Previous broadening formation:

Previously on the weekly time frame chart, the price action of Stellar formed a broadening formation, and every time after getting rejected by the support it was forming higher than the previous high. But during the recent drop, the priceline of Lumens has broken down a very strong support structure of this broadening formation and now moving around the 50 simple moving average on the weekly time frame. After 50 simple moving average, there are also 100 and 200 simple moving averages strong support beneath the price action of XLM

Support and resistance levels:

If we take a look at the major support and resistance levels on the weekly time frame chart, then it can be easily observed that the priceline has been strongly rejected by the 70 cents resistance level. Ater $0.70 the price action broke down the different supports at $0.55, $0.45. $0.35 and $0.28 respectively. Now it is moving above $0.22 support level. During this recent downward rally, the price action has spike up to $0.20. Therefore, now the $0.22 cents resistance has been replaced by the $0.20.

Broke out the resistance of channel:

The price line has also broken out the resistance of a down-channel for a big move.

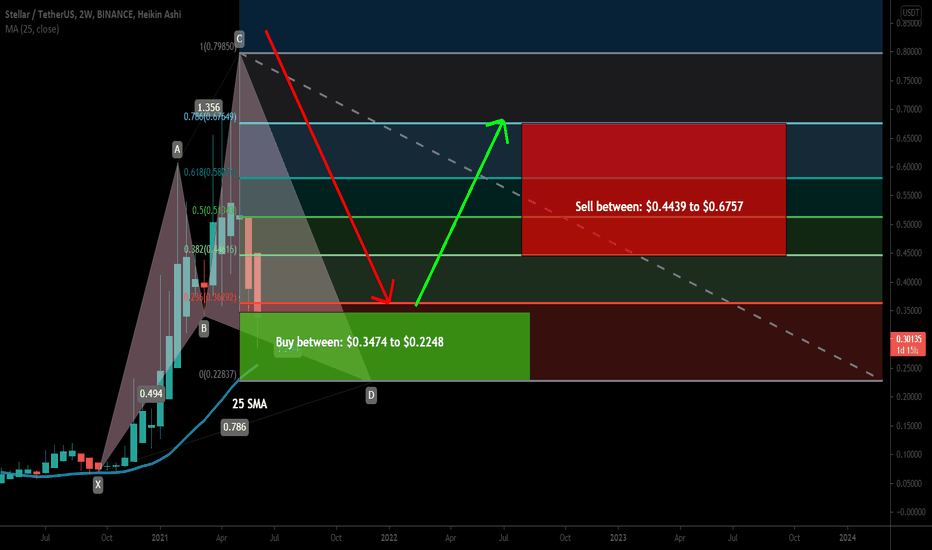

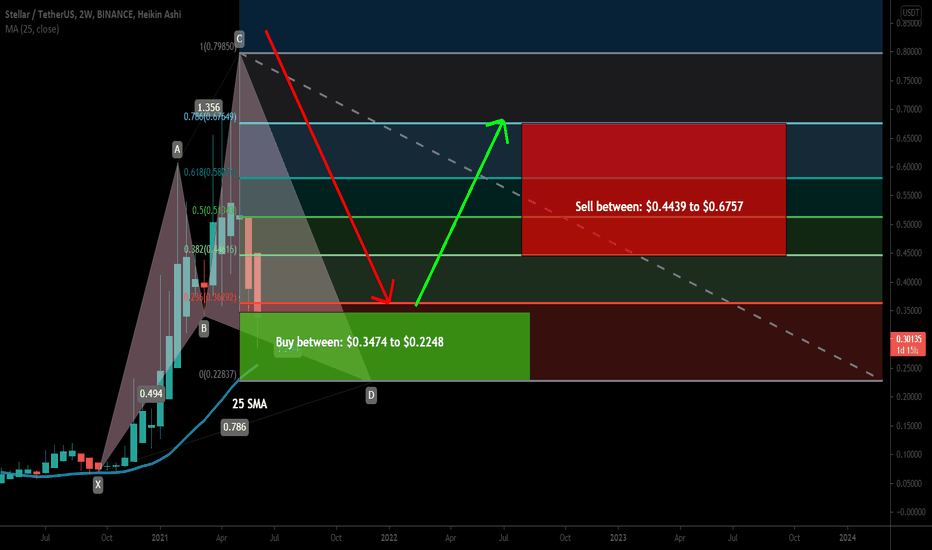

Big bullish Cypher move:

XLM also has formed a big bullish Cypher patter, I have already shared the details of this pattern in my previous article for more details you can visit the below article:

New broadening formation:

After breaking down the support of the previous broadening formation which was formed on the weekly time frame now the priceline of XLM has Formed another broadening formation on the daily time frame and moving at the support of this broadening formation. If the priceline will be reversed bullish from here and reach the resistance then it can move up to 80 cents.

Previously on the weekly time frame chart, the price action of Stellar formed a broadening formation, and every time after getting rejected by the support it was forming higher than the previous high. But during the recent drop, the priceline of Lumens has broken down a very strong support structure of this broadening formation and now moving around the 50 simple moving average on the weekly time frame. After 50 simple moving average, there are also 100 and 200 simple moving averages strong support beneath the price action of XLM

Support and resistance levels:

If we take a look at the major support and resistance levels on the weekly time frame chart, then it can be easily observed that the priceline has been strongly rejected by the 70 cents resistance level. Ater $0.70 the price action broke down the different supports at $0.55, $0.45. $0.35 and $0.28 respectively. Now it is moving above $0.22 support level. During this recent downward rally, the price action has spike up to $0.20. Therefore, now the $0.22 cents resistance has been replaced by the $0.20.

Broke out the resistance of channel:

The price line has also broken out the resistance of a down-channel for a big move.

Big bullish Cypher move:

XLM also has formed a big bullish Cypher patter, I have already shared the details of this pattern in my previous article for more details you can visit the below article:

New broadening formation:

After breaking down the support of the previous broadening formation which was formed on the weekly time frame now the priceline of XLM has Formed another broadening formation on the daily time frame and moving at the support of this broadening formation. If the priceline will be reversed bullish from here and reach the resistance then it can move up to 80 cents.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.