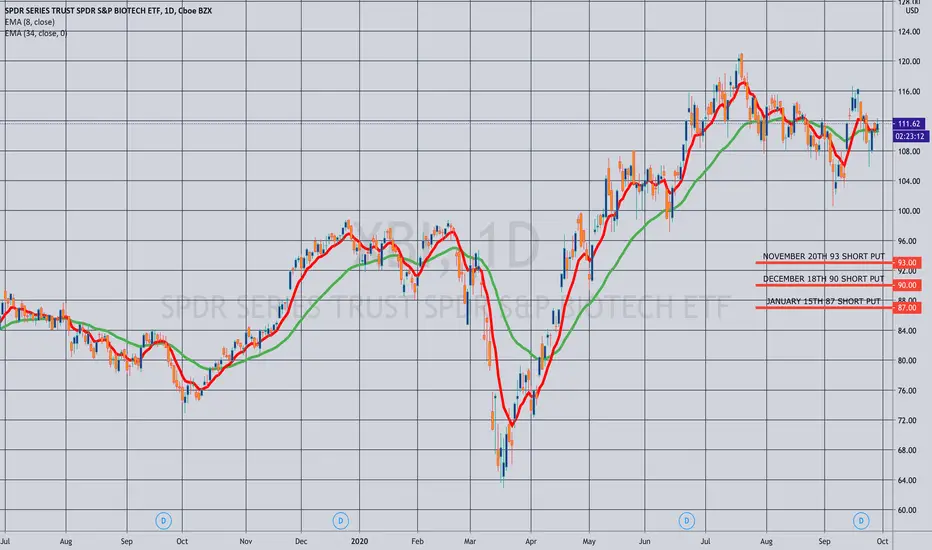

OPENING (IRA): XBI NOV/DEC/JAN 87/90/93 SHORT PUT LADDER

... for a 5.91 credit in total.

Notes: Going where the volatility is ... . 30-day greater than 35% (39.8%) with the November at-the-money short straddle paying 13.1% of where the stock is currently trading.

This isn't usually an IRA play I go for, since you won't get paid to wait if you get assigned shares (the yield is absolutely paltry at .10%). However, I'm pretty much in all the plays or in a closely correlated play at the top of the exchange-traded-fund board: XOP (56.2%) (play on in XLE); GDXJ (51.1%) (plays on in SLV and GLD); SLV (47.7%); EWZ (47.5%); GDX (42.9%) (plays on in SLV/GLD); XLE (42.6%), and SMH (39.6%) (no play on).

Notes: Going where the volatility is ... . 30-day greater than 35% (39.8%) with the November at-the-money short straddle paying 13.1% of where the stock is currently trading.

This isn't usually an IRA play I go for, since you won't get paid to wait if you get assigned shares (the yield is absolutely paltry at .10%). However, I'm pretty much in all the plays or in a closely correlated play at the top of the exchange-traded-fund board: XOP (56.2%) (play on in XLE); GDXJ (51.1%) (plays on in SLV and GLD); SLV (47.7%); EWZ (47.5%); GDX (42.9%) (plays on in SLV/GLD); XLE (42.6%), and SMH (39.6%) (no play on).

Trade active

Out of the November 20th 93 for .28. Scratch at 5.63.Trade closed manually

Out of the December 90 for .21 and the January 87 for .33 today. 5.63 - .21 - .33 = 5.09 ($509) profit.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.