⚖️ WaverVanir Institutional Macro x SMC x Fib Structure

🧠 Macro Narrative (Q3 2025)

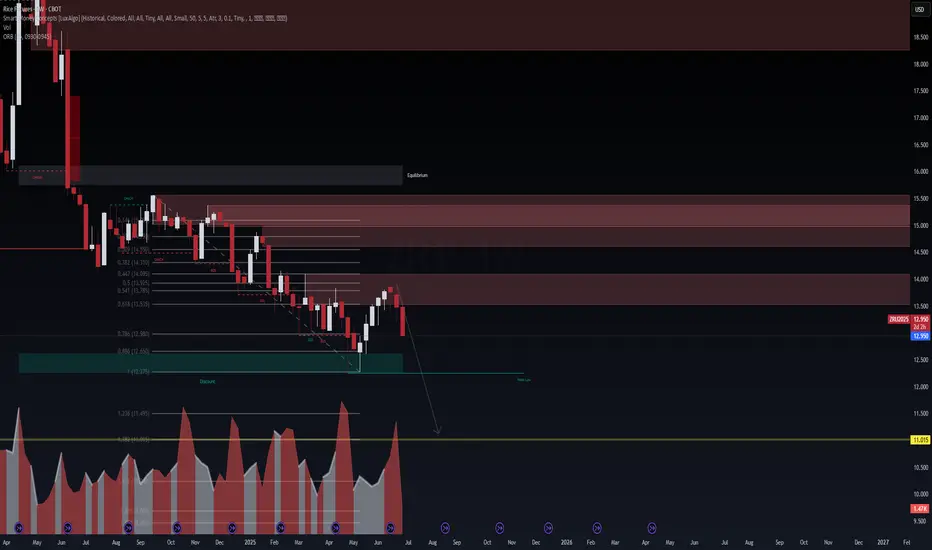

Global food inflation is quietly brewing beneath the headlines. With the Black Sea grain corridor compromised, Indian monsoon disruptions, and rising fertilizer input costs due to Middle East instability, the commodity complex is showing undercurrents of supply chain fragility. However, Rice remains heavily discounted, suggesting Smart Money may be accumulating beneath equilibrium before a macro repricing event.

🧠 Technical Thesis – Weekly Timeframe

🔻 CHoCH confirms breakdown of bullish structure

📉 Price has consistently respected the 0.618 retracement zone (~13.55) before facing strong supply rejection

🔺 Major BOS (Break of Structure) zones remain unmitigated above, but order flow is clearly bearish

🟩 Discount Zone (12.275–11.495): Price is revisiting this key institutional demand area

📐 Fibonacci Extensions hint at downside continuation:

1.236 @ 11.495

1.618 @ 10.240

🧭 Target Zones & Execution Plan

📍 Primary TP: 11.495 (1.236 extension)

📍 Extended TP: 10.240 (1.618) – only if macro panic unfolds

📍 Invalidation: Weekly close above 13.80 supply zone

🛡️ Risk Management

🔒 Entry: Break-and-retest of 12.65 (0.886 retracement + low-volume node)

🎯 RR Ratio: ~3.5R for 1st target, >5R for extended

🔥 Max Risk: 0.75% portfolio allocation

⚠️ Hedge risk via broader grains basket or options if volatility spikes

🧬 WaverVanir Insight

Institutional algorithms are likely building shorts in supply zones while layering passive bids in the discount range. We anticipate a "liquidity run" under weak lows before a potential Q4 reversal, depending on global food security narratives.

🔻 Until then, bias remains short.

#RiceFutures #SMC #WaverVanir #Commodities #InflationHedge #FibAnalysis #MacroTrading #SmartMoney #ZRU2025 #VolanXProtocol

🧠 Macro Narrative (Q3 2025)

Global food inflation is quietly brewing beneath the headlines. With the Black Sea grain corridor compromised, Indian monsoon disruptions, and rising fertilizer input costs due to Middle East instability, the commodity complex is showing undercurrents of supply chain fragility. However, Rice remains heavily discounted, suggesting Smart Money may be accumulating beneath equilibrium before a macro repricing event.

🧠 Technical Thesis – Weekly Timeframe

🔻 CHoCH confirms breakdown of bullish structure

📉 Price has consistently respected the 0.618 retracement zone (~13.55) before facing strong supply rejection

🔺 Major BOS (Break of Structure) zones remain unmitigated above, but order flow is clearly bearish

🟩 Discount Zone (12.275–11.495): Price is revisiting this key institutional demand area

📐 Fibonacci Extensions hint at downside continuation:

1.236 @ 11.495

1.618 @ 10.240

🧭 Target Zones & Execution Plan

📍 Primary TP: 11.495 (1.236 extension)

📍 Extended TP: 10.240 (1.618) – only if macro panic unfolds

📍 Invalidation: Weekly close above 13.80 supply zone

🛡️ Risk Management

🔒 Entry: Break-and-retest of 12.65 (0.886 retracement + low-volume node)

🎯 RR Ratio: ~3.5R for 1st target, >5R for extended

🔥 Max Risk: 0.75% portfolio allocation

⚠️ Hedge risk via broader grains basket or options if volatility spikes

🧬 WaverVanir Insight

Institutional algorithms are likely building shorts in supply zones while layering passive bids in the discount range. We anticipate a "liquidity run" under weak lows before a potential Q4 reversal, depending on global food security narratives.

🔻 Until then, bias remains short.

#RiceFutures #SMC #WaverVanir #Commodities #InflationHedge #FibAnalysis #MacroTrading #SmartMoney #ZRU2025 #VolanXProtocol

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.