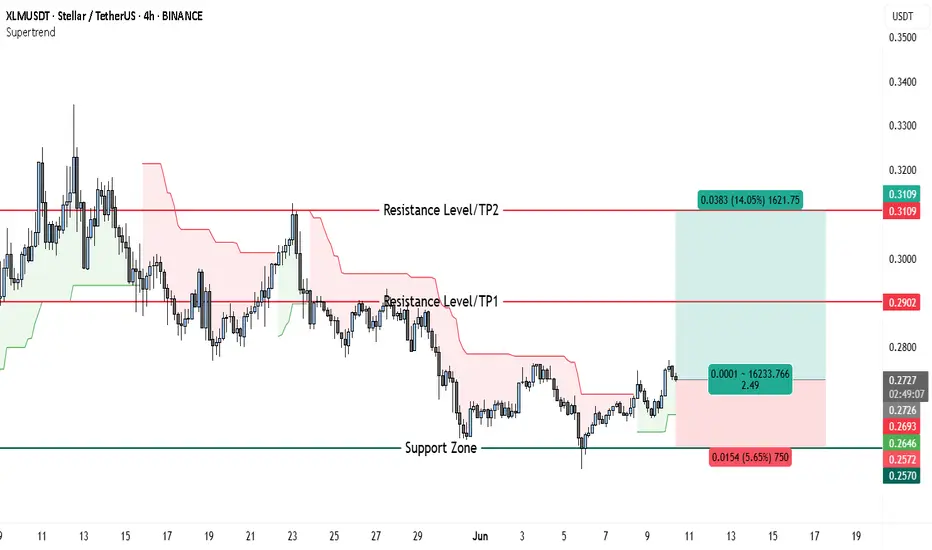

XLMUSDT is currently forming a bullish reversal structure on the 4-hour chart. After a prolonged downtrend, price has established a support base around the $0.2570 level. This zone has acted as a key support, rejecting downside attempts multiple times, and creating a potential accumulation floor.

The price is now pushing above short-term consolidation, hinting at a possible breakout from the recent range. This range behavior, followed by an early higher low formation, indicates that buyers may be stepping in more aggressively.

Support Zone

The support zone around $0.2570 to $0.2585 is structurally significant. Price dipped into this level twice and was strongly rejected both times. The most recent low around this zone created a long wick, suggesting liquidity grab and potential trend reversal.

This zone now serves as a clear invalidation point for the bullish setup. A break below would likely invalidate the long bias and open the door for a deeper retracement.

Resistance Levels and Take-Profit Targets

The chart identifies two major resistance levels.

The first resistance is around $0.2902, marking Take Profit 1 (TP1). This level acted as resistance multiple times in the past and should be the first area where selling pressure could return.

The second resistance, marked at $0.3109 (TP2), is a higher timeframe resistance zone. It was previously a strong ceiling before the drop in early June. If the momentum is sustained, this area becomes a logical final target for the current bullish swing.

Supertrend Confirmation

The Supertrend indicator has recently flipped green, supporting the bullish bias. The flip occurred after price reclaimed the mid-range, and the price is now consolidating just above the Supertrend baseline.

This is a classic bullish signal on the 4H chart, particularly when it aligns with a structural bottoming pattern and a clean risk-reward setup.

Risk–Reward Setup

The current setup offers a favorable risk-to-reward ratio of 2.49. Entry is positioned near $0.2723, with the stop-loss placed just below the support zone at $0.2570. This limits downside risk to approximately 5.6%.

The upside, on the other hand, stretches up to $0.3109, offering potential gains of around 14%. Even the first target at $0.2902 offers a decent 6.5% return, making this trade attractive for swing traders aiming for a mid-term move.

Momentum Shift and Potential Breakout

What strengthens the bullish case further is the price action attempting to break out of the recent lower high zone. There is a clear effort to reclaim momentum, and a successful 4H candle close above $0.2770 would signal a clean breakout and continuation.

Earlier price action shows signs of accumulation, including a liquidity sweep below $0.2570 followed by strong rejection — a common reversal pattern in crypto markets.

The price is now pushing above short-term consolidation, hinting at a possible breakout from the recent range. This range behavior, followed by an early higher low formation, indicates that buyers may be stepping in more aggressively.

Support Zone

The support zone around $0.2570 to $0.2585 is structurally significant. Price dipped into this level twice and was strongly rejected both times. The most recent low around this zone created a long wick, suggesting liquidity grab and potential trend reversal.

This zone now serves as a clear invalidation point for the bullish setup. A break below would likely invalidate the long bias and open the door for a deeper retracement.

Resistance Levels and Take-Profit Targets

The chart identifies two major resistance levels.

The first resistance is around $0.2902, marking Take Profit 1 (TP1). This level acted as resistance multiple times in the past and should be the first area where selling pressure could return.

The second resistance, marked at $0.3109 (TP2), is a higher timeframe resistance zone. It was previously a strong ceiling before the drop in early June. If the momentum is sustained, this area becomes a logical final target for the current bullish swing.

Supertrend Confirmation

The Supertrend indicator has recently flipped green, supporting the bullish bias. The flip occurred after price reclaimed the mid-range, and the price is now consolidating just above the Supertrend baseline.

This is a classic bullish signal on the 4H chart, particularly when it aligns with a structural bottoming pattern and a clean risk-reward setup.

Risk–Reward Setup

The current setup offers a favorable risk-to-reward ratio of 2.49. Entry is positioned near $0.2723, with the stop-loss placed just below the support zone at $0.2570. This limits downside risk to approximately 5.6%.

The upside, on the other hand, stretches up to $0.3109, offering potential gains of around 14%. Even the first target at $0.2902 offers a decent 6.5% return, making this trade attractive for swing traders aiming for a mid-term move.

Momentum Shift and Potential Breakout

What strengthens the bullish case further is the price action attempting to break out of the recent lower high zone. There is a clear effort to reclaim momentum, and a successful 4H candle close above $0.2770 would signal a clean breakout and continuation.

Earlier price action shows signs of accumulation, including a liquidity sweep below $0.2570 followed by strong rejection — a common reversal pattern in crypto markets.

Trade forex, indices, stocks and metals with up to US$100.000 in company's funding.

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Trade forex, indices, stocks and metals with up to US$100.000 in company's funding.

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.