Hi,

Welcome to this analysis about XRPUSD, we are looking at the local 15-minute timeframe perspective. XRPUSD is definitely one of the main volatile currencies in the cryptocurrency market these times as its bullish exaggerations moved strongly above remaining resistances however in such circumstances it is necessary to realize the overbought conditions in which price-actions maintain, with XRPUSD this is important because the volatility can also reverse more swiftly in such situations, this does not mean XRPUSD is completely bearish however it is necessary to properly assess such dynamics to rightly line-up and do not overspeculate the market into a one-sighted direction as it is often seen these times.

Structural Developments:

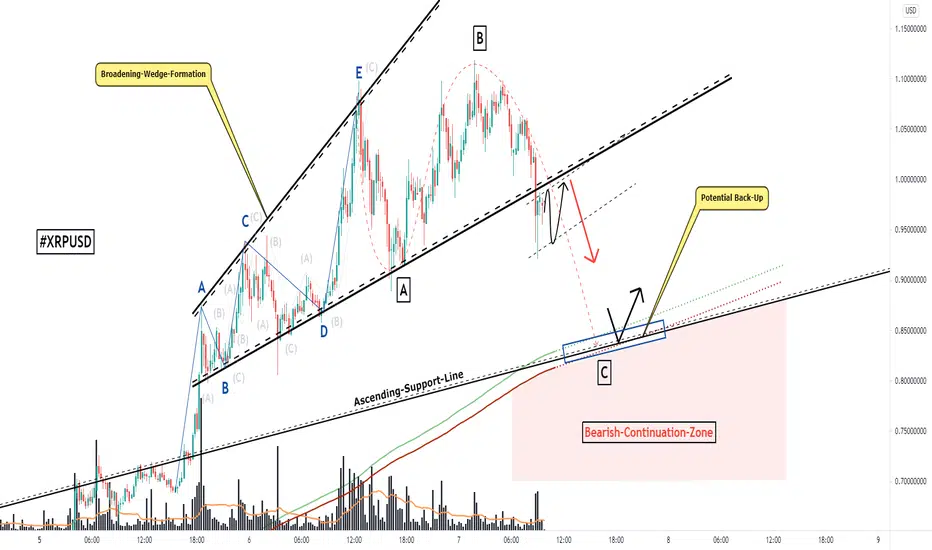

When determining XRPUSD current situation we can watch there in my chart this main broadening-wedge-formation that XRPUSD has formed with the coherent wave-count in the formation which already recently completed and after XRPUSD failed to form a new high XRPUSD bounced below the lower boundary to close there, this price-action completed the whole broadening-wedge-formation bearishly to the downside and for now XRPUSD is about to fully validate this breakout with the confirmational flag it is forming below the lower boundary which is actually the setup for the further bearish continuations and development to the downside, this is also confirming to the dynamic markdown-wave C in the wave-count to the downside as it is shown.

Upcoming Determinations:

In recent times XRPUSD managed to show up with great upside volatility on the global perspectives however on the more local perspectives XRPUSD now initially developed this reversal set-up from where XRPUSD is primarily likely to continue firstly into the potential backup marked in my chart in blue where several supports coming together and therefore is a possible zone to maintain a considerable reversal however when this zone does not hold and XRPUSD continues with bearishness to close in the bearish-continuation-zone this will give the edge for further bearish continuations and lower levels to be reached and tested, therefore it will be necessary to elevate on how XRPUSD approaches these dynamics.

In this manner, thank you for watching the analysis and great contentment for everybody supporting, all the best!

"Trading effectively is about assessing possibilities, not certainties."

Information provided is only educational and should not be used to take action in the market.

Welcome to this analysis about XRPUSD, we are looking at the local 15-minute timeframe perspective. XRPUSD is definitely one of the main volatile currencies in the cryptocurrency market these times as its bullish exaggerations moved strongly above remaining resistances however in such circumstances it is necessary to realize the overbought conditions in which price-actions maintain, with XRPUSD this is important because the volatility can also reverse more swiftly in such situations, this does not mean XRPUSD is completely bearish however it is necessary to properly assess such dynamics to rightly line-up and do not overspeculate the market into a one-sighted direction as it is often seen these times.

Structural Developments:

When determining XRPUSD current situation we can watch there in my chart this main broadening-wedge-formation that XRPUSD has formed with the coherent wave-count in the formation which already recently completed and after XRPUSD failed to form a new high XRPUSD bounced below the lower boundary to close there, this price-action completed the whole broadening-wedge-formation bearishly to the downside and for now XRPUSD is about to fully validate this breakout with the confirmational flag it is forming below the lower boundary which is actually the setup for the further bearish continuations and development to the downside, this is also confirming to the dynamic markdown-wave C in the wave-count to the downside as it is shown.

Upcoming Determinations:

In recent times XRPUSD managed to show up with great upside volatility on the global perspectives however on the more local perspectives XRPUSD now initially developed this reversal set-up from where XRPUSD is primarily likely to continue firstly into the potential backup marked in my chart in blue where several supports coming together and therefore is a possible zone to maintain a considerable reversal however when this zone does not hold and XRPUSD continues with bearishness to close in the bearish-continuation-zone this will give the edge for further bearish continuations and lower levels to be reached and tested, therefore it will be necessary to elevate on how XRPUSD approaches these dynamics.

In this manner, thank you for watching the analysis and great contentment for everybody supporting, all the best!

"Trading effectively is about assessing possibilities, not certainties."

Information provided is only educational and should not be used to take action in the market.

►✅JOIN THE BEST+ TOP TELEGRAM TRADING CHANNEL: t.me/VincePrinceForexGoldStocks

►🚀Write To Join the Elite VIP Signal Channels: @Vince_Prince

►🔥JOIN BYBIT TOP EXCHANGE►🎁 UP TO $30,000 BONUS NOW: partner.bybit.com/b/VinceByBit

►🚀Write To Join the Elite VIP Signal Channels: @Vince_Prince

►🔥JOIN BYBIT TOP EXCHANGE►🎁 UP TO $30,000 BONUS NOW: partner.bybit.com/b/VinceByBit

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

►✅JOIN THE BEST+ TOP TELEGRAM TRADING CHANNEL: t.me/VincePrinceForexGoldStocks

►🚀Write To Join the Elite VIP Signal Channels: @Vince_Prince

►🔥JOIN BYBIT TOP EXCHANGE►🎁 UP TO $30,000 BONUS NOW: partner.bybit.com/b/VinceByBit

►🚀Write To Join the Elite VIP Signal Channels: @Vince_Prince

►🔥JOIN BYBIT TOP EXCHANGE►🎁 UP TO $30,000 BONUS NOW: partner.bybit.com/b/VinceByBit

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.