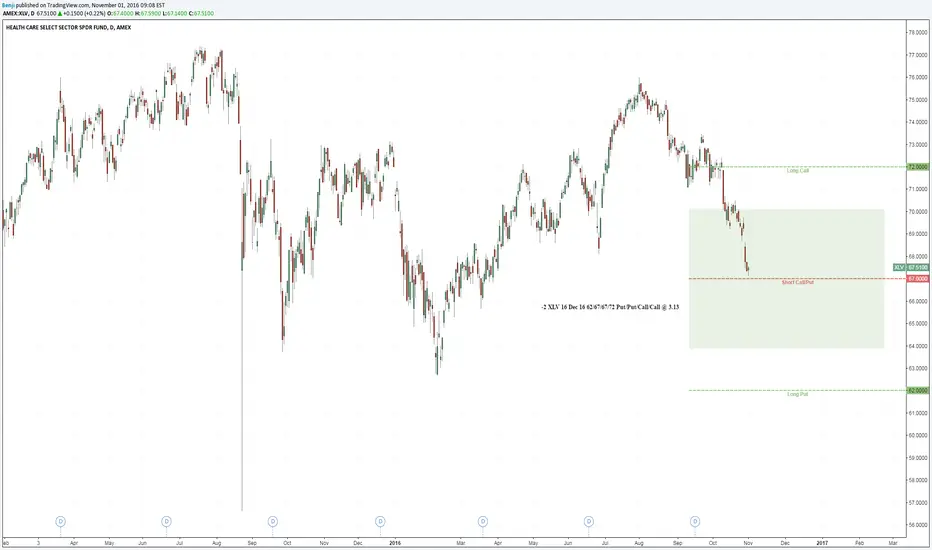

Took a Position here on XLV with an IRON FLY.

-2 XLV 16 Dec 16 62/67/67/72 Put/Put/Call/Call @ 3.13

Credit: 3.13 ($626)

Risk: 1.87 ($374)

Target: ~2.33 ($160)

Break evens are in green.

-2 XLV 16 Dec 16 62/67/67/72 Put/Put/Call/Call @ 3.13

Credit: 3.13 ($626)

Risk: 1.87 ($374)

Target: ~2.33 ($160)

Break evens are in green.

Trade active

I rolled the short 67/72 call spread here for a loss and rolled it up to the 71/74 to create another Iron fly with my adjusted put side. This also reduced around $600 in buying power, so I could defend my trades better. The credit received for this new position is $364 (1.82/contract).

As of right now, I have a realized loss of $106, so I'll probably look to take this spread off around there in profit, or a little higher to cover some of the trade fees.

My new BEs are 72.82 to the upside and 69.18 to the downside.

Trade active

I took the call spread off of this trade here for an .11 debit, or nearly worthless. All that is left is the 66/71 put spread.Trade closed manually

Bought back the short put spread for 3.84 today to free up buying power and bite the bullet here. I will post the options chain on here to follow my progression once I get it.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.