________________________________

2. U.S. Dollar Resilience (8.5/10)

The DXY recently surged above 101, buoyed by relative U.S. growth outperformance and ongoing EM weakness. Since gold is dollar-priced, a strong greenback makes gold more expensive for non-dollar buyers, crimping global demand.

💵 Sustained dollar strength could push gold closer to $3,100 unless countered by inflation or new geopolitical stress.

________________________________________

3. Central Bank Buying & “De-Dollarization” Flows (8/10)

This is the new wild card.

Countries like China, India, Turkey, and Russia are accelerating gold reserves accumulation—partly to hedge against dollar-centric sanctions and diversify away from U.S. Treasuries. Q2 2025 data shows a 35% jump in net central bank purchases year-on-year.

🏦 This bid underpins the gold market even when ETFs and retail are sellers.

________________________________________

4. U.S.–China Trade Normalization (7.5/10)

The May 2025 Geneva agreement was a big de-risking event. While tariffs haven’t vanished, steady progress on tech and agriculture reduces tail risk for global trade, putting downward pressure on gold’s safe-haven premium.

🌏 Any breakdown or tariff surprise could quickly reverse this.

________________________________________

5. Algorithmic & Quant Trading Flows (7/10)

Gold’s volatility is now heavily influenced by systematic funds. CTA (commodity trading advisor) and quant-driven selling accelerated the recent drop once $3,300 was breached. This non-fundamental selling creates overshoots—but also sharp reversals on technical bounces.

🤖 Expect snapbacks when positioning reaches extremes.

________________________________________

6. U.S.–U.K. & EU Trade Deals (6.5/10)

Both deals have reduced the global uncertainty premium. While the economic impact is moderate, improved global relations have pushed capital into equities and away from gold.

🇬🇧 Keep an eye on political risk, especially if new tariffs or Brexit-related shocks re-emerge.

________________________________________

7. India–Pakistan and Middle East Geopolitical Risks (6.5/10)

Tensions have cooled, but remain a latent driver. The India–Pakistan border saw restraint in May; Iran–U.S. talks are “cautiously positive.” Any surprise flare-up, especially involving oil, can quickly restore gold’s safe-haven bid.

🕊️ Event-driven spikes likely, but not sustained unless escalation persists.

________________________________________

8. ETF Flows, Retail & Institutional Demand (6/10)

ETF inflows have slowed sharply in 2025, but central bank and Asian buying partly offset this. U.S. retail interest has faded due to higher Treasury yields, but any sign of real rates rolling over could spark new inflows.

📈 ETF demand is now more a symptom than a cause of price moves.

________________________________________

9. Technological Demand & Jewelry Trends (5.5/10)

Longer-term, gold’s use in electronics, EVs, and green tech is rising modestly (up ~3% YoY). Indian and Chinese jewelry demand—seasonally soft now—could rebound late 2025 if income and sentiment recover.

📿 Not a short-term driver, but a steady tailwind in the background.

________________________________________

10. Fiscal Risk & U.S. Debt Sustainability (5.5/10)

Rising concerns about the U.S. debt trajectory, especially if deficits widen or the U.S. nears a shutdown or downgrade, can trigger flight-to-quality bids for gold. This is not the main driver now, but is a key “black swan” risk if Treasury auctions stumble.

💣 Could move up the list rapidly on negative headlines.

________________________________________

🌐 Other Catalysts to Watch:

• Israel – Iran tensions in the Middle East – limited impact on gold prices.

• Crypto Market Volatility (5/10): Periods of sharp crypto drawdowns have triggered some rotation into gold, but the correlation is inconsistent.

• Chinese Real Estate Stress (5/10): Signs of further slowdown or crisis (e.g., major developer defaults) could boost gold as a defensive play in Asia.

• Physical Supply Disruptions (4/10): Mine strikes, export restrictions, or transport bottlenecks can create localized price spikes, but rarely move the global market for long.

________________________________________

🏆 2025 Gold Catalyst Rankings (with Impact Scores)

Rank Catalyst Strength/10 Current Impact Direction Notes

1 Fed “Higher for Longer” Policy 9.0 Very High Bearish Key yield driver

2 U.S. Dollar Resilience 8.5 Very High Bearish Hurts non-USD demand

3 Central Bank & “De-Dollarization” Buying 8.0 High Bullish Structural support

4 U.S.–China Trade Normalization 7.5 High Bearish De-risks global trade

5 Algorithmic/Quant Trading Flows 7.0 High Bearish Magnifies volatility

6 U.S.–U.K./EU Trade Deals 6.5 Moderate Bearish Risk appetite rising

7 India–Pakistan/Mideast Geopolitics 6.5 Moderate Neutral Event risk

8 ETF, Retail & Institutional Flows 6.0 Moderate Bearish Trend follower

9 Tech/Jewelry Physical Demand 5.5 Low Bullish Seasonal uptick possible

10 U.S. Debt/Fiscal Sustainability 5.5 Low Bullish Potential tail risk

11 Crypto Market Volatility 5.0 Low Bullish Risk-off flows (sometimes)

12 China Property Crisis 5.0 Low Bullish Asian safe-haven buying

13 Physical Supply Disruptions 4.0 Very Low Bullish Rare but possible

________________________________________

🚦Where Next for Gold?

• Current price: ~$3,210/oz

• Key support: $3,150/oz

• Key upside triggers: A dovish Fed surprise, sharp dollar reversal, sudden geopolitical event, or central bank “buying spree.”

• Risks: Extended strong dollar, yield spike, no escalation of global risks.

________________________________________

Summary Table: 2025 Gold Price Catalysts Comparison

Catalyst 2024 Score 2025 Score Change Impact Direction (2025) Commentary

Fed Rate Policy 9 9 – Bearish Unchanged, still dominant

U.S. Dollar 8 8.5 ↑ Bearish Gained in strength

Central Bank Buying 7 8 ↑ Bullish Grown in importance, especially in Asia

U.S.-China Trade 7.5 7.5 – Bearish Still relevant, deal holding for now

Algorithmic/Quant Flows 6 7 ↑ Bearish Systematic trading influence is rising

Geopolitics (excl. Russia/Ukraine) 6 6.5 ↑ Neutral Slight increase, mostly latent risks

ETF/Institutional Flows 5 6 ↑ Bearish Slower, but still influential

Jewelry/Tech Demand 4.5 5.5 ↑ Bullish Tech/jewelry more important now

U.S. Debt/Fiscal Risk 5 5.5 ↑ Bullish Gaining attention with deficit concerns

Crypto Market Volatility 4 5 ↑ Bullish Correlation growing, but inconsistent

China Property Risk N/A 5 NEW Bullish Added due to emerging Asian risk

Physical Supply Disruption 3.5 4 ↑ Bullish Minor, only spikes on rare events

________________________________________

🥇 Bottom Line:

Gold’s retreat reflects a rebalancing of risk and yield, but the stage is set for sudden moves—especially if the Fed blinks, the dollar falters, or new shocks emerge. The top three catalysts (Fed, Dollar, Central Bank buying) are especially worth watching as we head into the second half of 2025.

Note

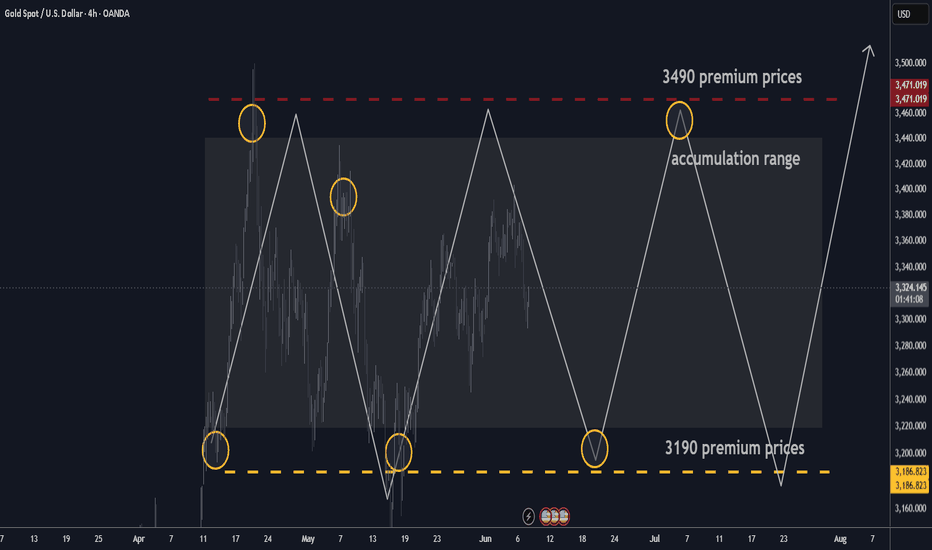

gold closing the week on a strong note near weekly high at 3432 USD.the strong S/R zone is 3450/3500 USD. beyond that - blue sky.

Note

just posted a new update for the gold traders check it out aboveNote

🚨 Market Alert: Israel-Iran Conflict Impact Forecast 📈🔴 Worst-Case Scenario: Regional War + U.S. Military Involvement

🚢 Oil (Brent): Soars to $150–$200+ if Strait of Hormuz closes

🥇 Gold: Skyrockets to $4,500–$5,000 (safe-haven rush)

₿ Bitcoin: Initial volatility; settles at $80k–$100k

📉 SPX: Crashes to 4,000–4,500

💻 NDX: Drops sharply to 15,000–16,000

🟠 Base-Case Scenario: Protracted Tension, No Major Disruption

🛢 Oil: Stabilizes at elevated $75–$95, occasional spikes

🥇 Gold: Moves higher, trading $3,500–$3,800

₿ Bitcoin: Trades steady, $90k–$110k range

📊 SPX: Pullback moderate, around 5,200–5,500

💻 NDX: Moderately lower, 18,000–19,000 range

🟢 Best-Case Scenario: Diplomatic De-Escalation

🌊 Oil: Eases down to $65–$75

🥇 Gold: Mild decline, holds at $3,300–$3,500

₿ Bitcoin: Positive sentiment, lifts to $100k–$120k

📈 SPX: Slight dip; stays strong near 5,800–6,200

💻 NDX: Minor correction, remains high at 20,000–22,000

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.