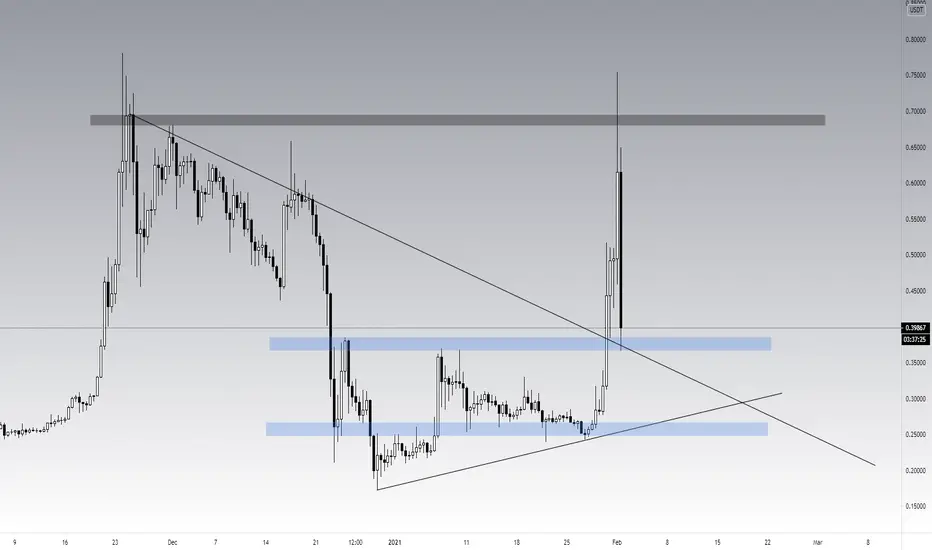

In the last 4 days of trading session, the Ripple has been very volatile. It went up from $0.25 to the very high level of $0.75 which in other word gives the extra 200% in the last 4 days. But, on the today's volatility it has a decent drop too from $0.75 to $0.39 region at the time I write this content. There are a lot of pros and cons regarding the latest days volatility. Some of the people said it was because of the group of people played a pump and dump scenario and the other one said that this is because of the positive sentiment because the Ripple labs filed the SEC as the feedback of the allegations. However, Both opinions have now affected the price in the market which we can't judge which condition and events is true.

During this scenario too, I want to remind you that trading is not just about how to predict the direction in he future but also it's a game of reaction which our end of profit will be judged based on the trade set up that we make on every significant event which can occurs anytime. As a trader, I don't really care about the fundamentals, rumors or even the pump and dump group. All I care is always about my set up, price action and the levels which is very important. That's why on these content, I want to share what I'm thinking of Ripple for the future and what are my technical bias for short term.

I've already told you that I have an absolute bias for the long term on Ripple which is super bullish. My reason is simple, it's all about the Ripple's product which for me is the new invention that could fix current bank's system that's been around since 40 years ago. If only the product is not good and not affordable, there would not be any big bank that make partnership with Ripple. Say it like American Express, Bank of America, and Standard Chartered are few of many Ripple's customers that use the Ripple's product as well. According top 20 coins that listed on the CMC, I can only see Ripple as the only company which is having a good relationship with current system. So, with all these facts I've already shared are more than enough for me as the main consideration to take Ripple as one of my biggest portfolio as of now.

Now, let's see from the technical perspective especially in the short term bias. We know that the price is now having a huge bearish pressure as it had a decent drop after tested the $0.7 region as the interim swing high and as the strong area of resistance. However, the price is now trending at the short term support which could potentially be the local bottom of this current movement. Using the body to body connecting method, I've found that the price where the price is trending right now is at the previous broken resistance trend line that is now becoming a support trend line which coincide with the blue area which is also previous broken horizontal resistance zone that is now becoming support too. We've seen the first legitimate action at this zone with a wick that is still holding true and has defended the price from further drop.

If this zone is able to hold the price from further drop, we may see a further bullish push to the area of interim swing high again in the future. But if, the price breaks below current support zone, I do believe that the next area is at $0.25 as the strongest ever area of support. What my set up for the long term purpose is to keep accumulating at every significant supports in the future. I don't care if the price will go lower but as long as it goes lower, it will be a good buying opportunity to catch the big wave in the future. I do believe in Ripple and this is one of my favorite coin, #xrpthestandard

During this scenario too, I want to remind you that trading is not just about how to predict the direction in he future but also it's a game of reaction which our end of profit will be judged based on the trade set up that we make on every significant event which can occurs anytime. As a trader, I don't really care about the fundamentals, rumors or even the pump and dump group. All I care is always about my set up, price action and the levels which is very important. That's why on these content, I want to share what I'm thinking of Ripple for the future and what are my technical bias for short term.

I've already told you that I have an absolute bias for the long term on Ripple which is super bullish. My reason is simple, it's all about the Ripple's product which for me is the new invention that could fix current bank's system that's been around since 40 years ago. If only the product is not good and not affordable, there would not be any big bank that make partnership with Ripple. Say it like American Express, Bank of America, and Standard Chartered are few of many Ripple's customers that use the Ripple's product as well. According top 20 coins that listed on the CMC, I can only see Ripple as the only company which is having a good relationship with current system. So, with all these facts I've already shared are more than enough for me as the main consideration to take Ripple as one of my biggest portfolio as of now.

Now, let's see from the technical perspective especially in the short term bias. We know that the price is now having a huge bearish pressure as it had a decent drop after tested the $0.7 region as the interim swing high and as the strong area of resistance. However, the price is now trending at the short term support which could potentially be the local bottom of this current movement. Using the body to body connecting method, I've found that the price where the price is trending right now is at the previous broken resistance trend line that is now becoming a support trend line which coincide with the blue area which is also previous broken horizontal resistance zone that is now becoming support too. We've seen the first legitimate action at this zone with a wick that is still holding true and has defended the price from further drop.

If this zone is able to hold the price from further drop, we may see a further bullish push to the area of interim swing high again in the future. But if, the price breaks below current support zone, I do believe that the next area is at $0.25 as the strongest ever area of support. What my set up for the long term purpose is to keep accumulating at every significant supports in the future. I don't care if the price will go lower but as long as it goes lower, it will be a good buying opportunity to catch the big wave in the future. I do believe in Ripple and this is one of my favorite coin, #xrpthestandard

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.