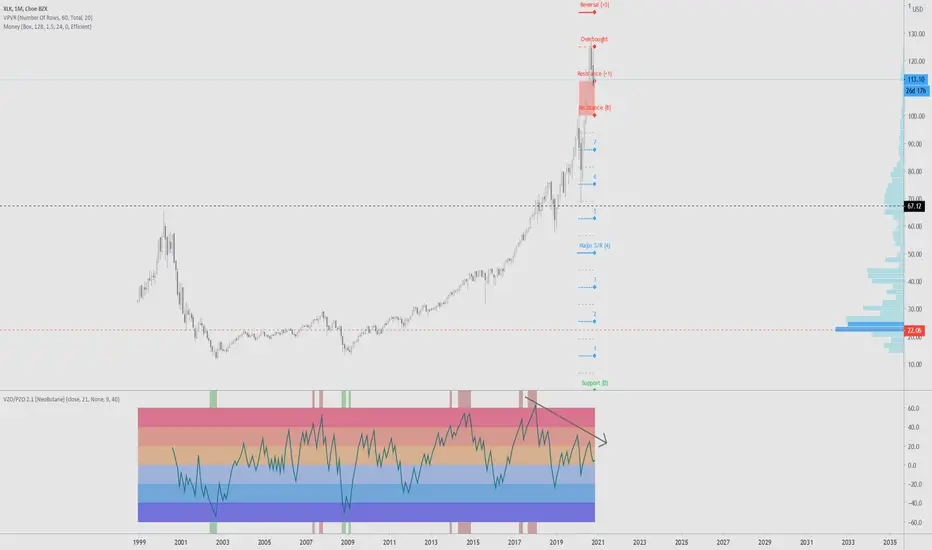

When comparing tech focused ETFs/indexes, namely  NDAQ and

NDAQ and  XLK, we can see that

XLK, we can see that  SPY has recently been outperforming them. My theory is that this is an unusual case and a sign that tech stocks are near tops.

SPY has recently been outperforming them. My theory is that this is an unusual case and a sign that tech stocks are near tops.

Given that I did not receive the dip I wanted, I have difficulty putting on a short position on tech. There is also the factor that the highs have not been truly swept yet.

Just something to keep an eye on.

$NDAQ/ SPY

SPY

$XLK/ SPY

SPY

For options plays, it would appear leaps for NDAQ would be ideal, while short term plays on

NDAQ would be ideal, while short term plays on  XLK would work out.

XLK would work out.  NDAQ is quite illiquid.

NDAQ is quite illiquid.

Given that I did not receive the dip I wanted, I have difficulty putting on a short position on tech. There is also the factor that the highs have not been truly swept yet.

Just something to keep an eye on.

$NDAQ/

$XLK/

For options plays, it would appear leaps for

My published indicators: tradingview.com/u/NeoButane/

Sorry if I haven't replied to your message yet, I'm a bit backlogged :)

Sorry if I haven't replied to your message yet, I'm a bit backlogged :)

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

My published indicators: tradingview.com/u/NeoButane/

Sorry if I haven't replied to your message yet, I'm a bit backlogged :)

Sorry if I haven't replied to your message yet, I'm a bit backlogged :)

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.