Updated

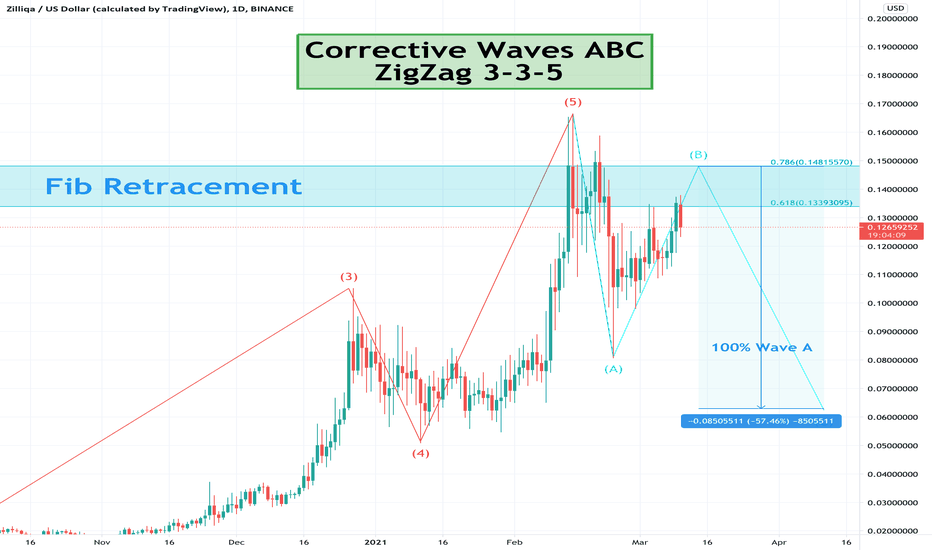

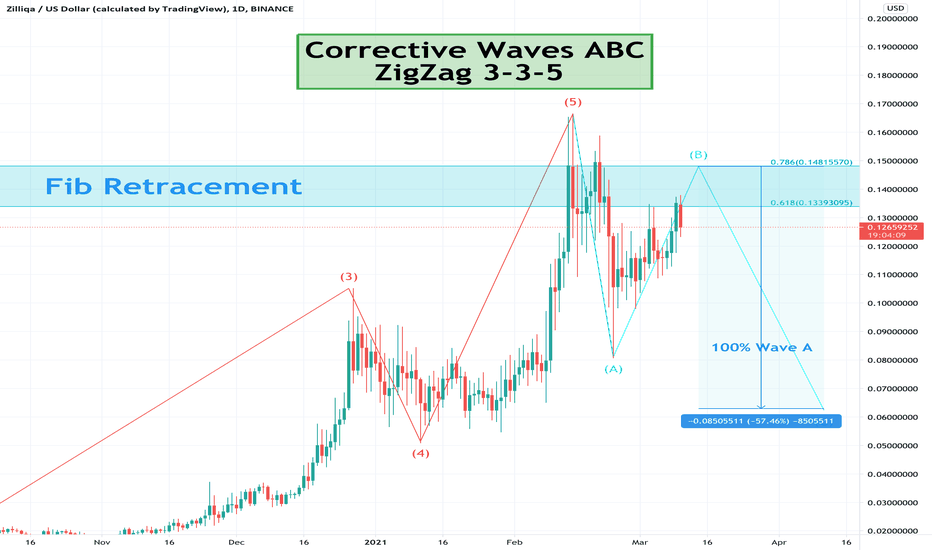

Is $ZIL really in a Corrective trend or an extended 5th Wave?

NOT FINANCIAL ADVICE

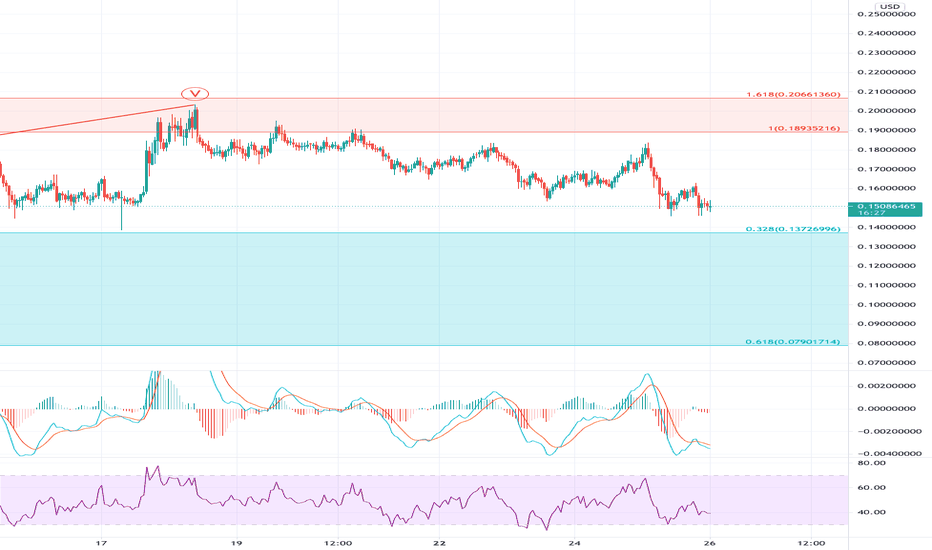

In this previous chart (shared below), I anticipated that if ZIL broke $0.19 resistance, that we might be in a 'fake' correction -- and it turned out so, as price action carried the momentum towards an extended fifth wave:

ZIL broke $0.19 resistance, that we might be in a 'fake' correction -- and it turned out so, as price action carried the momentum towards an extended fifth wave:

So the recent pullback actions (mid-Feb to early-Mar) were not sustained enough nor strong enough to warrant a full correction taking place, so we're left desiring for a bigger pullback this time round -- if only for us to launch towards an even bigger, stronger and more impressive bull run to break previous ATH of $0.23.

With this latest chart to accompany us, we can anticipate our next support levels for ZIL Bulls to take note of.

ZIL Bulls to take note of.

The Bulls will need to keep price action above $0.15 to prevent any further corrections.

If this major support level is broken, we could see ZIL dip towards its next strong support level of $0.11.

ZIL dip towards its next strong support level of $0.11.

Can the Bulls keep this Fifth Wave running hotter than it's meant to, or are we going to see it dip further?

In this previous chart (shared below), I anticipated that if

So the recent pullback actions (mid-Feb to early-Mar) were not sustained enough nor strong enough to warrant a full correction taking place, so we're left desiring for a bigger pullback this time round -- if only for us to launch towards an even bigger, stronger and more impressive bull run to break previous ATH of $0.23.

With this latest chart to accompany us, we can anticipate our next support levels for

The Bulls will need to keep price action above $0.15 to prevent any further corrections.

If this major support level is broken, we could see

Can the Bulls keep this Fifth Wave running hotter than it's meant to, or are we going to see it dip further?

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.