1️⃣ What Is Consumer Sentiment?

Consumer sentiment reflects how optimistic or pessimistic people feel about their financial situation and the overall economy. It’s a measure of people’s willingness to spend money. When confidence is high, consumers tend to spend more. When it's low, they hold back.

✅ It helps anticipate shifts in market behavior

✅ Used as a macroeconomic signal for traders and investors

✅ Often treated like a leading indicator for the S&P 500 and other indices

2️⃣ Why Is Consumer Sentiment Important?

The economy is largely driven by consumer spending. When people feel good about the economy, they:

- Buy more products

- Take on more debt

- Invest in assets

This behavior fuels business growth and market momentum. When sentiment drops, the opposite happens.

Sentiment is not always perfect or predictive, but it increases the probability of price moves — and in trading, we always aim for higher probabilities, not certainties.

3️⃣ Types of Sentiment Indicators

There are several forms of sentiment tracking:

✔️ Consumer Sentiment Index (e.g. University of Michigan)

✔️ News Sentiment (based on headline tone)

✔️ Market Sentiment Indicators (e.g. VIX, bond spreads)

✔️ Social/Headline Aggregators (e.g. AI-driven data that tracks public mood)

✔️ XLY/XLP what we have here

Each has strengths and limitations. For example, consumer sentiment is slower to change but more reliable long-term. News sentiment can be noisy and volatile but responsive.

4️⃣ How to Use Consumer Sentiment

Treat sentiment like a range or zone:

- High sentiment = potential market tops (overconfidence)

- Low sentiment = potential bottoms (fear and contraction)

Look for divergences:

- When sentiment is improving but markets are falling 👉 could signal a reversal

- When sentiment is declining while markets are rising 👉 could suggest caution

🧠 Think in probabilities, not possibilities. Just because sentiment is high doesn’t guarantee a rally but it does increase the odds, especially when combined with other data.

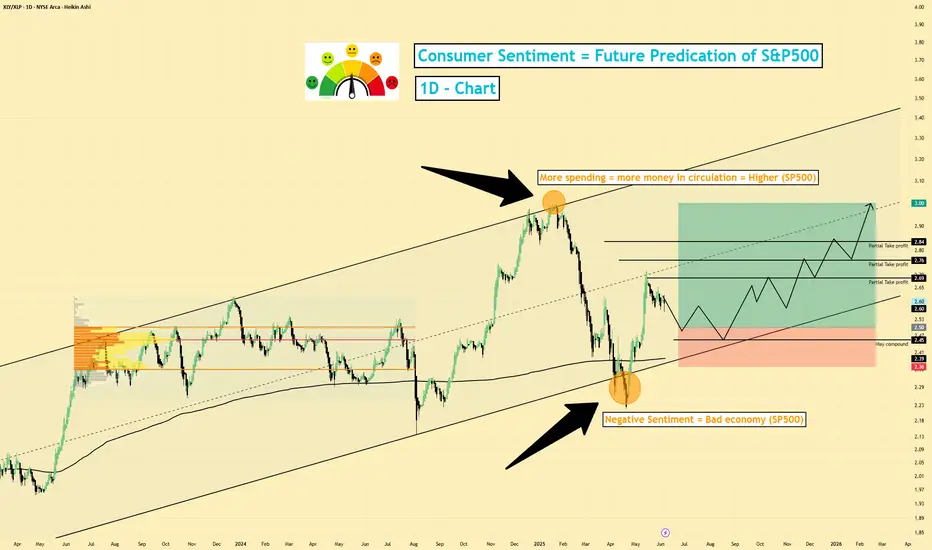

5️⃣ Example Ratios: XLY vs XLP

To break down consumer sentiment further, traders sometimes compare two:

XLY (Consumer Discretionary): Companies people spend money on when they feel confident (e.g. Amazon, Tesla)

XLP (Consumer Staples): Essential goods people buy regardless of economy (e.g. Walmart, Procter & Gamble)

If XLY/XLP is rising: consumer confidence is likely improving

If XLY/XLP is falling: sentiment is likely weakening

This ratio helps gauge spending behavior and risk appetite in a more visual, trackable way.

6️⃣ Limitations of Consumer Sentiment

⚠️ Not always aligned with price action in short-term

⚠️ Lagging data depending on source

⚠️ Can be influenced by temporary events (e.g. political shifts, news headlines)

⚠️ Doesn’t work well alone should be used with technical and fundamental analysis

7️⃣ Final Thoughts

Consumer sentiment is one of the most powerful but often overlooked indicators. It doesn’t tell you exactly what will happen, but it gives important context:

✅ Where we are in the economic cycle

✅ How confident people are in spending

✅ When the market may be out of sync with the real world

Use sentiment tools to build a higher-probability picture of what’s next. Combine them with price action, macro analysis, and volume-based tools for a more complete view.

2 Ways I can help you | Real Trades. Real Edge

1️⃣ The 4 Steps to Improve Your Trading Immediately: tradinggen.services/mohamad-link/

2️⃣ Get trade setups & breakdowns Here: t.me/TradeSimple_with_Mo

1️⃣ The 4 Steps to Improve Your Trading Immediately: tradinggen.services/mohamad-link/

2️⃣ Get trade setups & breakdowns Here: t.me/TradeSimple_with_Mo

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

2 Ways I can help you | Real Trades. Real Edge

1️⃣ The 4 Steps to Improve Your Trading Immediately: tradinggen.services/mohamad-link/

2️⃣ Get trade setups & breakdowns Here: t.me/TradeSimple_with_Mo

1️⃣ The 4 Steps to Improve Your Trading Immediately: tradinggen.services/mohamad-link/

2️⃣ Get trade setups & breakdowns Here: t.me/TradeSimple_with_Mo

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.