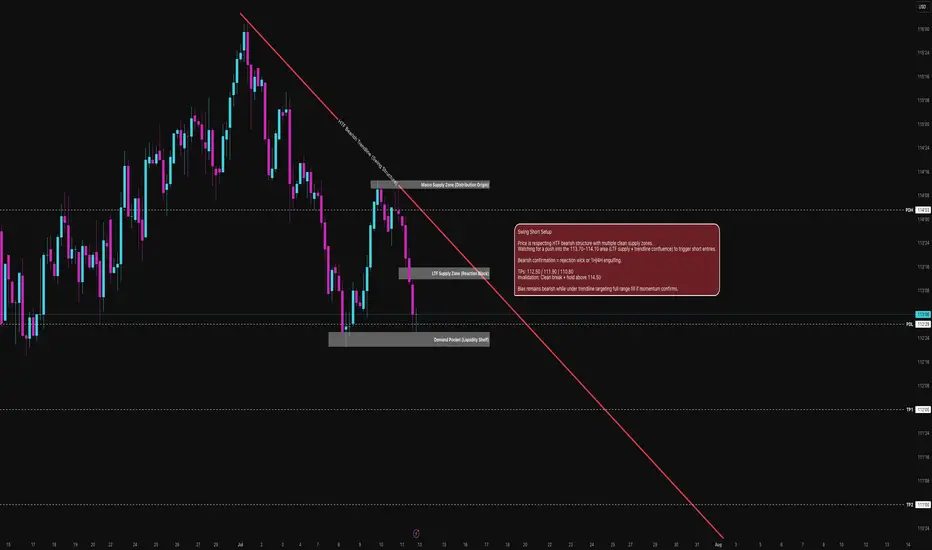

ZB has rallied straight into a triple-confluence zone that screams fade risk. We’re stacked beneath a key trend line, sitting inside layered supply, and printing a textbook lower high. This isn’t a breakout, it’s a test.

Bearish Confluences in Play:

- Macro Downtrend Intact – Still printing LHs/LLs

- Descending Trend line – Untouched, respected for weeks

- Stacked Supply Zones – Multiple rejection layers between 113.70–114.10

- Shallow Demand Bounce – No real momentum from bulls

- Clean Risk Parameters – Defined structure with clear invalidation

It’s everything you want in a measured swing short.

Confluence Breakdown:

- Bearish Market Structure - Strong 25%

- Trend line Resistance - Strong 20%

- Supply Zone Stack - Strong 20%

- Weak Demand Reaction - Moderate 10%

- Volume Profile Gap Below - Moderate 8%

- Estimated Rejection Probability - 78%

We don’t predict we prepare. And this setup is worth being ready for.

Trade Plan (Short)

Entry Zone: 113.70 – 114.10

(Supply zone + trend line resistance)

Stop Loss:

Tight SL: 114.20

Safe SL: 114.50 (above structure)

Targets:

- TP1: 112.50

- TP2: 111.90

- TP3: 110.80

Optional: Trail below TP2 if momentum kicks in.

Invalidation Plan

A clean break and hold above 114.50 invalidates the short bias. If price reclaims that zone and retests it cleanly, bulls take control.

Summary:

We’re at a high-probability inflection point. The structure favours downside. The risk is defined. The trend line hasn’t broken. The supply is real. This is a classic “short the rally” swing setup not a scalp, not a guess, not a gamble. Just smart structure-based positioning with confluence on its side.

Bearish Confluences in Play:

- Macro Downtrend Intact – Still printing LHs/LLs

- Descending Trend line – Untouched, respected for weeks

- Stacked Supply Zones – Multiple rejection layers between 113.70–114.10

- Shallow Demand Bounce – No real momentum from bulls

- Clean Risk Parameters – Defined structure with clear invalidation

It’s everything you want in a measured swing short.

Confluence Breakdown:

- Bearish Market Structure - Strong 25%

- Trend line Resistance - Strong 20%

- Supply Zone Stack - Strong 20%

- Weak Demand Reaction - Moderate 10%

- Volume Profile Gap Below - Moderate 8%

- Estimated Rejection Probability - 78%

We don’t predict we prepare. And this setup is worth being ready for.

Trade Plan (Short)

Entry Zone: 113.70 – 114.10

(Supply zone + trend line resistance)

Stop Loss:

Tight SL: 114.20

Safe SL: 114.50 (above structure)

Targets:

- TP1: 112.50

- TP2: 111.90

- TP3: 110.80

Optional: Trail below TP2 if momentum kicks in.

Invalidation Plan

A clean break and hold above 114.50 invalidates the short bias. If price reclaims that zone and retests it cleanly, bulls take control.

Summary:

We’re at a high-probability inflection point. The structure favours downside. The risk is defined. The trend line hasn’t broken. The supply is real. This is a classic “short the rally” swing setup not a scalp, not a guess, not a gamble. Just smart structure-based positioning with confluence on its side.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.