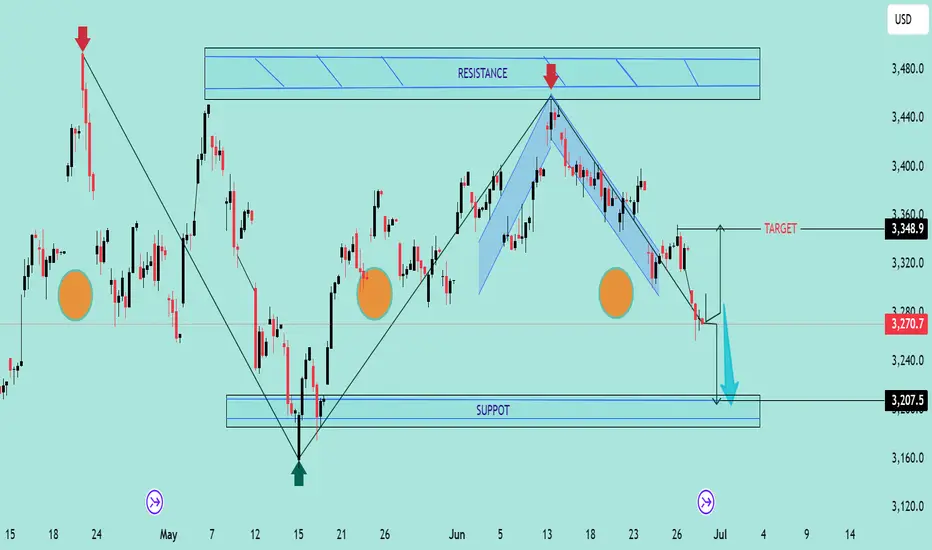

The chart reveals a classic Double Top pattern formation near the 3,360–3,480 resistance zone, followed by a clear bearish rejection (highlighted with red arrows). This confirms the presence of strong supply pressure in that region.

🔍 Key Technical Highlights:

🔺 Double Top Pattern

The price formed two swing highs near the resistance zone, failing to break above.

After the second peak, the price started declining, confirming the reversal pattern.

📉 Bearish Channel

The recent downtrend is contained within a descending channel, with consistent lower highs and lower lows.

Price broke below the neckline of the double top pattern around 3,270.

🎯 Target Projection

Based on the height of the double top pattern, the projected downside target is near 3,207.5, aligning perfectly with the support zone marked below.

🟠 Historical Support Areas

The large orange circles indicate key reaction points, confirming that the 3,207–3,220 area has acted as support in the past.

📊 Outlook:

If the current bearish momentum continues, price is likely to head towards the support target zone at 3,207.5. Any pullback toward 3,320–3,350 could provide a shorting opportunity with stops above the recent highs.

🔧 Bias: Bearish

📍 Resistance: 3,360–3,480

📍 Support: 3,207–3,220

📍 Target: 3,207.5

🔍 Key Technical Highlights:

🔺 Double Top Pattern

The price formed two swing highs near the resistance zone, failing to break above.

After the second peak, the price started declining, confirming the reversal pattern.

📉 Bearish Channel

The recent downtrend is contained within a descending channel, with consistent lower highs and lower lows.

Price broke below the neckline of the double top pattern around 3,270.

🎯 Target Projection

Based on the height of the double top pattern, the projected downside target is near 3,207.5, aligning perfectly with the support zone marked below.

🟠 Historical Support Areas

The large orange circles indicate key reaction points, confirming that the 3,207–3,220 area has acted as support in the past.

📊 Outlook:

If the current bearish momentum continues, price is likely to head towards the support target zone at 3,207.5. Any pullback toward 3,320–3,350 could provide a shorting opportunity with stops above the recent highs.

🔧 Bias: Bearish

📍 Resistance: 3,360–3,480

📍 Support: 3,207–3,220

📍 Target: 3,207.5

Trade closed: target reached

JOIN MY TELEGRAM CHANNEL

t.me/StellarMarketAnalysis

JOIN MY RECOMMENTED BROKER REFFREL LINK

⤵️one.exnesstrack.net/a/uvd1etcgg1

PARTNER CODE⤵️

uvd1etcgg1

t.me/StellarMarketAnalysis

JOIN MY RECOMMENTED BROKER REFFREL LINK

⤵️one.exnesstrack.net/a/uvd1etcgg1

PARTNER CODE⤵️

uvd1etcgg1

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

JOIN MY TELEGRAM CHANNEL

t.me/StellarMarketAnalysis

JOIN MY RECOMMENTED BROKER REFFREL LINK

⤵️one.exnesstrack.net/a/uvd1etcgg1

PARTNER CODE⤵️

uvd1etcgg1

t.me/StellarMarketAnalysis

JOIN MY RECOMMENTED BROKER REFFREL LINK

⤵️one.exnesstrack.net/a/uvd1etcgg1

PARTNER CODE⤵️

uvd1etcgg1

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.