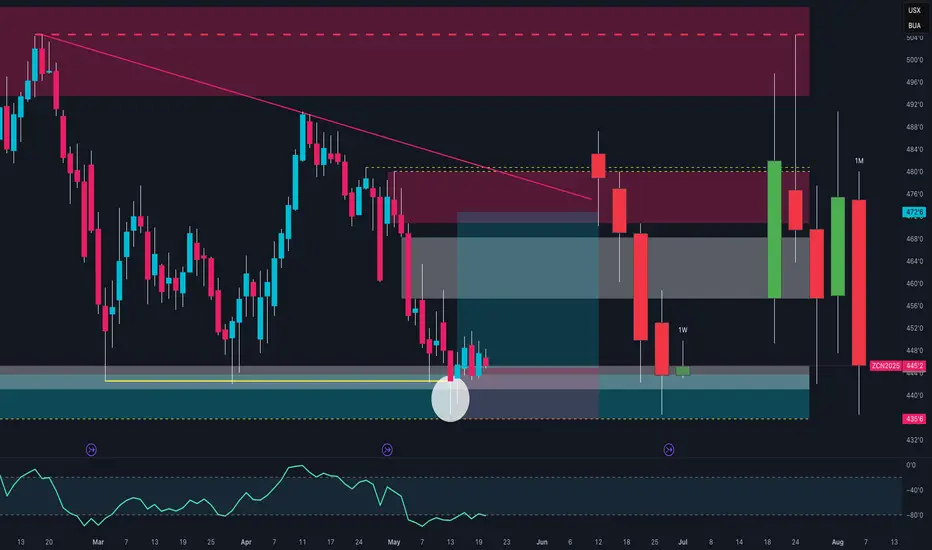

Corn futures are currently at a technically significant juncture. After an extended bearish phase from the yearly highs, price has reached a key monthly demand zone between 445 and 435 cents, an area that has historically triggered major reversals. This level is further validated by technical signals indicating potential exhaustion of the bearish momentum: the price action is showing rejection candles, and the RSI is recovering from oversold territory, creating room for a possible upside move.

However, it’s important to consider the seasonal context, which doesn’t favor an immediate reversal. Historical data shows that May, June, and July are statistically the weakest months for Corn. In particular, July tends to be highly bearish, with an average performance of -22% over the last 20 years and -36% over the last 10. This means that while the technical setup may suggest a potential bounce, seasonal pressure may continue to cap prices in the short term, making a sustained rally unlikely before August.

The COT positioning adds another layer of insight. Non-commercial traders (speculators) have recently closed a significant number of long positions and added shorts, reflecting strong bearish sentiment. In contrast, commercials (hedgers) have increased long exposure and decreased shorts, signaling optimism and a willingness to accumulate at these levels. This divergence often marks contrarian opportunities, especially when speculators are heavily short and commercials are heavily long—often a sign of a market bottom forming.

🧠 Summary:

Corn is sitting on major structural support, with early signs of a potential rebound. Yet, the seasonality remains bearish through mid-summer. The COT report, however, supports a bullish medium-term outlook, particularly heading into August–September, when prices historically begin to climb decisively.

🔔 Trading Outlook:

In the short term, tactical longs can be considered if the 445–435 area holds, with tight risk management. Initial targets are set at 465 and 472. The true strategic setup, however, is more likely to emerge in the coming months, with August as the key window for a sustained upside move supported by both seasonal and COT positioning.

However, it’s important to consider the seasonal context, which doesn’t favor an immediate reversal. Historical data shows that May, June, and July are statistically the weakest months for Corn. In particular, July tends to be highly bearish, with an average performance of -22% over the last 20 years and -36% over the last 10. This means that while the technical setup may suggest a potential bounce, seasonal pressure may continue to cap prices in the short term, making a sustained rally unlikely before August.

The COT positioning adds another layer of insight. Non-commercial traders (speculators) have recently closed a significant number of long positions and added shorts, reflecting strong bearish sentiment. In contrast, commercials (hedgers) have increased long exposure and decreased shorts, signaling optimism and a willingness to accumulate at these levels. This divergence often marks contrarian opportunities, especially when speculators are heavily short and commercials are heavily long—often a sign of a market bottom forming.

🧠 Summary:

Corn is sitting on major structural support, with early signs of a potential rebound. Yet, the seasonality remains bearish through mid-summer. The COT report, however, supports a bullish medium-term outlook, particularly heading into August–September, when prices historically begin to climb decisively.

🔔 Trading Outlook:

In the short term, tactical longs can be considered if the 445–435 area holds, with tight risk management. Initial targets are set at 465 and 472. The true strategic setup, however, is more likely to emerge in the coming months, with August as the key window for a sustained upside move supported by both seasonal and COT positioning.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.