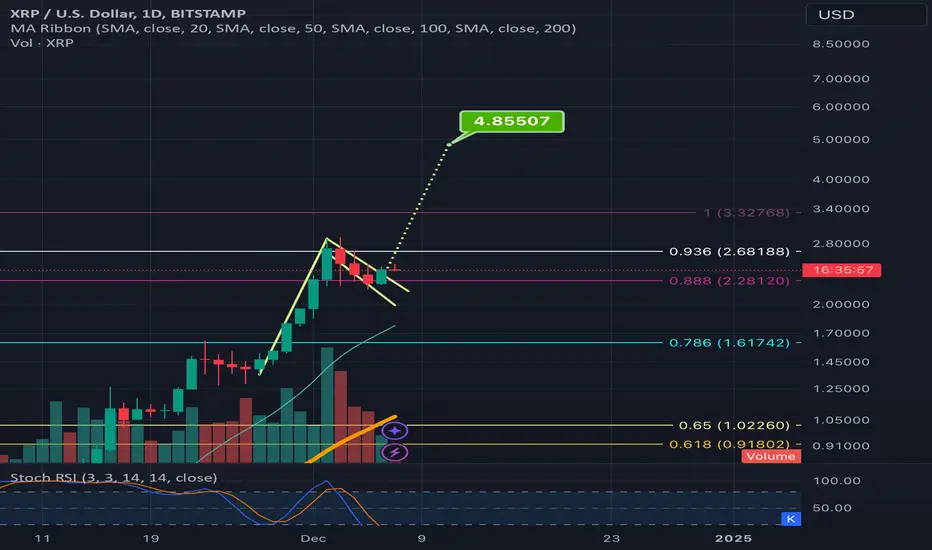

Brace yourself and fair warning this post is gonna get slightly more esoteric than some are comfortable with as it delves into numerology, so fair warning. I found it extremely interesting from a numerological standpoint when I saw chartguy had predicted that this current xrp correction would ultimately find support on the .888 Fibonacci retracement level and as of now it appears it has. The number 38 as well as 888( aka 3 8s) has been coming up like crazy all the time for me this entire year, but then I also noticed it more than a few times specifically in reference to ripple and xrp. For example Ripple now has 38 billion xrp remaining locked in escrow. I found an iage during XRP’s 2016 pump of Brad on CNBC or fox business ot some channel like it and enxt to them they had put a graphic up on screen along side Brad Garlinghouse that said XRP had gone up 38,000% percent. Next fast forwarding back to a little earlierthis year, the last low xrp had put in as a bottom before finally slowly climbing back up to the blast off point was 38 cents. Because I had been seeing all these connections with 38 in regards to xrp and ripple but also in many other elements in my personal life, I bought some more xrp at 38 cents feeling like it would actually mark the most recent bottom and low and behold it did. Also the all time high for xrp on a few different exchanges is $3.80. Like I said above, another way to represent 38 is with 3 8’s aka (888). So on the lion’s gate portal this year 8/8/2024, 2024 numerologically reduces to 8 as well giving us the first time in quite awhile we have had 8/8/8 date like that, I was expecting something noteworthy to occur being that it’s a time that’s known for manifestation and abundance every year but with 3 8s instead of just the usual 8/8 it should be even more so, and sure enough ti was right on this weekend that Judge Torres issued her final judgement in the RIpple vs SEC case after 4 long years of waiting patiently for it to arrive. All this being said, when I then see that XRP corrected down exactly to the .888 Fibonacci level and is holding support there, if it does continue upwards from this level, it will simply be more confirmation and confluence to me that there is something significantly special and interrelated between xrp, and the numbers 38.88,888, 11, and 1111. I won’t go into the 11 significance too much in this idea as I’d prefer to focus on the 8s instead….so I’ll leave the numerology talk there for now and focus instead of the actual TA behind this logarithmic bullflag

Trade active

So this same bullflag on the linear chart only has a breakout target of around $4.06 but as usually the logarithmic target is noticeably higher, in this instance the logchart’s bullflag target is at $4.86. I’d we were to mirror the 2016 move then, we would see our first real correction of this altcoin bull market for xrp i think around 15% above our previous all time high which on bitstamp since its high was around 3.27 would place it right at around 3.80. However since 3.80 and 3.84 were common highs on other exchanges then 15% above that would get us to around $4.416 which is halfway between the linear charts bullflag target at $4.06 and this log chart’s $4.86 target. Thanks to being able to include standard deviations, I therefore think that there is still a way to hit the full log chart target before the first significant correction while still following the fractal and continuing to mirror the breakout fro the 2016-2017 bull run. Whatever may happen here I have then 4 potential targets I’ll be eyeing on this short ter position move and that is $3.80, $4.06, $4.416, and finally the logchart flag’s full target at $4.86. *not financial advice*Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.