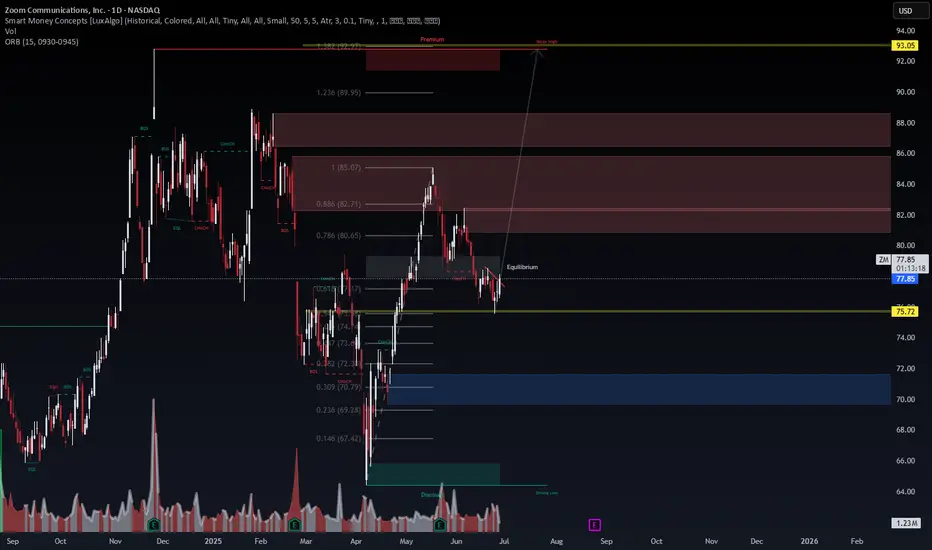

Strategy Type: Debit Call Spread (defined risk, favorable skew)

Thesis: Price moving from $77 toward the $85–$93 liquidity zone

🧾 Setup Details (as of $77.76 spot)

📅 Expiry:

August 16, 2025 (standard monthly expiration – gives time for move to unfold post-earnings and macro catalysts)

⚙️ Structure:

Buy 80 Call @ ~$3.70

Sell 90 Call @ ~$1.10

Net Debit (Cost): ≈ $2.60 per spread

Max Profit: $10 spread - $2.60 cost = $7.40

Max Loss: $2.60

Break-Even: $82.60

📈 Profit Scenario

Stock Price @ Expiry P&L per spread

≤ $80 -100% loss (-$260)

$82.60 Break-even

$90 Max gain ($740 profit)

≥ $93.05 Full liquidity sweep – still capped at $90

🧮 Risk-Reward

R:R Ratio: 2.85:1

Probability of Profit (est.): ~42% (based on delta skew + chart breakout zones)

Implied Volatility Rank: Neutral-high (useful for buying debit spreads)

🛡️ Why Debit Spread?

Controlled risk — limited to your premium paid ($260)

Aligns with structure shift and price roadmap toward $85–$93

Selling 90C offsets premium and reduces theta decay

🪛 Adjustments

If ZM breaks above $80.65 with volume, consider adding a second spread or switching to long calls for momentum

If ZM fails to hold $75.72 key level, cut or hedge with short-dated puts (70P)

🔁 Alternate (More Aggressive) Play:

Buy August 85C outright

Cost ≈ $1.30

Break-even ≈ $86.30

Max reward: unlimited

Use if expecting strong earnings surprise or short squeeze

Thesis: Price moving from $77 toward the $85–$93 liquidity zone

🧾 Setup Details (as of $77.76 spot)

📅 Expiry:

August 16, 2025 (standard monthly expiration – gives time for move to unfold post-earnings and macro catalysts)

⚙️ Structure:

Buy 80 Call @ ~$3.70

Sell 90 Call @ ~$1.10

Net Debit (Cost): ≈ $2.60 per spread

Max Profit: $10 spread - $2.60 cost = $7.40

Max Loss: $2.60

Break-Even: $82.60

📈 Profit Scenario

Stock Price @ Expiry P&L per spread

≤ $80 -100% loss (-$260)

$82.60 Break-even

$90 Max gain ($740 profit)

≥ $93.05 Full liquidity sweep – still capped at $90

🧮 Risk-Reward

R:R Ratio: 2.85:1

Probability of Profit (est.): ~42% (based on delta skew + chart breakout zones)

Implied Volatility Rank: Neutral-high (useful for buying debit spreads)

🛡️ Why Debit Spread?

Controlled risk — limited to your premium paid ($260)

Aligns with structure shift and price roadmap toward $85–$93

Selling 90C offsets premium and reduces theta decay

🪛 Adjustments

If ZM breaks above $80.65 with volume, consider adding a second spread or switching to long calls for momentum

If ZM fails to hold $75.72 key level, cut or hedge with short-dated puts (70P)

🔁 Alternate (More Aggressive) Play:

Buy August 85C outright

Cost ≈ $1.30

Break-even ≈ $86.30

Max reward: unlimited

Use if expecting strong earnings surprise or short squeeze

Note

“This isn’t just a breakout... it’s a statement.”While Zoom (ZM) might not serve you a cold Modelo, it is setting up for what looks like a momentum cocktail. 🍸

📈 Technical Ingredients:

Structure shift (CHoCH + BOS) ✔

Equilibrium retest holding like a seasoned bouncer 💪

Fair Value Gaps above like untouched premium bottles — just waiting to be uncorked

Fibonacci confirms – we’re not buying hype, we’re buying value in motion

💰 Fundamental Twist:

Zoom still prints FCF

Trading well below post-pandemic multiples

AI tailwinds may sound buzzy, but corporate adoption keeps flowing

🧠 So no, this isn’t a random Thursday trade. It’s a calculated entry with institutional footprints all over it.

If you needed an excuse to click “Buy” and call it “Smart Money Alignment” — you just got it.

Cheers to your next liquidity sweep 🍾

— WaverVanir International LLC

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.