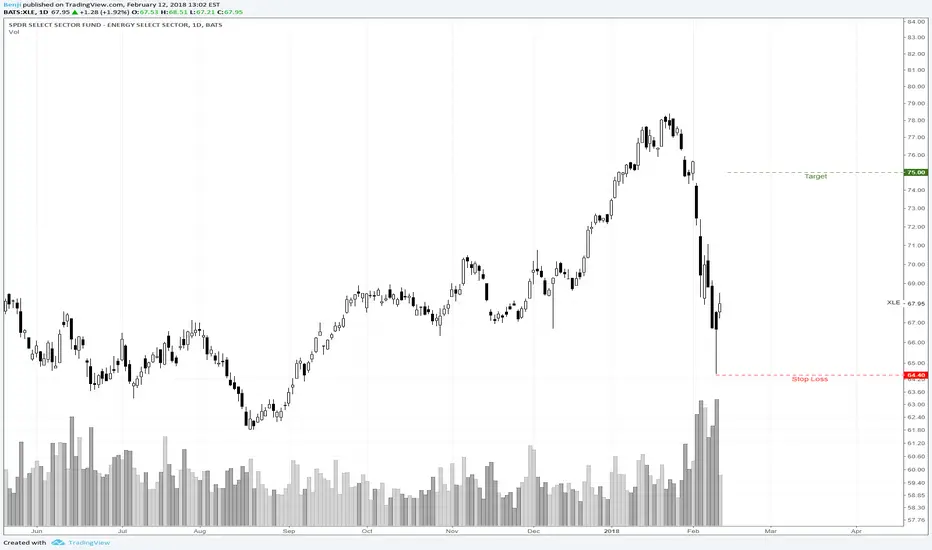

Long via Jun15/Mar16 diagonal for $4.37

POP: 50%

Max Loss: $4.37

Stop Loss: Price at $64.40

Max win: As of right now, $263

Target: Price at $75

Long Jun15 $66 call: 61 delta

Short Mar16 $73 call: 14 delta.

I structured this trade to give me the most profit as close to my target as possible (in the case it shoots straight up), while still having a positive theta trade. For reference try to match the thetas of both options up for choosing a strike for your short.

I will continue to roll the short call each cycle to continue to eliminate basis as well.

POP: 50%

Max Loss: $4.37

Stop Loss: Price at $64.40

Max win: As of right now, $263

Target: Price at $75

Long Jun15 $66 call: 61 delta

Short Mar16 $73 call: 14 delta.

I structured this trade to give me the most profit as close to my target as possible (in the case it shoots straight up), while still having a positive theta trade. For reference try to match the thetas of both options up for choosing a strike for your short.

I will continue to roll the short call each cycle to continue to eliminate basis as well.

Trade active

Added to this position on the strength on a pullback.Feb23 66/67 short put spreads @ $.25

short $67 put: 38 delta

long $66 put: 26 delta

Max win: $50

Max loss: $150

Likely to let these expire worthless, but if we get a sharp reversal through my stop - I'll try to salvage a little bit of them.

Trade active

Price is continuing to get favorable, so I am going to dabble just a bit more. I also moved up my stop level to help reduce any risk.I added a risk reversal for June15 expiration.

long $53 put: 7 delta

short $65 put: 33 delta

long $72 call: 35 delta

Overall trade was for $.04 credit.

Stop loss: Price at $66.50

Target: $72

Trade active

Still working with trying to keep this trade neutral to positive theta.Sold the Apr20 54/64 put spread ($.91 cr) to reduce basis a bit further. This looks to be under some short term support here.

short 64 put: 25 delta

long 54 put: 5 delta

Max loss: $909

Stop loss: 2.5x cr received

Target: 50% cr received.

Note

I've also added a synthetic strangle here to capture some high IV/theta in the process. Sold Apr20 60/66/72/78 iron condor for $1.69

POP: 51%

DTE: 62

Max Loss: $431

Max Win: $169

Stop loss: $338

Target: 50% of cr received

long 60 put: 13 delta

short 66 put: 32 delta

short 72 call: 25 delta

short 78 call: 8 delta

Trade active

The original $73 call on the core call spread position had widdled down significantly over this time and small down move. I rolled it out to the Apr20 $73 call for add'l $.26. The basis on that spread is now $4.11.Trade active

Feb23 66/67 put spreads expired worthless, $50 profit.Trade closed: stop reached

Stopped out of the risk reversal trade here for $1.28 db, $132 loss.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.