EURUSDHello Traders! 👋

What are your thoughts on EURUSD?

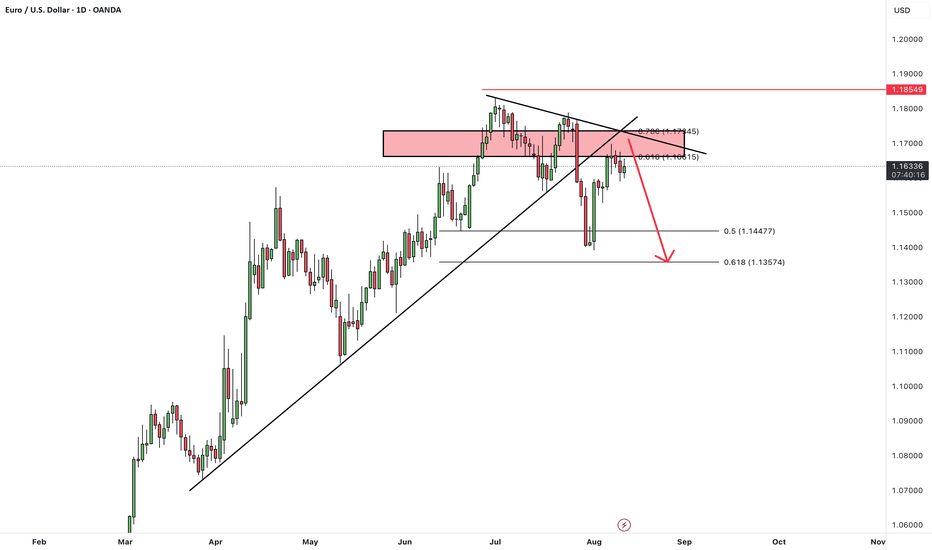

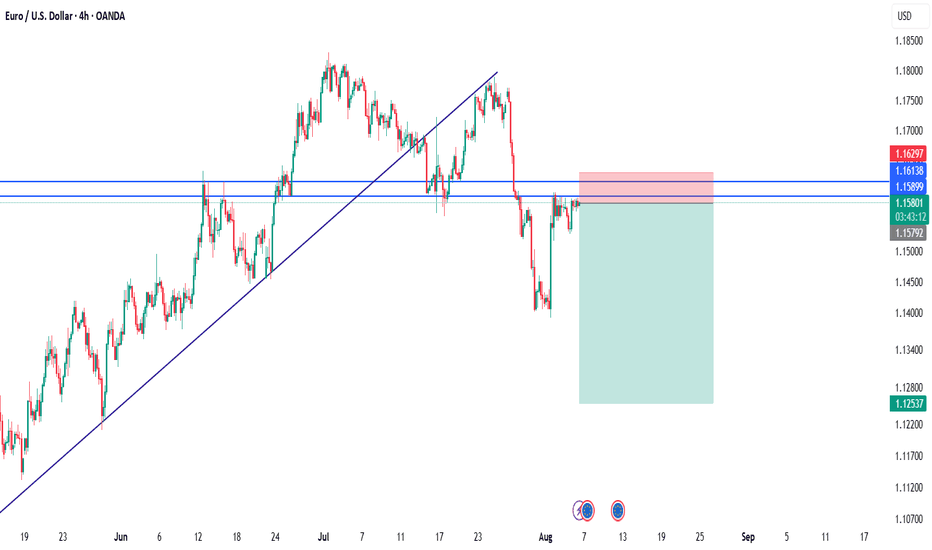

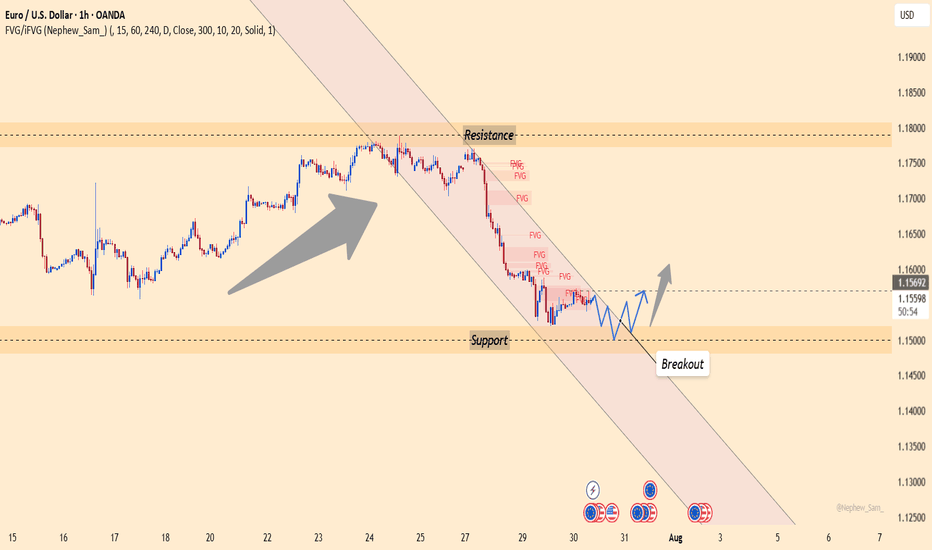

Price broke its ascending trendline and entered a corrective phase, retracing to the 50% and 61.8% Fibonacci levels .

Currently, the market is trading near a major resistance zone, which aligns with the 76.8% Fibonacci retracement, a supply area, the broken trendline, and a horizontal resistance — adding to the confluence and strength of this level.

As long as price remains below this resistance zone, the bias stays bearish, and we expect a move down toward the specified lower targets after some consolidation in this area.

Don’t forget to like and share your thoughts in the comments! ❤️

#eurusd#forex

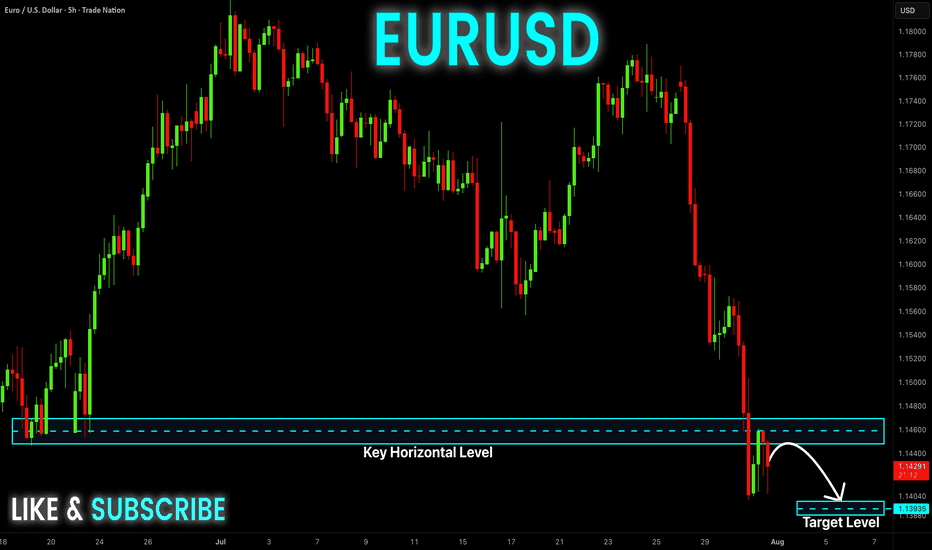

Here is why EURUSD bulls will holdBased on fundamental analysis, the dollar has remained in a risk on mood due to tariffs and the delay of Powell to cut rates. Despite the delay, President Trump has also been threatening the Fed independence making it difficult for the dollar to sustain gains. Technically the pair has been seen to clear sell side liquidity at 1.14500 zones. Therefore, if the pair maintains the momentum it will go to 1.19000

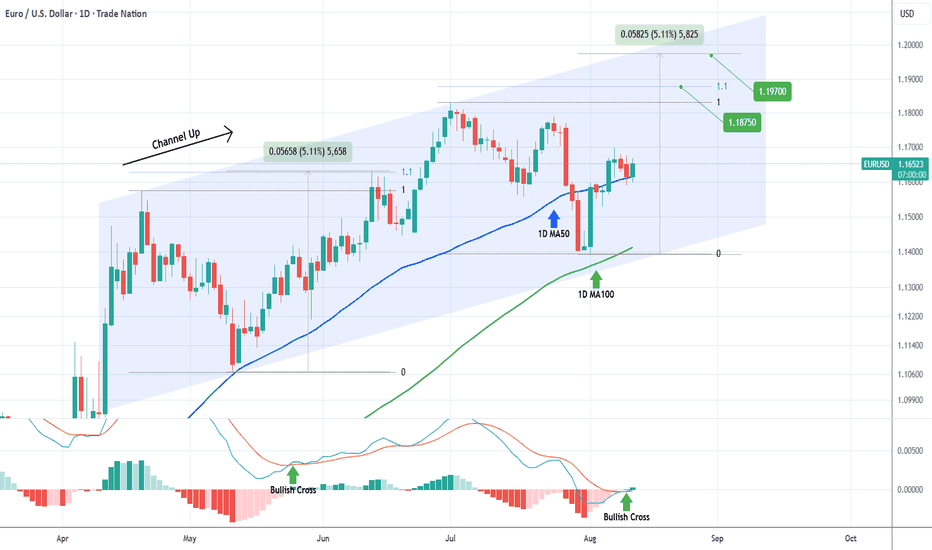

EURUSD 1D MA100 bounce targets 1.8750 at least.The EURUSD pair has been trading within a 4-month Channel Up and recently priced its latest Higher Low (pattern's bottom).

That happened to take place just above the 1D MA100 (green trend-line), giving a strong medium-term buy signal. As long as it holds, we expect the emerging Bullish Leg to target at least 1.18750 (the 1.1 Fibonacci extension) and in continuation 1.19700 (+5.11% from the bottom), both based on the previous Bullish Leg.

Notice also that the 1D MACD is forming its first Bullish Cross since May 26, a very strong additional buy signal.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

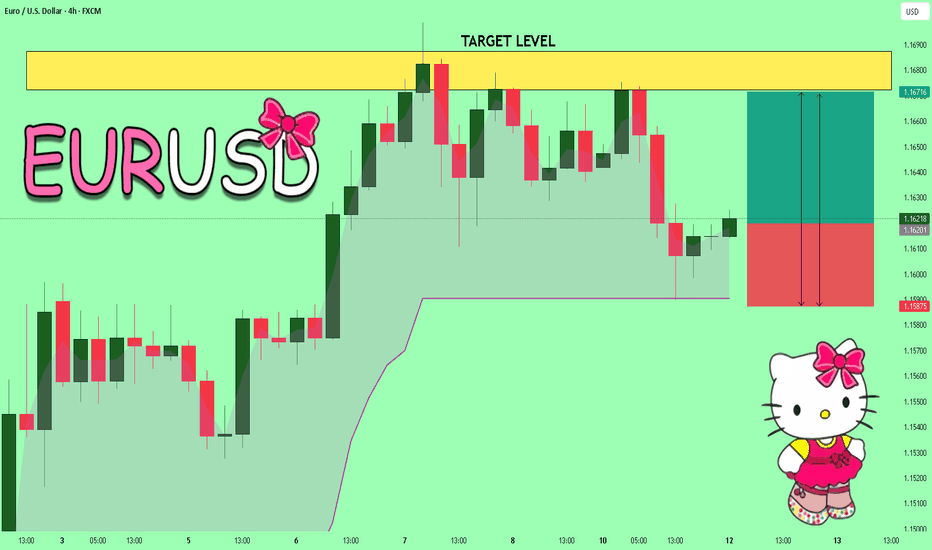

EURUSD: Will Go UP! BUY!

My dear friends,

Please, find my technical outlook for EURUSD below:

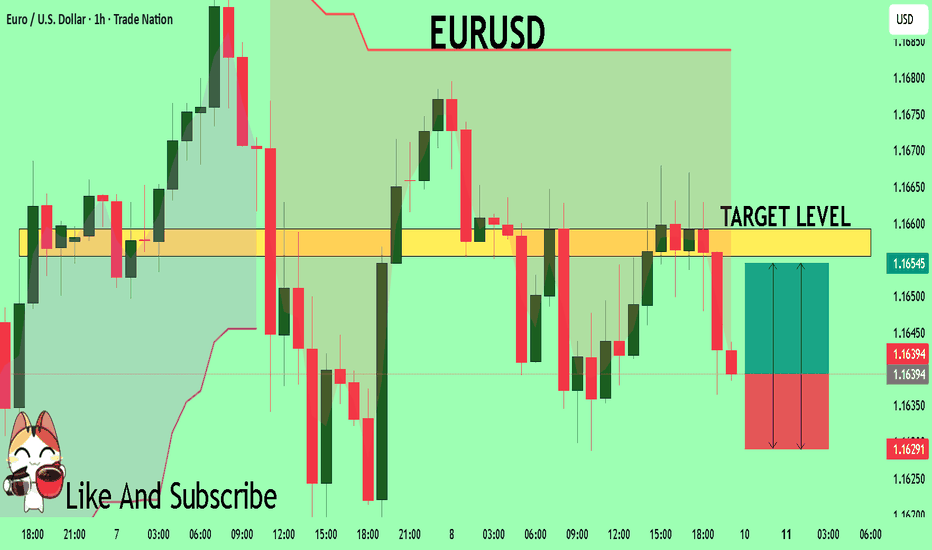

The price is coiling around a solid key level - 1.1623

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 1.1671

Safe Stop Loss - 1.1587

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURUSD: Uptrend Continues, Targeting New Resistance!Market Overview:

The CPI m/m was reported at 0.3%, higher than the expected 0.2%, boosting expectations that the Fed will continue to raise interest rates. Despite the strengthening USD, EURUSD continues its uptrend due to strong price structure and technical support in the short term.

Technical Analysis:

EURUSD is currently trading in an upward price channel, with strong support at 1.15800 USD. If the price maintains above this level, there is a high chance it will test the resistance at 1.16863 USD. If this resistance is broken, the price could continue to rise towards 1.17500 USD.

The chart shows that the upward price structure is supporting the trend, forming higher highs and higher lows, signaling the continuation of the bullish trend.

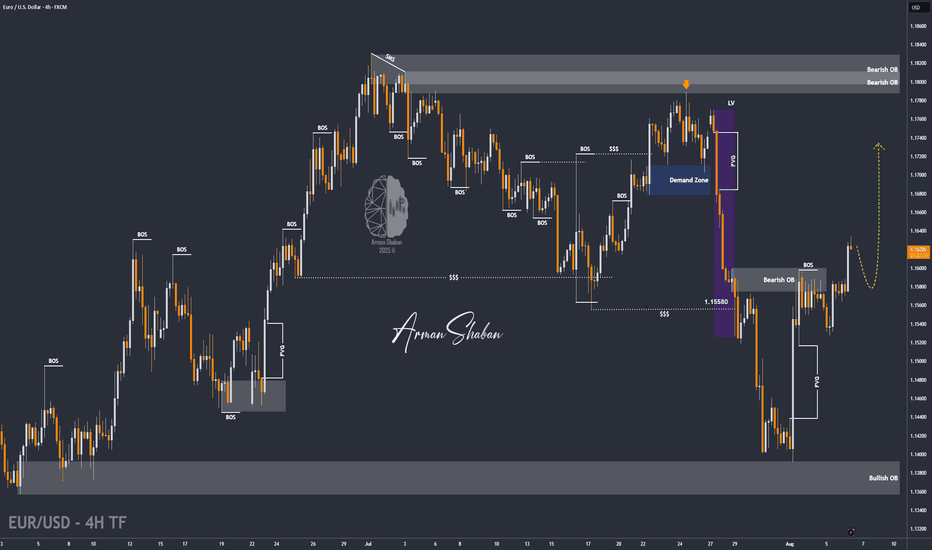

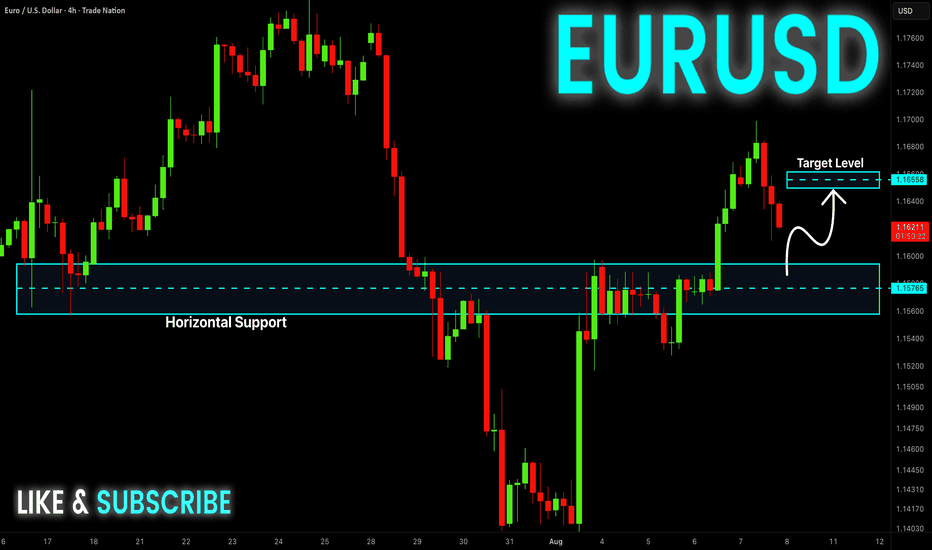

EUR/USD | Holding Above 1.16 Could Unlock More Upside! (READ IT)By analyzing the EURUSD chart on the 4-hour timeframe, we can see that the price reacted beautifully to all the marked zones on the chart. Especially after reaching the 1.14 demand area, it experienced a strong bullish move, rallying over 200 pips to hit 1.16. Currently, EURUSD is trading around 1.16220, and if it holds above the 1.16 level, we can expect further upside. The next bullish targets are 1.16435, 1.16780, 1.17100, and 1.17500.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

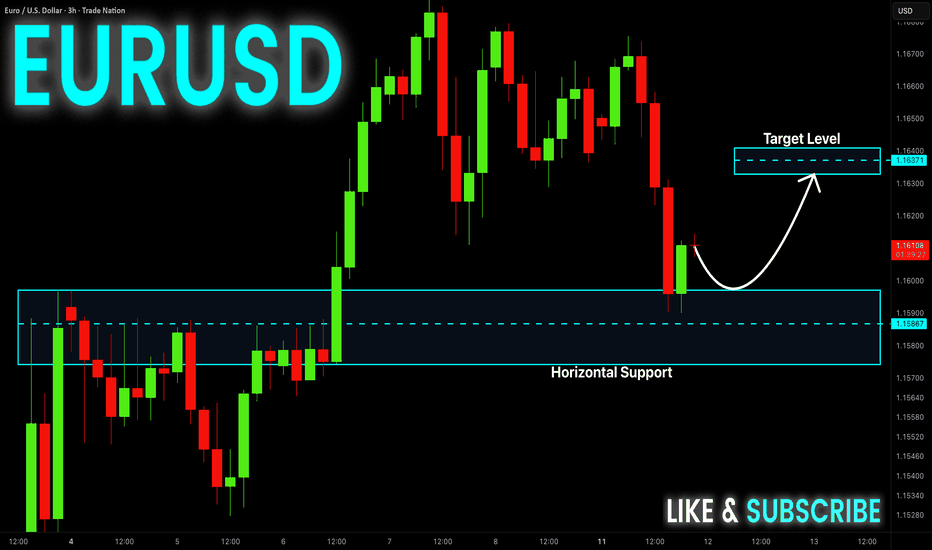

EUR-USD Potential Long! Buy!

Hello,Traders!

EUR-USD made a retest

Of the horizontal support

Of 1.1590 from where we

Are already seeing a bullish

Rebound thus we will be

Expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURUSD Massive Long! BUY!

My dear followers,

This is my opinion on the EURUSD next move:

The asset is approaching an important pivot point 1.1639

Bias - Bullish

Safe Stop Loss - 1.1629

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.1655

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

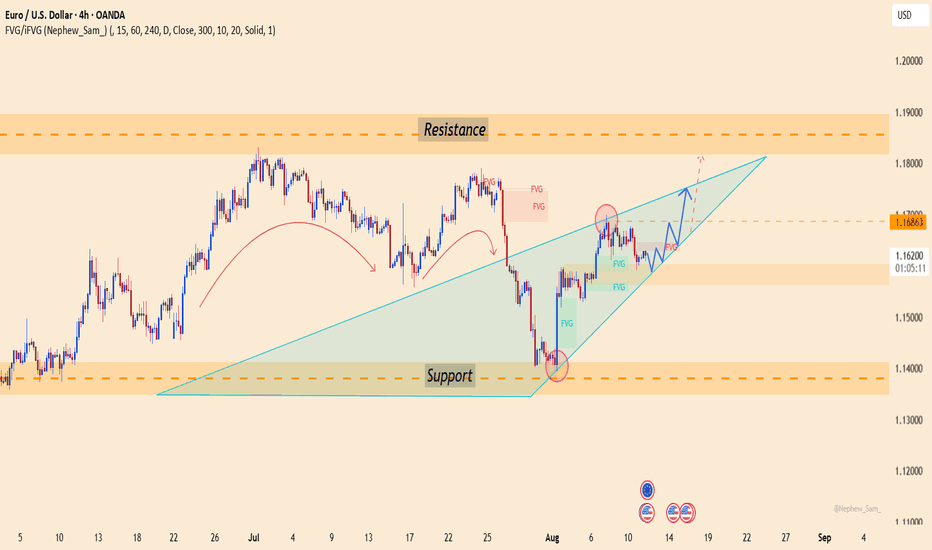

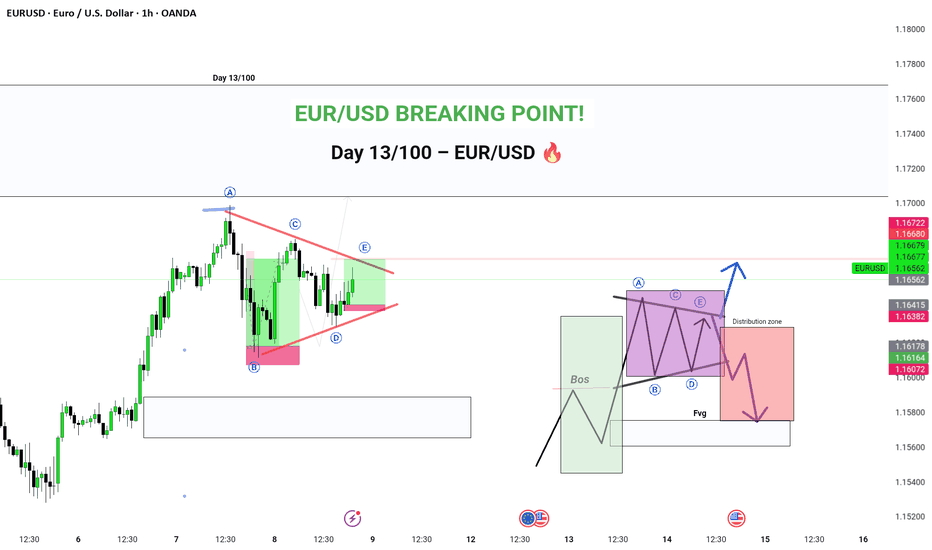

EUR/USD Breaking Point! ALERT Price action is coiling up in a tight triangle and a breakout is imminent! See how the ABCDE pattern on the chart is setting up for a potential explosive move. Will EUR/USD surge higher or drop to key support?

I've mapped out BOTH scenarios with clear technical targets—don’t miss your chance to catch the next big wave!

💡 Tap "Boost" if you found this analysis helpful.

📈 Follow my page for daily actionable trading setups!

👇 Drop your predictions in the comments below—are you bullish or bearish on EUR/USD this week?

Let’s win together!

EUR-USD Support Ahead! Buy!

Hello,Traders!

EUR-USD is making a local

Bearish correction but

We are bullish biased mid-term

So after the pair hits the horizontal

Support of 1.1577 we will be

Expecting a local bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

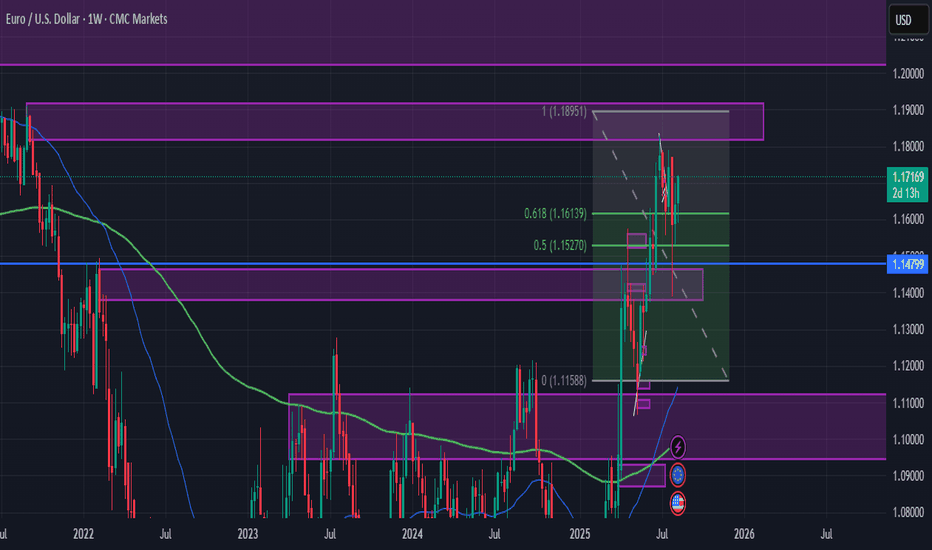

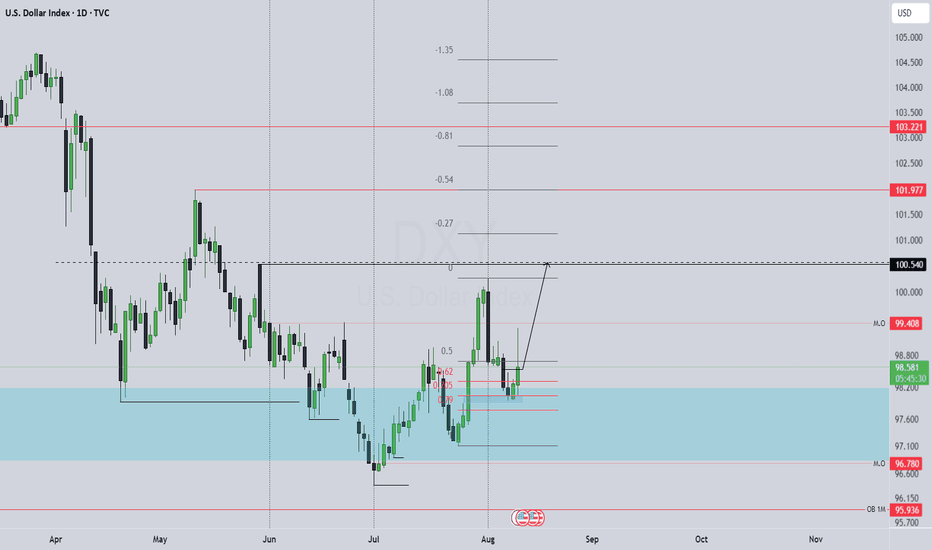

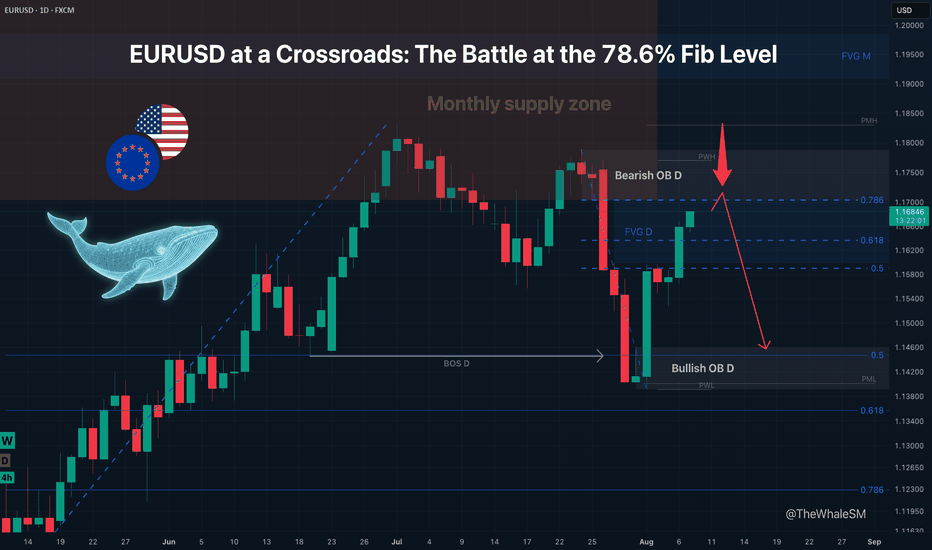

EURUSD at a Crossroads: The Battle at the 78.6% Fib LevelMarkets rarely move in a straight line. After a powerful rally was stopped by monthly supply, EURUSD has arrived at a critical crossroads. The higher timeframe trend is still bullish, but a potential daily downtrend is emerging. This analysis focuses on the single high-probability short setup that could define the next major move.

After the price found support at the 50% Fibonacci retracement level of the weekly structure , which coincided with the daily structure's break level, further decline was prevented by negative NFP news last Friday, which pushed the dollar index down. The long scenario from this level, which I detailed in my previous analysis " EURUSD: The Logic of Institutional Capital Unveiled ", is still active. An entry directly from that level was impossible due to the reversal occurring on highly volatile news, but it's still possible from the manipulation zone in the form of the bullish order block below.

This current analysis is a continuation of that one, but from the perspective of looking for short positions , as the price has shown its intention to first reach a zone of interest above. So, let's try to further unravel the logic and the next step of large capital.

The global uptrend of the pair was halted by a monthly supply zone , from which a correction began and subsequently reversed at the 50% weekly level. One might expect the uptrend to continue and only look for long entries. However, the fact that the price found its pivot point in a monthly supply zone and has since shown the potential genesis of a bearish daily structure allows us to consider counter-trend short trades, with fresh footprints from "smart money" to guide us.

On its continued ascent, the price will face resistance in the form of a bearish order block in conjunction with the 78.6% retracement level of the new, potentially bearish structure. Everything will depend on whether this level and order block hold and show a reversal reaction. The entry condition for a short will be the mitigation of this order block concurrently with reaching the 78.6% level, followed by price finding acceptance below it .

► Invalidation: Invalidation of the short scenario would be a break of the 78.6% level with the price finding acceptance above it.

In the case of a short setup forming and an entry being confirmed, the minimum target for the price will be the bullish daily order block below, which was formed during the liquidity sweep of the daily structure's break level.

A key global context for EURUSD to consider upon the mitigation of the daily bearish order block is the Dollar Index (DXY) . After breaking its bearish daily structure (BOS D) to the upside, it also began a correction after NFP. The target and potential reversal zone for DXY is the same as EURUSD's but a mirror image: the 78.6% Fibonacci retracement level in conjunction with a daily order block . It is highly probable that the potential setup formation on these two instruments will occur synchronously. Given their strong inverse correlation, a potential short setup on the euro pair would receive additional confirmation if a long setup forms on the Dollar Index.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The principles and conditions for forming the manipulation zones I show in this trade idea are detailed in my educational publication, which was chosen by TradingView for the "Editor's Picks" category and received a huge amount of positive feedback from this insightful trading community. To better understand the logic I've used here and the general principles of price movement in most markets from the perspective of institutional capital, I highly recommend checking out this guide if you haven't already. 👇

P.S. This is not a prediction of the exact price direction. It is a description of high-probability setup that become valid only if specific conditions are met when the price reaches the marked POI. If the conditions are not met, the setup are invalid. No setup has a 100% success rate, so if you decide to use this trade idea, always apply a stop-loss and proper risk management. Trade smart.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

If you found this analysis helpful, support it with a Boost! 🚀

Have a question or your own view on this idea? Share it in the comments. 💬

► Follow me on TradingView for timely updates on THIS idea (entry, targets & live trade management) and not to miss my next detailed breakdown.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

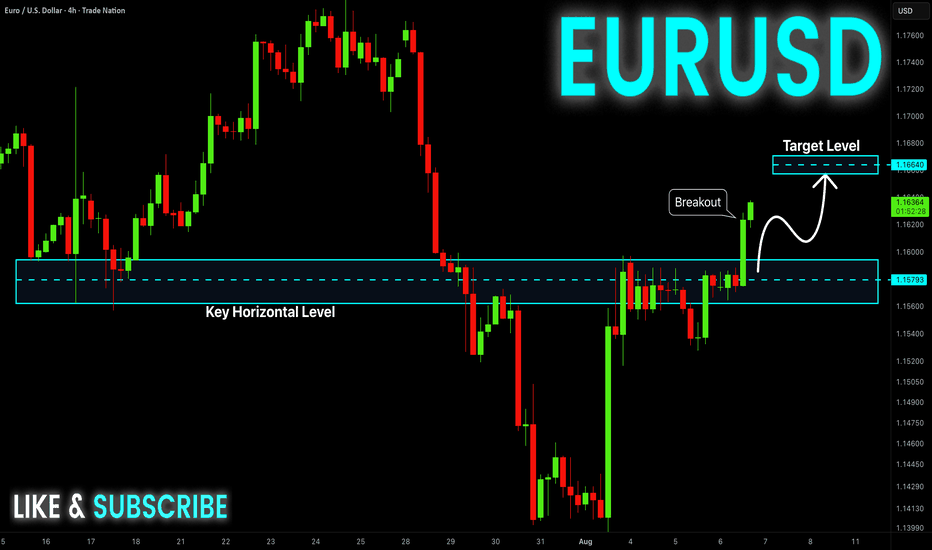

EUR-USD Bullish Breakout! Buy!

Hello,Traders!

EUR-USD is going up now

And the pair made a bullish

Breakout of the key horizontal

Level of 1.1593 and the breakout

Is confirmed so we are bullish

Biased and we will be

Expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

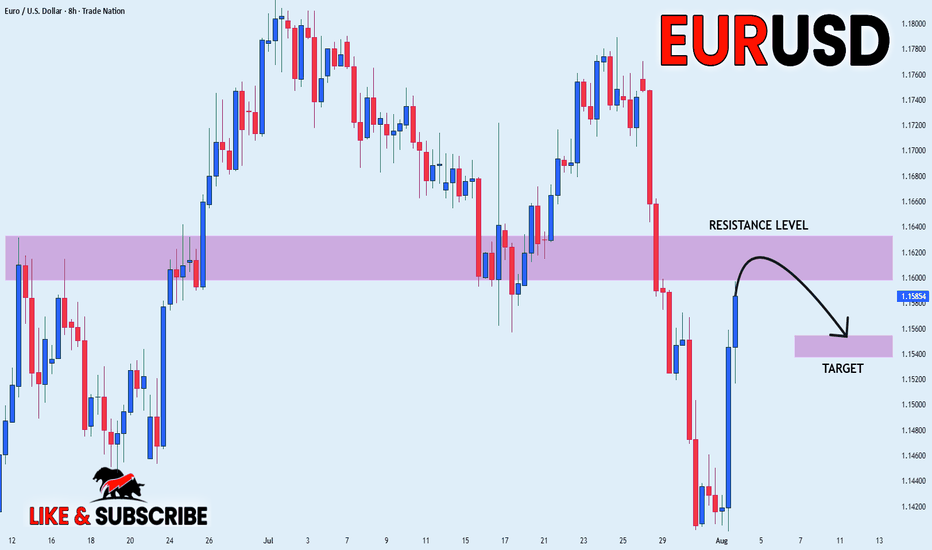

EURUSD After breaking below the ascending trendline, EUR/USD has confirmed a structural shift with strong bearish momentum. The pair retested the broken trendline and is now facing resistance between 1.1589 – 1.1613, which also aligns with a previous demand zone turned supply.

Price is currently respecting this area and forming a potential lower high, indicating the continuation of the downtrend.

🔻 Trade Setup (illustrated on chart):

Entry: Around 1.1589

Stop Loss: Above 1.1629

Target: Down to the 1.1250 area, near previous consolidation support.

This short setup is supported by:

Bearish break of structure

Failed bullish continuation

Macro backdrop (weak US data pushing rate cut odds up, but EUR remains fundamentally weak amid sluggish EU data)

📉 If price holds below 1.1613, bears may remain in control. A break above this zone invalidates the setup.

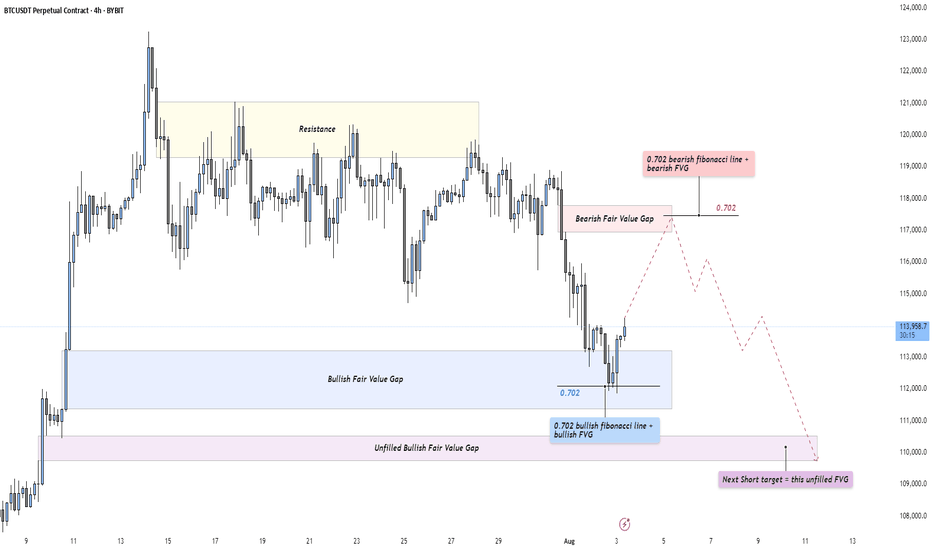

BTC - Short Setup at 0.702 Fibonacci & Fair Value GapMarket Context

Bitcoin recently rejected from a major resistance area and has since been retracing downward, finding temporary support inside a bullish Fair Value Gap. The market is currently in a corrective phase, with buyers attempting to defend lower levels while sellers look for optimal positions to reload shorts. This environment shows a classic tug-of-war between these two forces as price moves between supply and demand zones.

Consolidation and Current Phase

Although the prior consolidation has been broken, the current price action can still be described as corrective, with intraday structure forming lower highs. The bullish Fair Value Gap beneath price has been respected so far, creating a temporary base. However, the path remains complex, as the market has unfilled imbalances both above and below.

Bearish Retest Scenario

One key scenario involves a retracement toward the bearish Fair Value Gap near 117K, which also aligns with the 0.702 Fibonacci retracement level. This confluence makes it a high-probability area for sellers to step in again. A rejection from that zone would likely resume the downtrend, with the next logical target being the deeper unfilled bullish Fair Value Gap around 110K. This zone acts as a magnet for price due to the inefficiency left behind during the last rally.

Bullish Defense Scenario

For bulls to regain control, the current Fair Value Gap at 114K must hold, followed by a strong move that invalidates the lower-high structure. Such a move would need to break above the 117K bearish FVG with conviction. Only then could momentum shift back to the upside, opening the door for another challenge of the higher resistance zones.

Final Words

Patience and precision are key when dealing with setups like this. Let the market come to your level — and react with intent.

If you found this breakdown helpful, a like is much appreciated! Let me know in the comments what you think or if you’re watching the same zones.

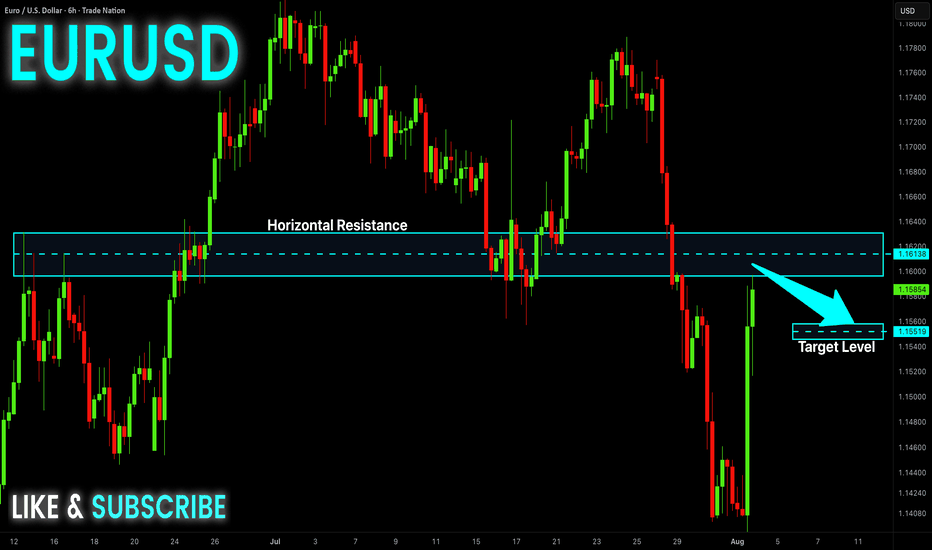

EUR-USD Will Fall! Sell!

Hello,Traders!

EUR-USD will hit the

Horizontal resistance of 1.1620

On Monday after making a

Powerful move up on Friday

And as the pair is locally

Overbought a local bearish

Correction is to be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

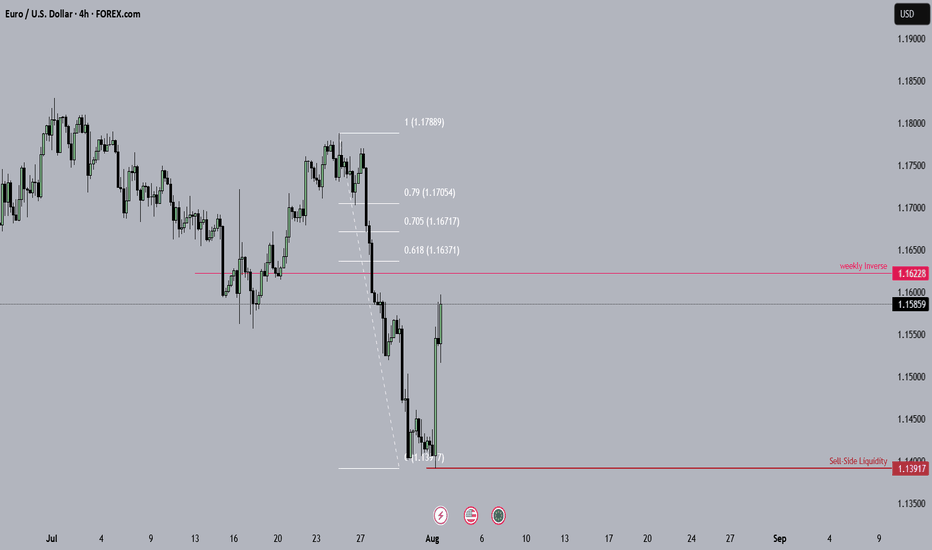

Fiber (EurUsd) Short Idea. Aug 4-8 This Idea wont be precise as my Last Euro Analysis, You can check that out on my Profile.

Now the what do i mean by it not being precise? it means that there is room for upside Movement But it should break that high (Fib high) and the target is Sell-Side Liquidity for this week Key Things in this charts are Liquidity gap, Breaker block IFVG weekly Inverse rejection block.

EUR_USD POTENTIAL SHORT|

✅EUR_USD has been growing recently

And the pair seems locally overbought

So as the pair is approaching

A horizontal resistance of 1.1632

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

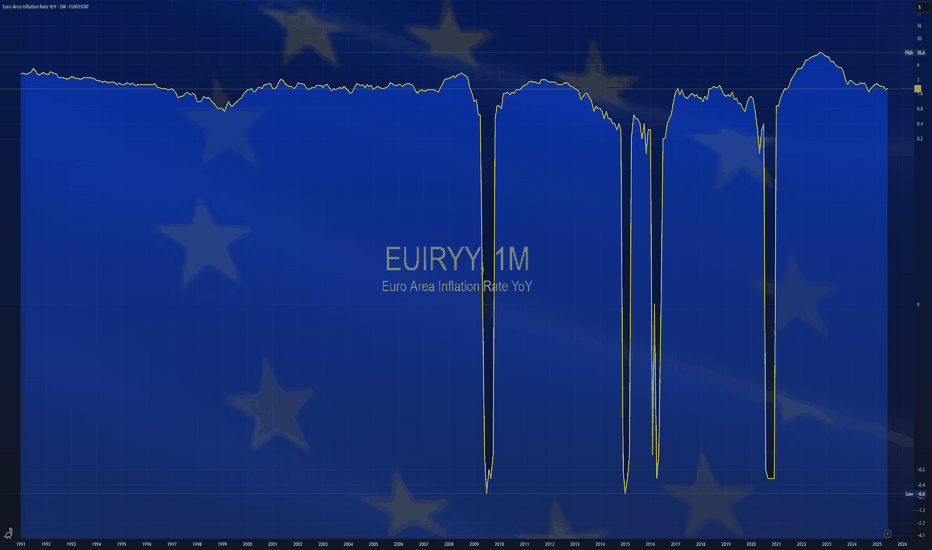

$EUIRYY -Europe CPI (July/2025)ECONOMICS:EUIRYY

July/2025

source: EUROSTAT

- Eurozone consumer price inflation held steady at 2.0% year-on-year in July 2025, unchanged from June but slightly above market expectations of 1.9%, according to preliminary estimates.

This marks the second consecutive month that inflation has aligned with the European Central Bank’s official target.

A slowdown in services inflation (3.1% vs 3.3% in June) helped offset faster price increases in food, alcohol & tobacco (3.3% vs 3.1%) and non-energy industrial goods (0.8% vs 0.5%).

Energy prices continued to decline, falling by 2.5% following a 2.6% drop in June.

Meanwhile, core inflation—which excludes energy, food, alcohol, and tobacco—remained unchanged at 2.3%, its lowest level since January 2022.

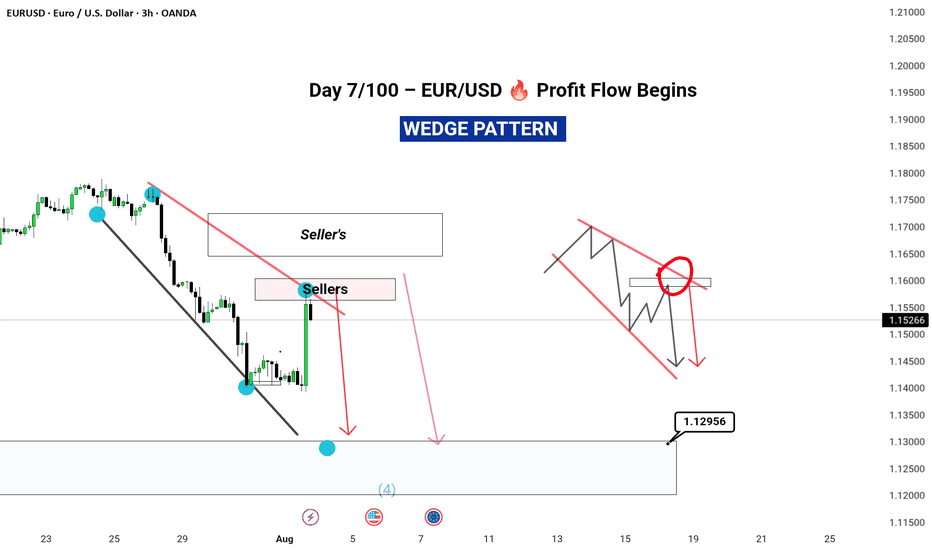

“Exactly What I Saw” promises value and transparency.

In today's analysis, I’ve identified a clear completion of Wave D, securing a 3% ROI across just two trades – all before the move unfolded.

🔍 What’s inside this breakdown?

• Multi-timeframe analysis: Weekly ➝ Daily ➝ 4H ➝ 1H

• Elliott Wave structure with confluence zones

• Trade psychology at key turning points

• Exact entry & exit insights explained

• Risk management for consistent returns

---

⚡ Highlights:

Precise reversal spotted before it was obvious

No indicator clutter – just clean, confident price action

Part of my 100-day breakdown series: real, raw, and repeatable setups

---

👣 Day 7 of 100 is just the beginning.

Tap Follow to stay ahead of the market – one wave at a time.

#EURUSD #ForexAnalysis #ElliottWave #Forex #TradingViewUK #SwingTrading #PriceAction #RiskReward #FXMindset #ForexTradersIndia #ForexEducation

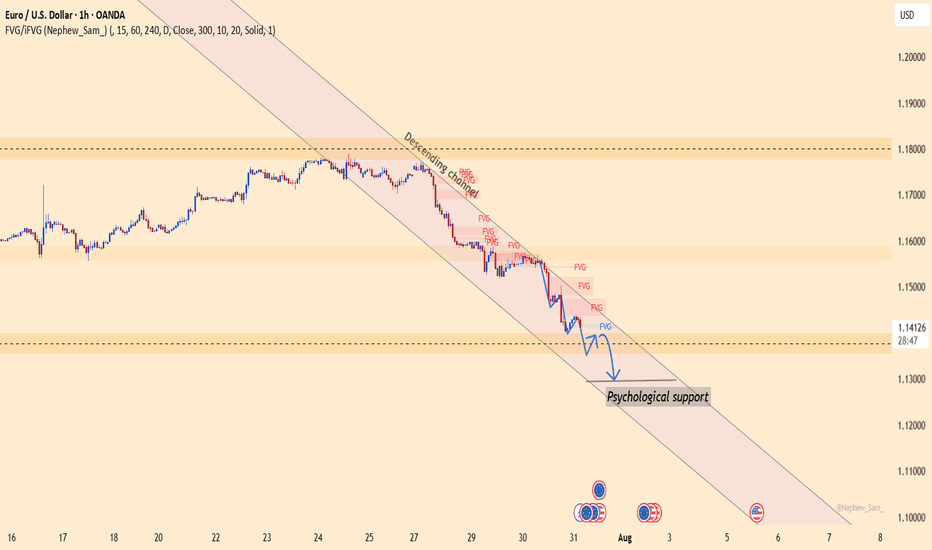

EURUSD plunges without brakes – The bears take full control!EURUSD continues its steep decline as both macroeconomic and technical pressures mount. A trade deal unfavorable to the EU, combined with the Fed’s hawkish stance, has fueled USD strength and dragged the euro sharply lower. At the same time, strong U.S. labor data and rising employment costs further reinforce the bearish outlook.

On the H1 chart, EURUSD is clearly moving within a descending channel. Key price zones have been broken with no significant bullish reaction, indicating that sellers remain firmly in control. The market is heading toward a psychological support area, with no signs of reversal as RSI stays weak.

I remain biased toward SELL setups on any short-term pullbacks, avoiding countertrend trades in this environment. If downside momentum continues, deeper targets may still be ahead.

In a market dominated by bearish sentiment, trading with the trend remains the smartest and safest approach.

EUR-USD Bearish Breakout! Sell!

Hello,Traders!

EUR-USD made a bearish

Breakout of the key horizontal

Level of 1.1460 then made

A retest and a pullback so

We are bearish biased and

We will be expecting a

Further bearish continuation

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURUSD – German GDP boosts EUR, but USD still holds the reins Germany’s recently released GDP data exceeded expectations, acting as a catalyst for EURUSD to rebound after a steep decline. However, this upward move remains fragile, as the USD continues to dominate the market—especially with several key U.S. economic reports set to be released later this week.

On the chart, EURUSD has just bounced from the 1.15000 support zone, which has historically served as a strong floor. If the price holds above this level and breaks the downtrend line, the short-term target could move toward the 1.15700 resistance zone.

Still, the path ahead won’t be easy. The market is closely watching upcoming U.S. data, such as the jobs report and the Core PCE index—the Fed’s preferred inflation gauge. If these figures come in strong, the USD could regain strength and put pressure back on EURUSD.