My trading plan is very simple.

I buy or sell when at three of these events happen:

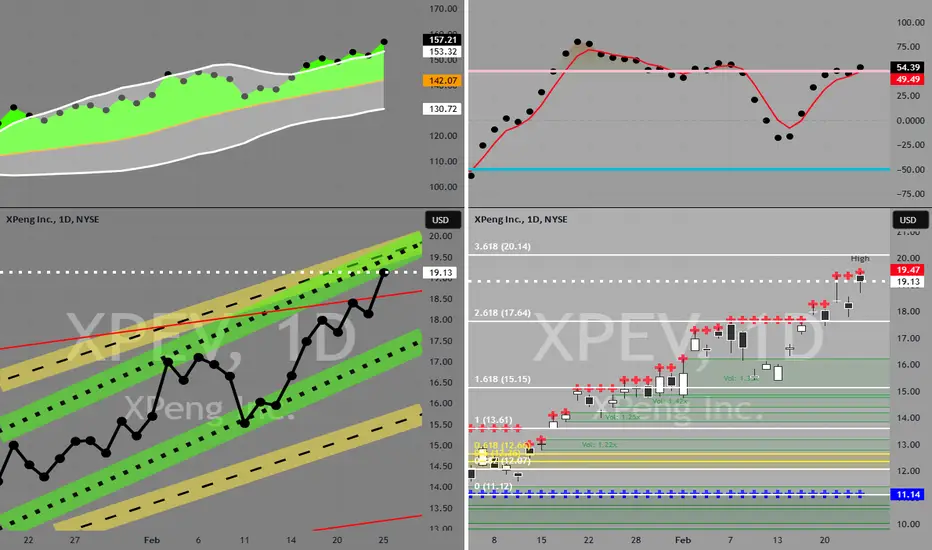

* Price tags the top or bottom of parallel channel zones

* Money flow spikes beyond it's Bollinger Bands

* Stochastic Momentum Index (SMI) at near oversold overbought level

* Price at Fibonacci levels

So...

Here's why I'm picking this symbol to do the thing.

Price in selling zone at top of channels

[Red Line 100 period / Yellow Zone 52 period / Green Zone 26 period]

Stochastic Momentum Index (SMI) at overbought level

Money flow momentum is spiked positive and under at top bottom of Bollinger Band

Price near Fibonacci level

Entry at $20

Target is lower channel around $17

I buy or sell when at three of these events happen:

* Price tags the top or bottom of parallel channel zones

* Money flow spikes beyond it's Bollinger Bands

* Stochastic Momentum Index (SMI) at near oversold overbought level

* Price at Fibonacci levels

So...

Here's why I'm picking this symbol to do the thing.

Price in selling zone at top of channels

[Red Line 100 period / Yellow Zone 52 period / Green Zone 26 period]

Stochastic Momentum Index (SMI) at overbought level

Money flow momentum is spiked positive and under at top bottom of Bollinger Band

Price near Fibonacci level

Entry at $20

Target is lower channel around $17

Trade closed manually

Closing short with small loss as price reaches bottom channel. Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.