🧱 Market Structure

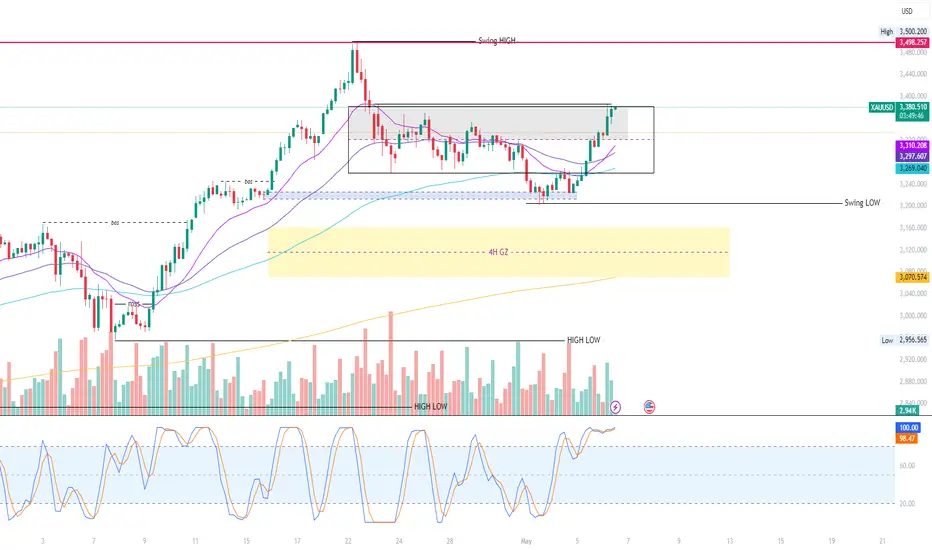

Recent Bullish BOS (Break of Structure) confirms buyer control.

Price is attempting a range breakout above key consolidation zone.

Next target: 3,488–3,500 (Swing High / Liquidity zone).

📌 Key Zones

Support: 3,320 – 3,340 (top of the box = retest area)

Resistance/Target: 3,488 – 3,500

Demand Zone (4H GZ): 3,120 (marked as deep institutional re-entry point)

📊 Indicators Aligned

EMAs are bullishly stacked (momentum up).

Volume increasing on bullish candles (breakout fuel).

Stoch RSI overbought (watch for short-term cooldown).

⚔️ Strategy at This Moment

Primary Bias: Bullish

Action:

Wait for a 4H candle close above the box

Enter on retest of the box top or small demand wick with confluence (e.g., bullish engulfing)

Protect trade with tight SL (below box or bullish candle low)

🎯 Targets:

TP1: 3,450

TP2: 3,488–3,500 (swing high)

❌ SL: 3,320 or tighter based on entry candle

🎯 Traits & Strengths

✅ Identifies structure early (BOS, CHoCH)

✅ Uses volume and EMAs to confirm breakout momentum

✅ Recognizes institutional footprints (e.g., GZ zones, wicks, liquidity grabs)

✅ Always waits for confirmation before entry — no emotional entries

✅ Backtested strategy and trusts the process

🔐 Trading Creed

“Price is noise. Structure is signal. I only enter where the weak exit.”

Recent Bullish BOS (Break of Structure) confirms buyer control.

Price is attempting a range breakout above key consolidation zone.

Next target: 3,488–3,500 (Swing High / Liquidity zone).

📌 Key Zones

Support: 3,320 – 3,340 (top of the box = retest area)

Resistance/Target: 3,488 – 3,500

Demand Zone (4H GZ): 3,120 (marked as deep institutional re-entry point)

📊 Indicators Aligned

EMAs are bullishly stacked (momentum up).

Volume increasing on bullish candles (breakout fuel).

Stoch RSI overbought (watch for short-term cooldown).

⚔️ Strategy at This Moment

Primary Bias: Bullish

Action:

Wait for a 4H candle close above the box

Enter on retest of the box top or small demand wick with confluence (e.g., bullish engulfing)

Protect trade with tight SL (below box or bullish candle low)

🎯 Targets:

TP1: 3,450

TP2: 3,488–3,500 (swing high)

❌ SL: 3,320 or tighter based on entry candle

🎯 Traits & Strengths

✅ Identifies structure early (BOS, CHoCH)

✅ Uses volume and EMAs to confirm breakout momentum

✅ Recognizes institutional footprints (e.g., GZ zones, wicks, liquidity grabs)

✅ Always waits for confirmation before entry — no emotional entries

✅ Backtested strategy and trusts the process

🔐 Trading Creed

“Price is noise. Structure is signal. I only enter where the weak exit.”

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.