Wheat Futures – Quick Update | May 28, 2025

---

📈 Overview

---

🔑 Key Technical Levels

Support:

Resistance:

---

🧰 Indicator Snapshot

| Indicator | Short-Term Bias|Confirmation Needed|

| ---------------------- | --------------------- | ------------------------- |

| RSI (1 h/4 h) | Bullish divergence | Break above 60–65 |

| Momentum (4 h) | Turning up | Close >\$5.35 |

| Volume | Above-average on dips | Sustained rise on rallies |

| MACD (1 h) | Positive | 4 h bullish cross |

| Candlesticks | Spinning top / doji | Follow-through above high |

| Elliott Wave | New Wave 3 unfolding | Hold >\$5.26 |

| Fibonacci Time | .618 cycle low hit | Time window May 29–31 |

| Seasonality | Bullish into June | No new lows |

| COT Positioning | Commercial buying | Fund short covering |

| Intraday/Weekly Cycles | Early June turn | Break \~June 4–6 |

---

🎯 Trading Plan

1. Short-Term (1–5 days):

• Buy dips into $5.26–5.30

• Targets: $5.38 → $5.50

• Stop: $5.24

• R:R: 2:1

2. Medium-Term (1–3 weeks)

• Accumulate $5.20–5.28

• Targets: $5.57 → \$5.75

• Stop: Daily close < $5.20

3. Long-Term (1–2 months)

• Build core above $5.06

• Targets: $5.75–6.08 (1×–1.618× Wave 1)

• Stop: Weekly close < $5.00

---

📅 Outlook

---

💡 Stay tuned for updates as we approach the May 29–31 cycle window.

---

📈 Overview

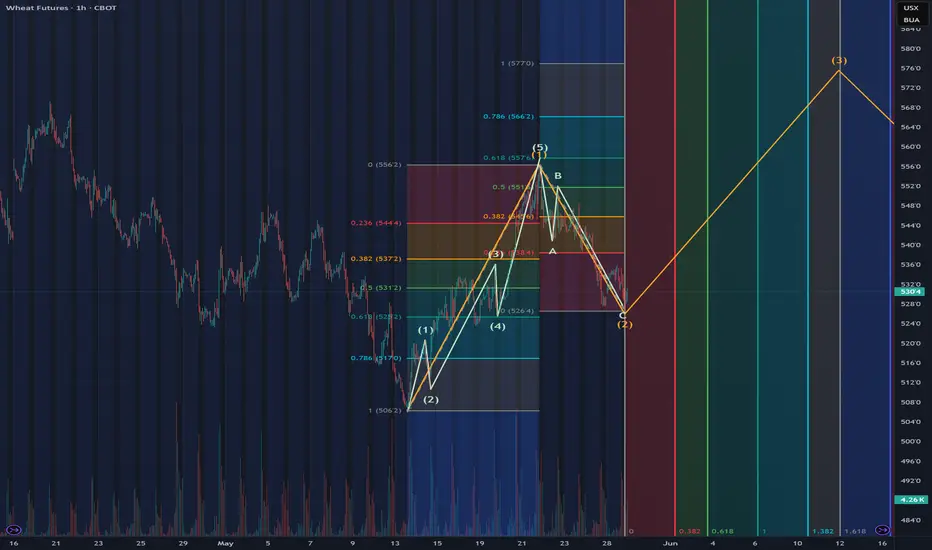

- Swing low formed at $5.06 on May 13 (capitulation volume spike)

- Pullback to $5.26–5.28 now likely completed Wave 2 of a new impulse

- Indecision candles (daily spinning top, 4 h dragonfly doji) signal exhaustion of selling

---

🔑 Key Technical Levels

Support:

- Short term: $5.26–5.28

- Medium term: $5.20

- Long term floor: $5.06

Resistance:

- Initial: $5.35–5.38 (50 EMA 4 h/1 h)

- Next: $5.50–5.55 (daily 50 EMA 5.40, 200 EMA 5.58)

- Stretch:$5.75–6.00

---

🧰 Indicator Snapshot

| Indicator | Short-Term Bias|Confirmation Needed|

| ---------------------- | --------------------- | ------------------------- |

| RSI (1 h/4 h) | Bullish divergence | Break above 60–65 |

| Momentum (4 h) | Turning up | Close >\$5.35 |

| Volume | Above-average on dips | Sustained rise on rallies |

| MACD (1 h) | Positive | 4 h bullish cross |

| Candlesticks | Spinning top / doji | Follow-through above high |

| Elliott Wave | New Wave 3 unfolding | Hold >\$5.26 |

| Fibonacci Time | .618 cycle low hit | Time window May 29–31 |

| Seasonality | Bullish into June | No new lows |

| COT Positioning | Commercial buying | Fund short covering |

| Intraday/Weekly Cycles | Early June turn | Break \~June 4–6 |

---

🎯 Trading Plan

1. Short-Term (1–5 days):

• Buy dips into $5.26–5.30

• Targets: $5.38 → $5.50

• Stop: $5.24

• R:R: 2:1

2. Medium-Term (1–3 weeks)

• Accumulate $5.20–5.28

• Targets: $5.57 → \$5.75

• Stop: Daily close < $5.20

3. Long-Term (1–2 months)

• Build core above $5.06

• Targets: $5.75–6.08 (1×–1.618× Wave 1)

• Stop: Weekly close < $5.00

---

📅 Outlook

- Bullish continuation likely into early June if $5.26 holds

- High-probability breakout above $5.35–5.38unlocks next leg toward $5.75+

- Invalidation: Close below $5.20 delays rally toward lower retest

---

💡 Stay tuned for updates as we approach the May 29–31 cycle window.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.