CBOT: Micro Soybean Futures (  MZS1!)

MZS1!)

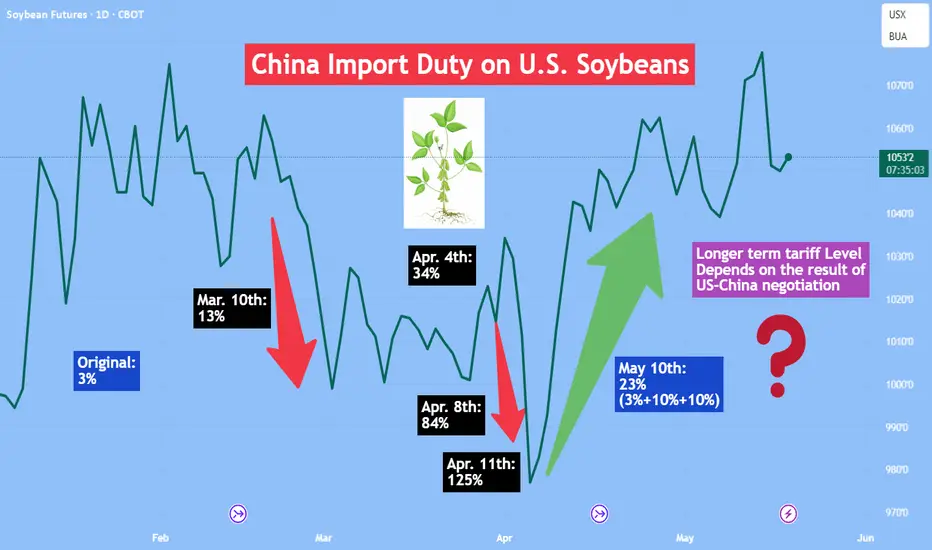

What’s the import duty China levied on U.S. soybeans? This is a million-dollar question.

Below is a timeline of how dramatically the tariff changed over the past few months:

• At the start of the year, China levied a 3% tariff on soybeans originated from the U.S.

• On March 10th, as a retaliatory method against U.S. tariffs, China raised the soybean import duty by 10%, making the total tariff at 13%.

• On April 4th, with additional tariff imposed, the soybean import duty is now 34%.

• On April 8th, a new wave of retaliation put the soybean duty to 84%.

• On April 11th, the soybean tariff is raised to a staggering 125%.

• U.S. and China held trade negotiation in Switzerland. The soybean tariff is temporarily reduced to 23% beginning May 14th.

Trade conflict is now the key driver in CBOT soybean futures. Raising tariffs caused soybean prices to fall sharply in both March and April. Rumors of trade negotiation, weeks before the actual tariff reduction, triggered a big rebound in April through May.

The WASDE Report

On May 12th, the US Department of Agriculture (USDA) released the latest World Agricultural Supply and Demand Estimates (WASDE) report.

U.S. soybean expectations for 2025/26 show a slight decline in supply, higher crushes, lower exports and lower ending stocks compared to 2024/25. U.S. soybean production is expected to fall to 4.34 billion bushels. Soybean supplies are down less than 1% from 2024/25 due to higher initial stocks but lower imports and production.

Global trade in soybeans reflects an acceleration in demand for protein meal consumption. Higher opening stocks and higher soybean production in South America increased export supplies. As a result, the U.S. share of global soybean exports is expected to fall to 26% from 28% last year, despite increased global demand. As a result, U.S. soybean exports are expected to be 1.815 billion bushels, down 35 million bushels from 2024/25.

The May WASDE report is considered neutral. The market reaction has been mute.

Trading with Micro Soybean Futures

The latest CFTC Commitments of Traders report shows that, as of May 13th, CBOT soybean futures have total open interest of 822,498 contracts.

• Managed Money has 136,702 in long, 81,035 in short, and 122,315 in spreading

• Compared to the previous week, long positions were up by 10,457 (+8.3%) while shorts were down by 3,482 (-4.5%)

• The long-short ratio of 1.7-to-1 as well as the position change pattern show that the “Small Money” has turned more bullish on soybeans

The agreement between US and China, while temporary in nature, gives hope to future tariff reduction. The trade negotiation is ongoing in the next 90 days. Depending on the result, China’s tariff on U.S. soybean could go up, go down, or remain at 23%.

To express a view on the future direction of soybean tariff, CBOT Micro Soybean Futures ($MZS) could be used to form a trading strategy.

• At 23% tariff, US soybeans are at the price disadvantage to South American beans. If the tariff were to go up or even just stay the same, US farmers will lose market share in soybean exports. Therefore, short soybeans if the expectation is no trade deal.

• On the other hand, a reduction of tariff level would benefit the better-quality U.S. beans. Therefore, long soybeans if the view is for lowered tariff.

The August contract MZSQ5 is tradeable through August 22nd. This contract expires after the negotiation deadline and could be used for an event-driven strategy.

The contract size of the micro soybean futures (MZS) is 500 bushels, or just 1/10 of the benchmark standard soybean futures (ZS). At Friday closing price of 10.455, each MZS contract has a notional value of $5,227.5. The minimum margin is $205 for the August contract at the time of this writing.

Hypothetically, if August soybean price goes up to $12 due to a favorable trade deal, a long futures position will gain $772.50 (= (12-10.455) * 500).

If August soybean price fell to $9 as the trade talk broke down, a short futures position will gain $727.50 (= (10.455 - 9) * 500).

The risk of futures trading is to be on the wrong side of the price direction. To hedge the downside risk, the trader could set a stoploss at his order. For example,

• A stop loss at $10 for a long order would set the maximum loss to $227.50 (= (10-10.455) x 500).

• A stop loss at $11 for a short order would set the maximum loss to $272.50 (= (10.455-11) x 500).

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme/

What’s the import duty China levied on U.S. soybeans? This is a million-dollar question.

Below is a timeline of how dramatically the tariff changed over the past few months:

• At the start of the year, China levied a 3% tariff on soybeans originated from the U.S.

• On March 10th, as a retaliatory method against U.S. tariffs, China raised the soybean import duty by 10%, making the total tariff at 13%.

• On April 4th, with additional tariff imposed, the soybean import duty is now 34%.

• On April 8th, a new wave of retaliation put the soybean duty to 84%.

• On April 11th, the soybean tariff is raised to a staggering 125%.

• U.S. and China held trade negotiation in Switzerland. The soybean tariff is temporarily reduced to 23% beginning May 14th.

Trade conflict is now the key driver in CBOT soybean futures. Raising tariffs caused soybean prices to fall sharply in both March and April. Rumors of trade negotiation, weeks before the actual tariff reduction, triggered a big rebound in April through May.

The WASDE Report

On May 12th, the US Department of Agriculture (USDA) released the latest World Agricultural Supply and Demand Estimates (WASDE) report.

U.S. soybean expectations for 2025/26 show a slight decline in supply, higher crushes, lower exports and lower ending stocks compared to 2024/25. U.S. soybean production is expected to fall to 4.34 billion bushels. Soybean supplies are down less than 1% from 2024/25 due to higher initial stocks but lower imports and production.

Global trade in soybeans reflects an acceleration in demand for protein meal consumption. Higher opening stocks and higher soybean production in South America increased export supplies. As a result, the U.S. share of global soybean exports is expected to fall to 26% from 28% last year, despite increased global demand. As a result, U.S. soybean exports are expected to be 1.815 billion bushels, down 35 million bushels from 2024/25.

The May WASDE report is considered neutral. The market reaction has been mute.

Trading with Micro Soybean Futures

The latest CFTC Commitments of Traders report shows that, as of May 13th, CBOT soybean futures have total open interest of 822,498 contracts.

• Managed Money has 136,702 in long, 81,035 in short, and 122,315 in spreading

• Compared to the previous week, long positions were up by 10,457 (+8.3%) while shorts were down by 3,482 (-4.5%)

• The long-short ratio of 1.7-to-1 as well as the position change pattern show that the “Small Money” has turned more bullish on soybeans

The agreement between US and China, while temporary in nature, gives hope to future tariff reduction. The trade negotiation is ongoing in the next 90 days. Depending on the result, China’s tariff on U.S. soybean could go up, go down, or remain at 23%.

To express a view on the future direction of soybean tariff, CBOT Micro Soybean Futures ($MZS) could be used to form a trading strategy.

• At 23% tariff, US soybeans are at the price disadvantage to South American beans. If the tariff were to go up or even just stay the same, US farmers will lose market share in soybean exports. Therefore, short soybeans if the expectation is no trade deal.

• On the other hand, a reduction of tariff level would benefit the better-quality U.S. beans. Therefore, long soybeans if the view is for lowered tariff.

The August contract MZSQ5 is tradeable through August 22nd. This contract expires after the negotiation deadline and could be used for an event-driven strategy.

The contract size of the micro soybean futures (MZS) is 500 bushels, or just 1/10 of the benchmark standard soybean futures (ZS). At Friday closing price of 10.455, each MZS contract has a notional value of $5,227.5. The minimum margin is $205 for the August contract at the time of this writing.

Hypothetically, if August soybean price goes up to $12 due to a favorable trade deal, a long futures position will gain $772.50 (= (12-10.455) * 500).

If August soybean price fell to $9 as the trade talk broke down, a short futures position will gain $727.50 (= (10.455 - 9) * 500).

The risk of futures trading is to be on the wrong side of the price direction. To hedge the downside risk, the trader could set a stoploss at his order. For example,

• A stop loss at $10 for a long order would set the maximum loss to $227.50 (= (10-10.455) x 500).

• A stop loss at $11 for a short order would set the maximum loss to $272.50 (= (10.455-11) x 500).

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme/

Jim W. Huang, CFA

jimwenhuang@gmail.com

cmegroup.com/markets/microsuite.html

jimwenhuang@gmail.com

cmegroup.com/markets/microsuite.html

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Jim W. Huang, CFA

jimwenhuang@gmail.com

cmegroup.com/markets/microsuite.html

jimwenhuang@gmail.com

cmegroup.com/markets/microsuite.html

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.