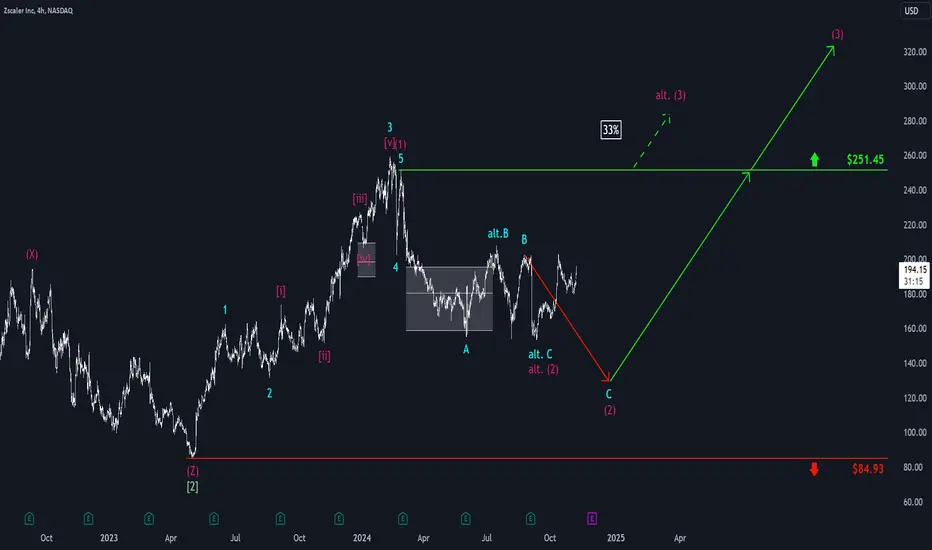

After a rapid rise in early September, the ZS stock managed to reach the highs from August, but there was no significant acceptance at this level. Structurally, the upward movement isn't sufficient for us to consider wave (2) as completed. So far, the bullish signals lack a clear impulsive character, and we expect new lows during the magenta wave (2), which should primarily end above the support at $84.93. Once a trend reversal has been initiated, the subsequent wave (3) should push through the resistance at $251.45. According to our 33% likely alternative scenario, this could also happen directly.

📊 Free daily market insights combining macro + Elliott Wave analysis

🚀 Spot trends early with momentum, sentiment & price structure

🌐 Join thousands trading smarter - full free analyses at dailymarketupdate.com

🚀 Spot trends early with momentum, sentiment & price structure

🌐 Join thousands trading smarter - full free analyses at dailymarketupdate.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📊 Free daily market insights combining macro + Elliott Wave analysis

🚀 Spot trends early with momentum, sentiment & price structure

🌐 Join thousands trading smarter - full free analyses at dailymarketupdate.com

🚀 Spot trends early with momentum, sentiment & price structure

🌐 Join thousands trading smarter - full free analyses at dailymarketupdate.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.