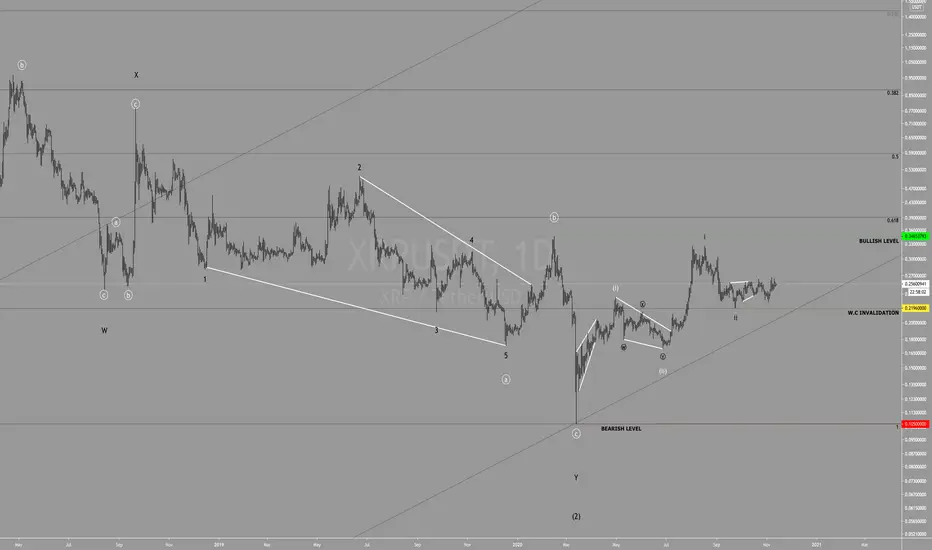

Bottom Line: Favoring higher against 0.2197.

Key Levels: Below 0.1890, 0.2197, 0.2287 Above 0.3039, 0.3272, 0.3440

Outlook: Considering a second wave correction ended and the early stages of a third wave rally have begun against 0.2197.

Analysis: The less than impulsive wave structure from the current pullback low at 0.2450 keeps us from confirming the end of the setback. For that reason, we can't rule out a further low before the larger advance resumes. At this stage, only very impulsive price action above 0.2675 would shift the odds in favor of a completed correction.

Key Levels: Below 0.1890, 0.2197, 0.2287 Above 0.3039, 0.3272, 0.3440

Outlook: Considering a second wave correction ended and the early stages of a third wave rally have begun against 0.2197.

Analysis: The less than impulsive wave structure from the current pullback low at 0.2450 keeps us from confirming the end of the setback. For that reason, we can't rule out a further low before the larger advance resumes. At this stage, only very impulsive price action above 0.2675 would shift the odds in favor of a completed correction.

Note

Note: Prices can vary between exchanges, and consequently there may be differences in our chart prices due to different data sets.Trade active

Trade active

Trade active

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.