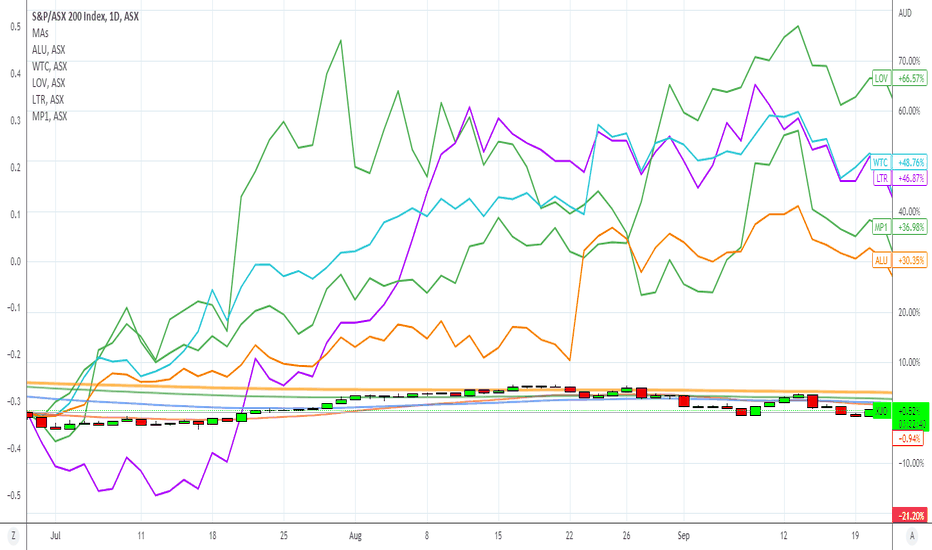

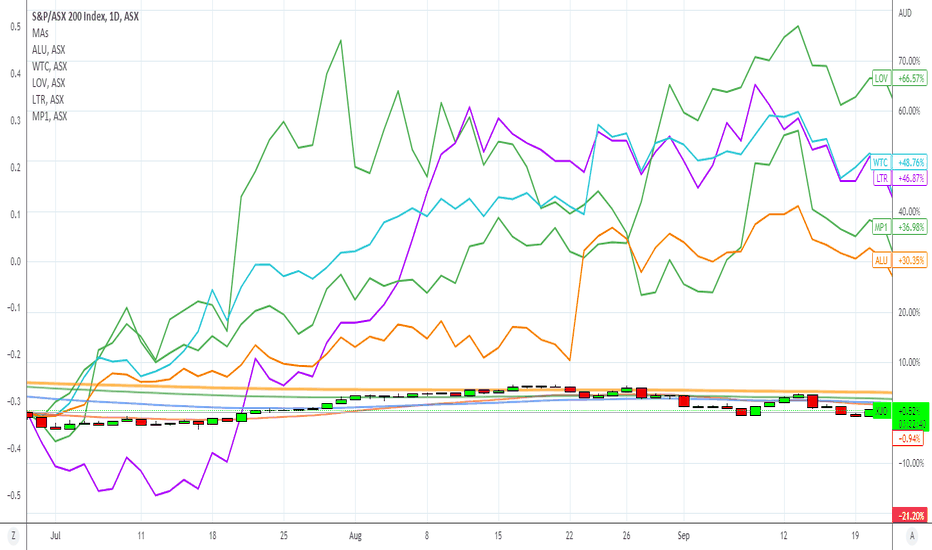

Thought I'd throw up a diverse bunch of ASX growth stocks with decent market caps showing solid relative strength compared to the XJO (represented by the candles). XJO IS STILL DOWN ROUGHLY 4%.

Considering how crappy the market has been since mid February, the below stocks have held up really well and could be out performers over the next 18 months or so:

Market down approx 16% (Feb top - April low), currently still down 4%.

Since the February top:

Downer (DOW)16%

Telstra (TLS) 18%

Superloop (SLC) 29%

A2 Milk (A2M) 41%

Nanosonic (NAN) 42%

Eagers Auto (APE) 47%

Check out a similar list below from 2022 where all stocks had runs ranging from 60% to 160% over the next year or so after showing strong relative strength during 2022 lows(interest rates uncertainty)

Considering how crappy the market has been since mid February, the below stocks have held up really well and could be out performers over the next 18 months or so:

Market down approx 16% (Feb top - April low), currently still down 4%.

Since the February top:

Downer (DOW)16%

Telstra (TLS) 18%

Superloop (SLC) 29%

A2 Milk (A2M) 41%

Nanosonic (NAN) 42%

Eagers Auto (APE) 47%

Check out a similar list below from 2022 where all stocks had runs ranging from 60% to 160% over the next year or so after showing strong relative strength during 2022 lows(interest rates uncertainty)

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.