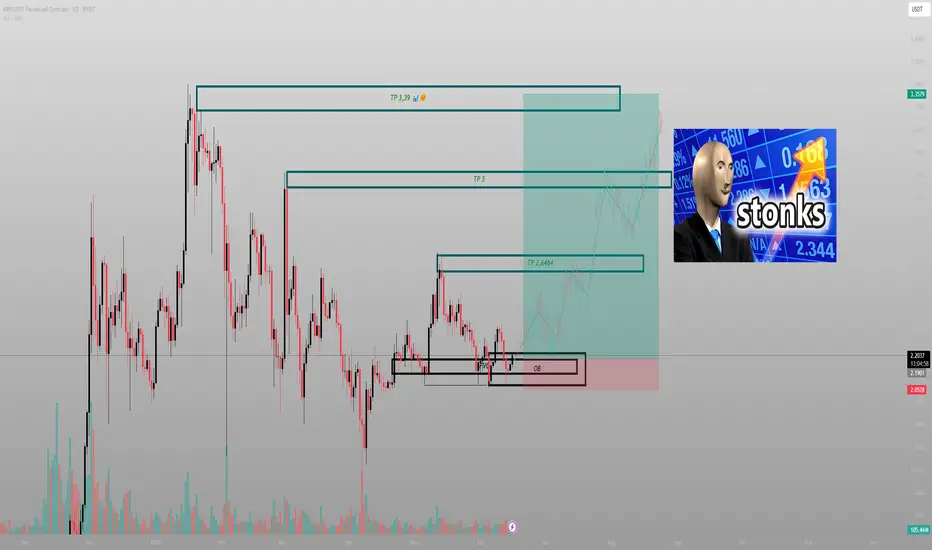

Price was coiled in a defined OB + FVG combo — building pressure while the rest of the market slept. The moment we swept the low into the Order Block, the trade became personal. This wasn’t noise — it was alignment.

Why I entered:

Daily FVG + OB overlap — textbook Smart Money entry zone

Volume spike at the OB low, signaling smart accumulation

Structural BOS confirmation on intraday after sweep

What followed was an impulsive push through inefficiencies, climbing level by level toward pre-defined liquidity pools.

Targets:

TP1: 2.6464 — rebalancing zone

TP2: 3.00 — clean inefficiency top

TP3: 3.39 — liquidity magnet

Trade thesis:

Entry was set between 2.05–2.10, stop placed with precision below the OB. No guessing. Just calculated structure + narrative.

I don’t chase moves. I let price come to my zone. And when it does, I strike with full conviction.

Final words:

“Your edge doesn’t scream. It sits quietly in imbalance — waiting.”

Why I entered:

Daily FVG + OB overlap — textbook Smart Money entry zone

Volume spike at the OB low, signaling smart accumulation

Structural BOS confirmation on intraday after sweep

What followed was an impulsive push through inefficiencies, climbing level by level toward pre-defined liquidity pools.

Targets:

TP1: 2.6464 — rebalancing zone

TP2: 3.00 — clean inefficiency top

TP3: 3.39 — liquidity magnet

Trade thesis:

Entry was set between 2.05–2.10, stop placed with precision below the OB. No guessing. Just calculated structure + narrative.

I don’t chase moves. I let price come to my zone. And when it does, I strike with full conviction.

Final words:

“Your edge doesn’t scream. It sits quietly in imbalance — waiting.”

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.