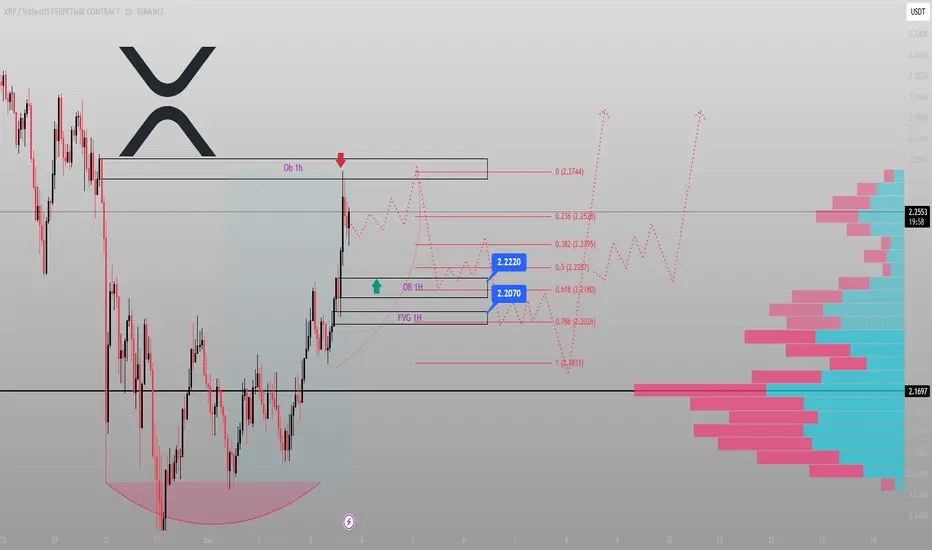

Here’s how this unfolds:

Price tapped into a clean 1H OB and immediately rejected

Below that, we’ve got confluence between OB + FVG zones around 2.2220 and 2.2070 — that’s the re-entry window

Fibonacci levels reinforce the structure:

• 0.5 at 2.2287

• 0.618 at 2.2180

• 0.786 near 2.0266 — last line before deeper rotation

If price holds above the OB and starts to consolidate into a bullish MSS, I expect a rotation back toward the premium wick at 2.2744 — maybe even higher depending on volume profile buildup.

But if we lose 2.2070 decisively, all eyes go to 2.1697 and then 2.1831 — where the real volume sits.

Execution bias:

Accumulation above 2.2070 → bullish continuation valid

Break and hold below? Reversion into deeper discount zones likely

Targeting the sweep of 2.2528 and eventual test of 2.30+ if structure confirms

The move isn’t over. It’s transitioning. You either read the shift or get caught in it.

More setups built on narrative and price logic? They’re in the profile description. I don’t chase — I position.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.