I have owned XME-this year. I sold a month ago when it was 7% higher. Why ?

Caveat Emptor ! This is Latin for "Let the buyer beware."

You see, XME-has gold-and-silver miners, and I am bullish for this group.

But alas, poor Yorek, XME-also has basic metals such as steel-copper-aluminum-zinc.

The basic metals are not doing well. So how can XME-stay strong?

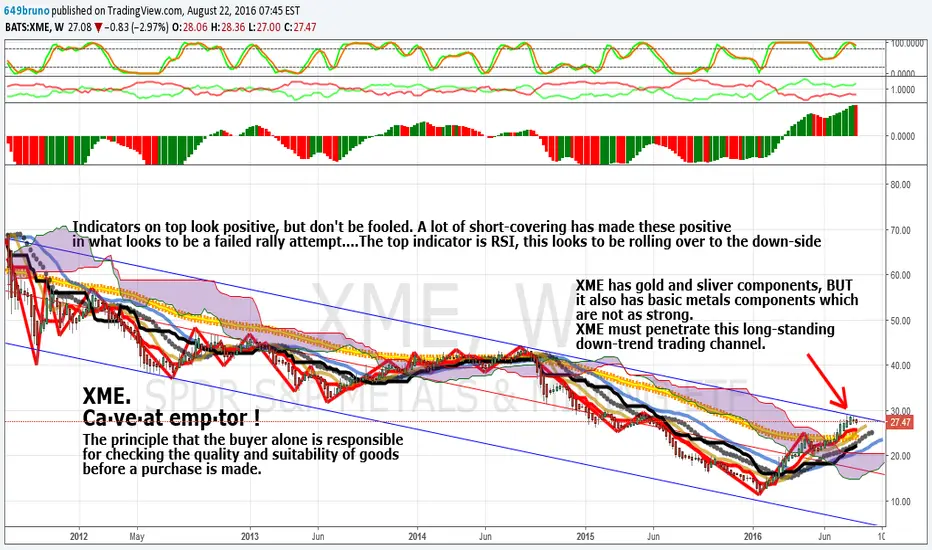

From a technical perspective, XME-is at an 8 year down trend line.

I say "Caveat Emptor", let the buyer beware.

This weekend I have taken the time to publish eight basic metals components of-XME. All are weak.

So, for those of you who like-XME, please take note that the basic metals side of this-ETF may drag-XME down.

One last point. If the basic metals are not doing well, then the real growth in the US economy will likely remain weak.

I would argue that this is why the chart I published for the 10 Year T-Note yield is sinking, and has been for years.

(I hope the Federal Reserve can see this).

I have published ten charts in all to make my point for-XME. Eight basic metals stocks were weak.

The gold-miner I published was Hecla-Mining, which was very strong.

In my opinion, the forward progress in XME-is really going to be difficult. Why? I feel that basic metals prices are heading down.

Final thoughts: "Why do you have to 'put your two cents in'... But it's only a 'penny for your thoughts'? Where's that extra penny going to?"

As always, good luck to you. Don.

Caveat Emptor ! This is Latin for "Let the buyer beware."

You see, XME-has gold-and-silver miners, and I am bullish for this group.

But alas, poor Yorek, XME-also has basic metals such as steel-copper-aluminum-zinc.

The basic metals are not doing well. So how can XME-stay strong?

From a technical perspective, XME-is at an 8 year down trend line.

I say "Caveat Emptor", let the buyer beware.

This weekend I have taken the time to publish eight basic metals components of-XME. All are weak.

So, for those of you who like-XME, please take note that the basic metals side of this-ETF may drag-XME down.

One last point. If the basic metals are not doing well, then the real growth in the US economy will likely remain weak.

I would argue that this is why the chart I published for the 10 Year T-Note yield is sinking, and has been for years.

(I hope the Federal Reserve can see this).

I have published ten charts in all to make my point for-XME. Eight basic metals stocks were weak.

The gold-miner I published was Hecla-Mining, which was very strong.

In my opinion, the forward progress in XME-is really going to be difficult. Why? I feel that basic metals prices are heading down.

Final thoughts: "Why do you have to 'put your two cents in'... But it's only a 'penny for your thoughts'? Where's that extra penny going to?"

As always, good luck to you. Don.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.