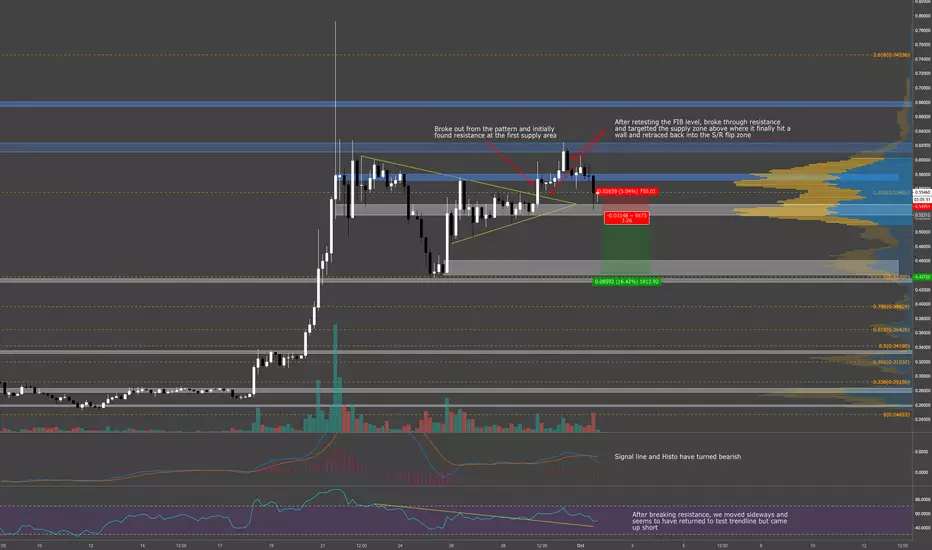

Ripple broke past resistance this weekend testing areas of supply before getting rejected at previous SFP highs and moving back down into once a resistance zone. There wasn't much volume on that move up but the rejection volume down into the support level did garner a rise in volume but held for now. This zone is key for any XRP move upwards as a break from this zone would cause a retest of the lower demand areas near $0.46. Break of the $0.437 areas could cause the price to make a full retreat back down to $0.39 however, we don't see that happening unless Bitcoin wets the bed.

Both metrics for the MACD are hinting bearish so far and the RSI sees to be trending sideways and hasn't given a clear indication of direction yet. Price is currently finding hard to remain above the 1.618%FIB level and a close below here could spell a revisit of the demand zone below.

Possible safe short scalp would be a break and retest of this demand zone all the way down to the FIB zone test on the last move down. Any longs would only be considered if we could get back above the $0.58 area.

Thanks guys!

Both metrics for the MACD are hinting bearish so far and the RSI sees to be trending sideways and hasn't given a clear indication of direction yet. Price is currently finding hard to remain above the 1.618%FIB level and a close below here could spell a revisit of the demand zone below.

Possible safe short scalp would be a break and retest of this demand zone all the way down to the FIB zone test on the last move down. Any longs would only be considered if we could get back above the $0.58 area.

Thanks guys!

Note

Ripple had another spike up into resistance but once again was unable to break and close above, moving back lower finding support along the FIB level.MACD continues to trend lower while the RSI remains flat. Just like the other coins, decision time is nearing but until then this is a no-trade zone.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.