Something big brewing on XRPETH 1 day chart: looks like a bullish reversal candle of sorts as bittrex doesnt typically fall victim to flashcrash scam wicks like ethereum does. Neutral for now but won't take much to make my flip to long on this one just looking for some follow up confirmation on the next candle or 2. Massive bullwick and massive volume seems to hint at more to come.

1daychart

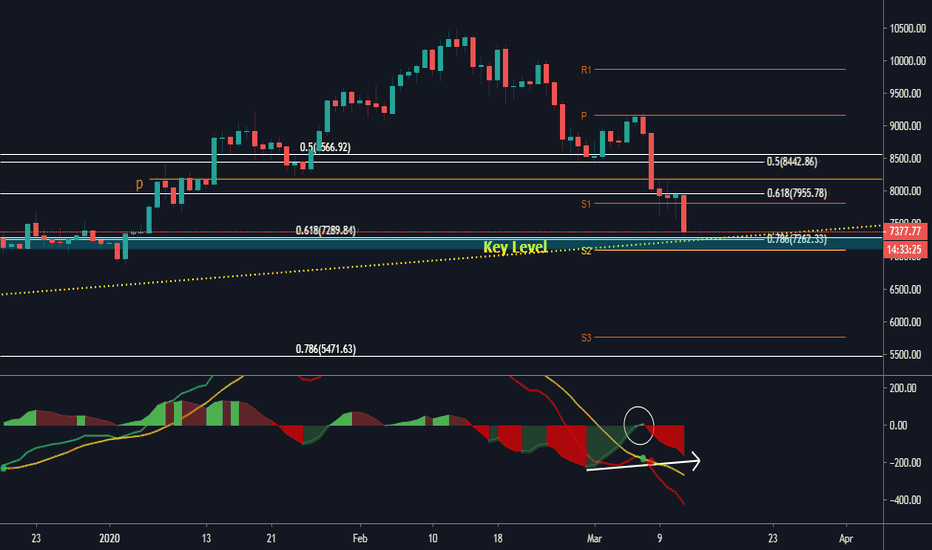

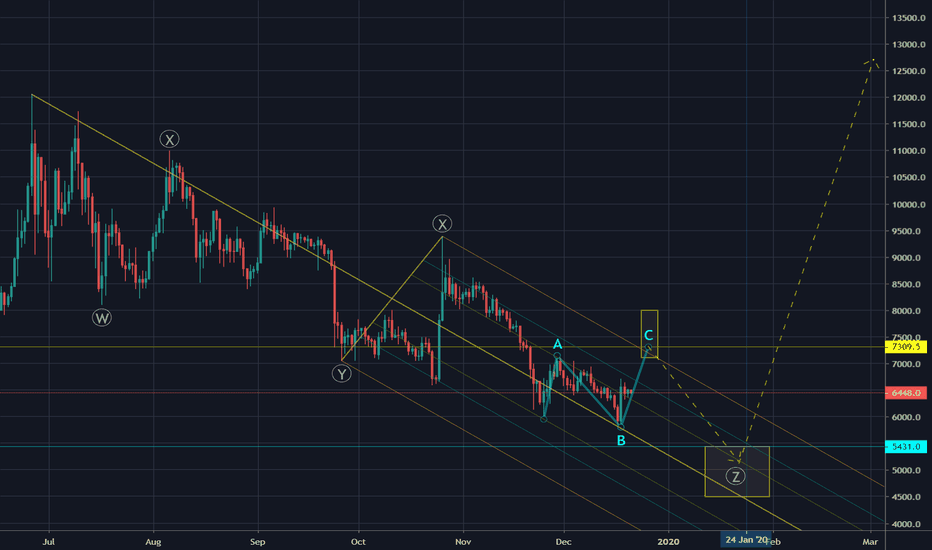

Our Question , Does the key level support Bitcoin ? Hey Guys , Bitcoin has reached the key level , Supported by 0.786 & 0.618 Fibo and traditional pivot and weekly trend line !

In the meantime we can have a strong hidden divergence on the MACD , If the key level changes the trend !

But if the key level is lost and the weekly candle opens below 7000 , We expect it to fall to the 0.786 Fibo range .

---- Login with science . Good Luck ----

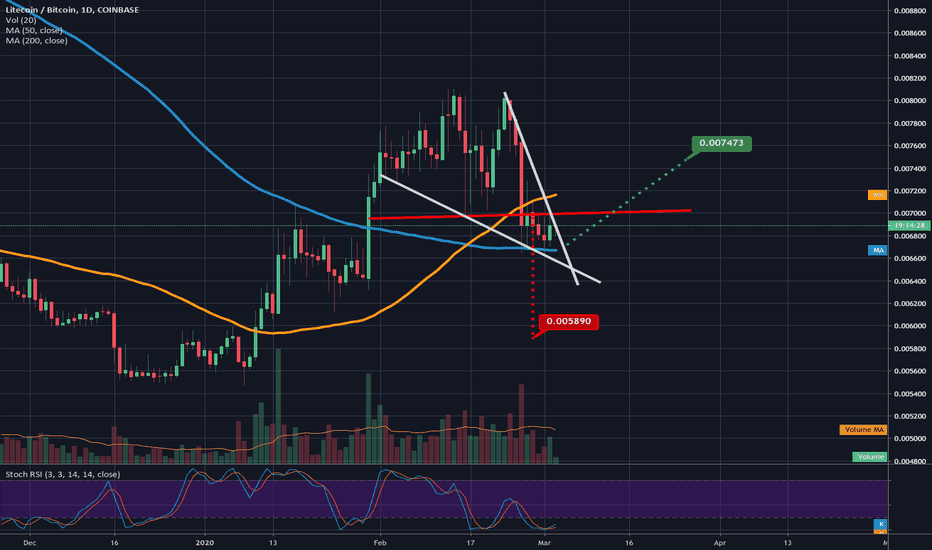

LTCBTC at a key fulcrum point.ltcbtc at a key fulcrum point. Needs to maintain support on the one day 200ma to trigger the falling wedge breakout and maintain the golden cross...if it loses 1day 200ma support then it will likely trigger the double top breakdown which could send it into a deathcross. If it did flip back to deathcross, that deathcross could still be more of a deathcross fakeout as long as prive action were to have a huge rebound after the breakdown. So even if the double top were to occur that doesn't necessarily mean a sustained deathcross is a guarantee we could still just have a deathcross fakeout and flip right back into a golden cross shortly there after.

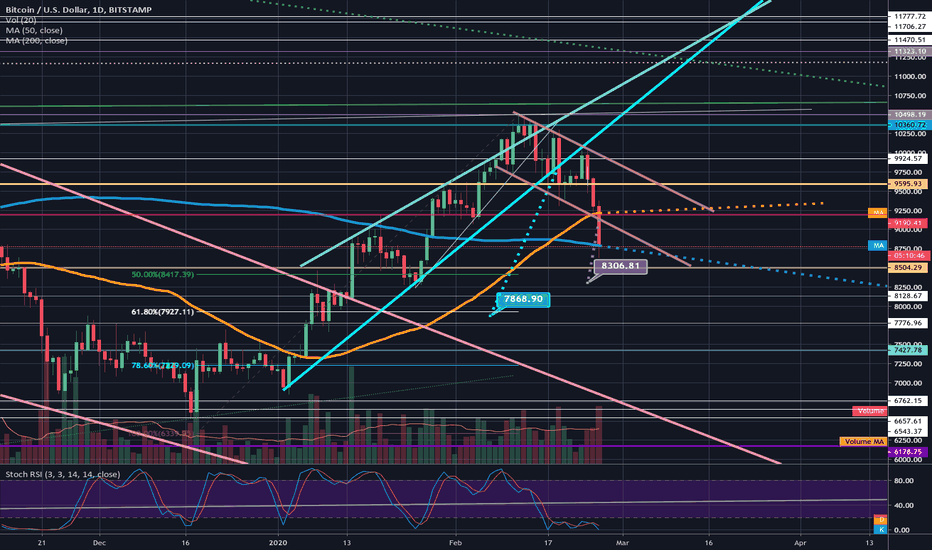

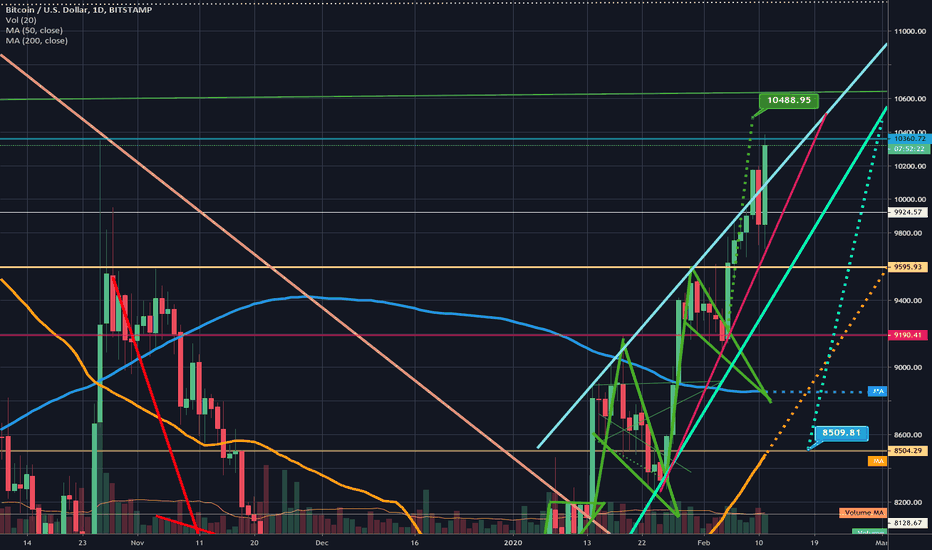

If 1day 200ma fails 4 potential targets= 8.5k, 8.3k,7927, & 7868Still a chance the 1 day 200ma may provide body support by the next 2 daily closes but in the meantime targets like filling the gap at 8.5k are veryr easonable...we also have the breakdown target from the descending purple channel around 8.3k if we were to go lower than these 2 the next target would be the golden pocket fibonacci retracement level at $7927 and finally just below that the blue rising wedges breakdown target at 7868. I will likely ladder in a little bit of buys each time we hit one of these price points. Not financial advice however you choose your own destiny. Only short if the 1 day 200ma is solidified as resistance here.

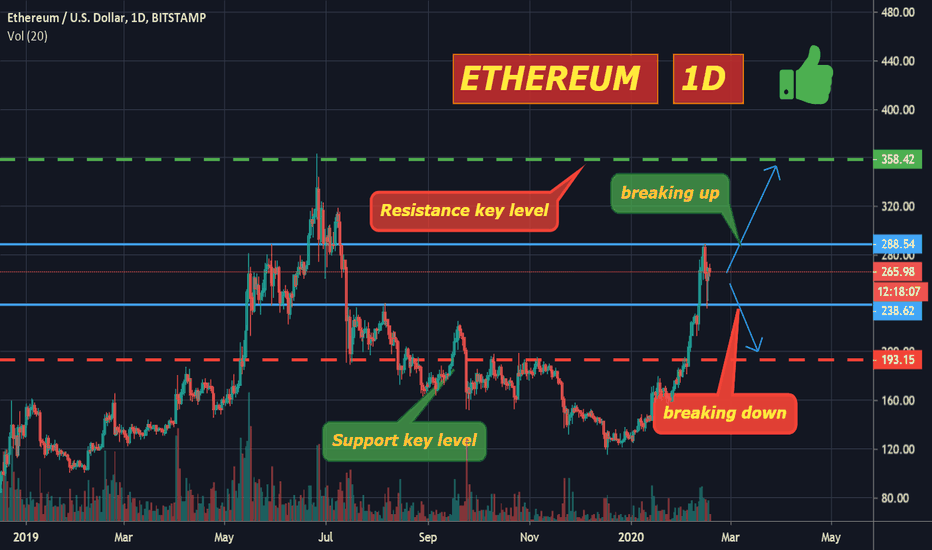

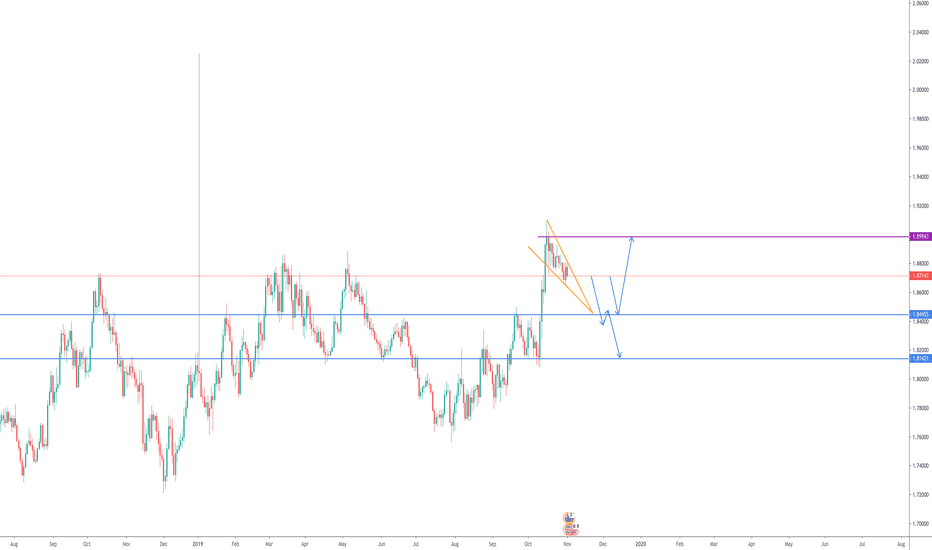

ETHEREUM 1D prediction, trading channelHi guys! Big forecast for the Ethereum coin on the daily chart .

WHY!?

1.A small range has formed in which the coin is now located

2.Strong support and strong resistance to trade.

3.Long when breaking up and fixing with the body at 1D

4.Short when breaking down and fixing the body to 1D

If you like the idea, please support like and subscribe!

Ideas will come out every day!

Higher high achieved!! Closed my 5x long.This is fantastic news for the bulls as we just achieved a higher high on the 1 day chart. I now expect us to go back down and fill the cme gap at 8.5k. If so I will be loading up on alts and btc in that range. I closed my 5x long at 10400 and am very happy with the results.

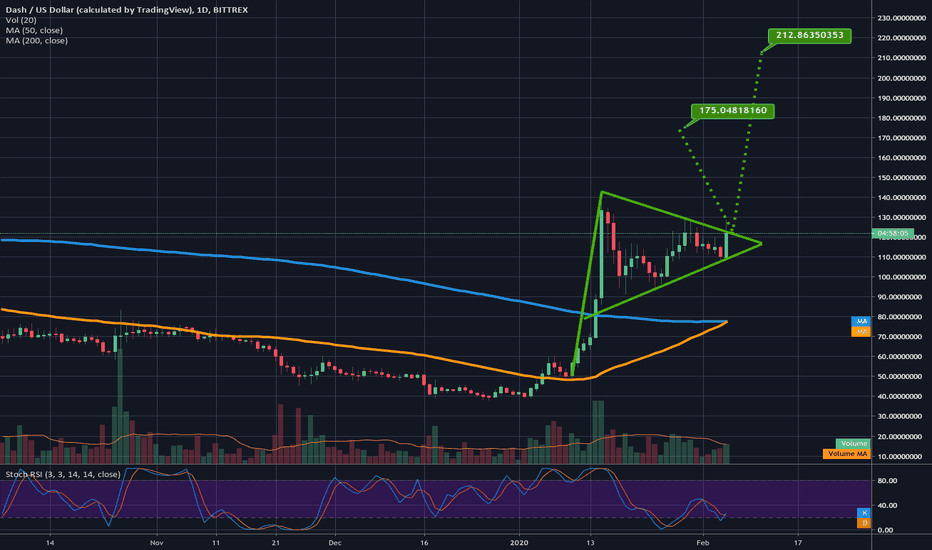

bittrex dashusd no breakout of triangle yet like krakenshowing the chart for dashusd on bittrex to because unlike krakens it hasnt broken out of the pennant yet..also put a lower breakout target in case it only counts the triangle and not the the pennant and its around $175. On both exchanges however the golden cross should occur by the next daily candle so I'm, still very bullish

Kraken DASHUSD chart eyeing goldencross by tomorrow! Target=$220Haven't checked dashusd on other exchanges yet for confluence but on the Kraken exchange it looks ready to blow! *not financial advice* . We see here a symmetrical triangle in an uptrend attached to a flag pole= bullish pennant. If it reaches the pennants breakout target we are looking at a target of around 200-220, if it only reaches the triangles target it will be considerably lower but with the inevitable impending golden cross I anticipate it will reach the full breakout target.

price action very close to reaching inv h&s breakout target; I anticipate we may even test the 1 day 200 MA (in blue) before any significant retrace. If price action can find a way to close more than 2 consecutive 1 day candles above the 1day200ma however this may be a legitimate breakout from the wedge.

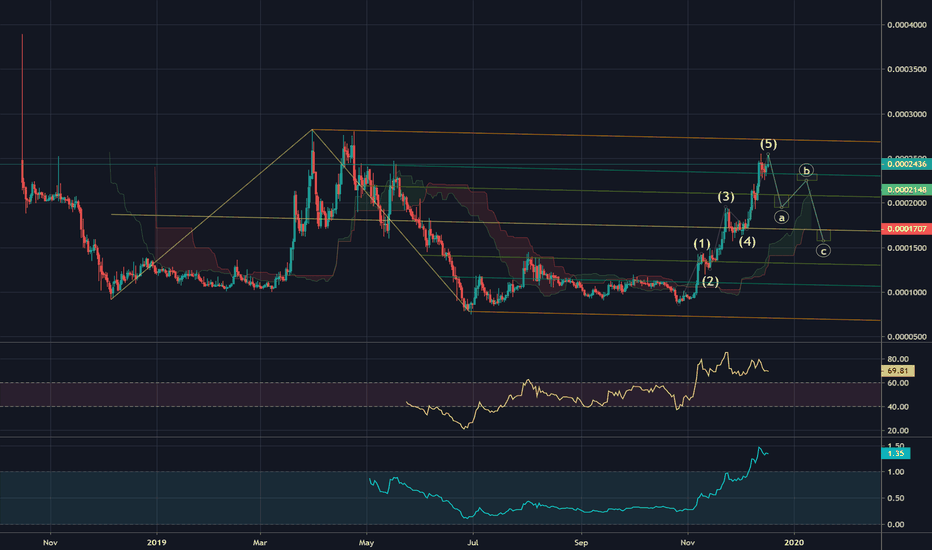

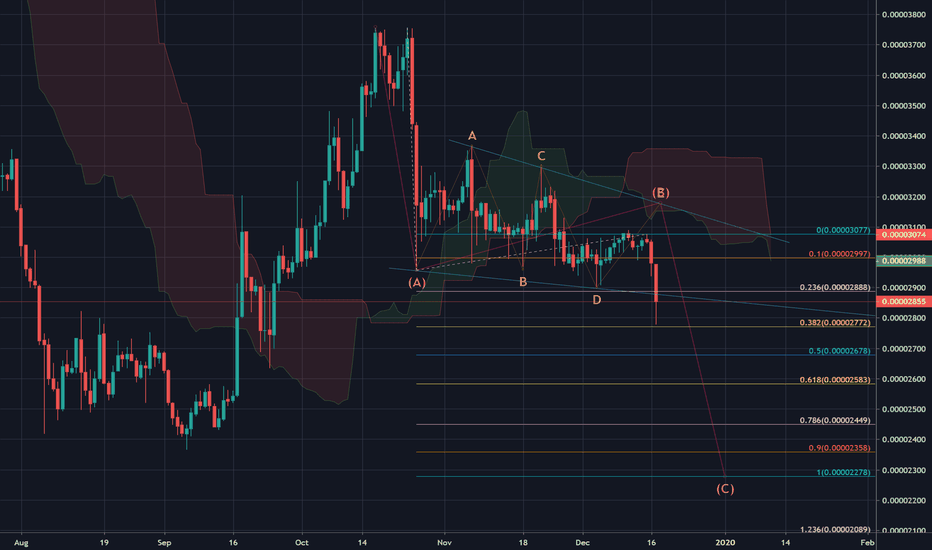

XTZBTC 1day chart: elliott wave & pitchforkXTZBTC seems to have reached its top.

ABC down with targets.

Time to go short?

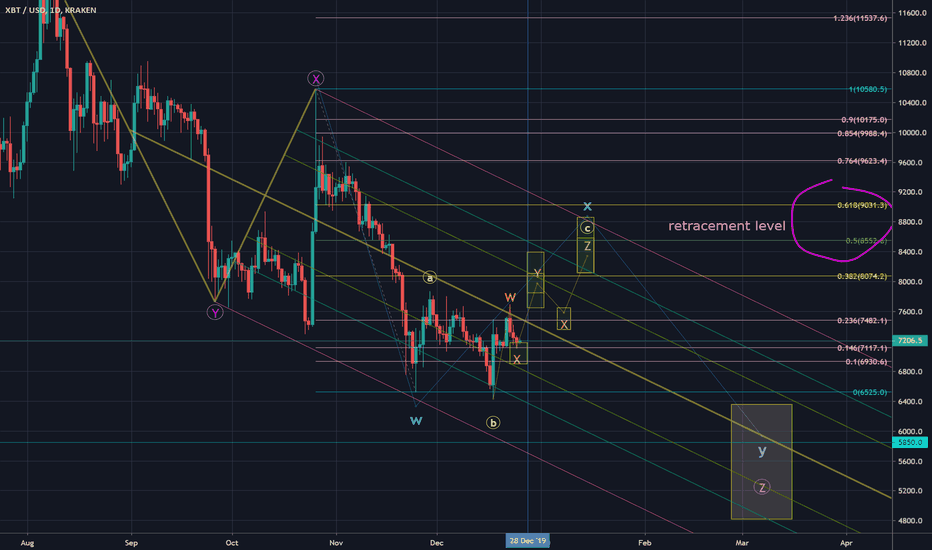

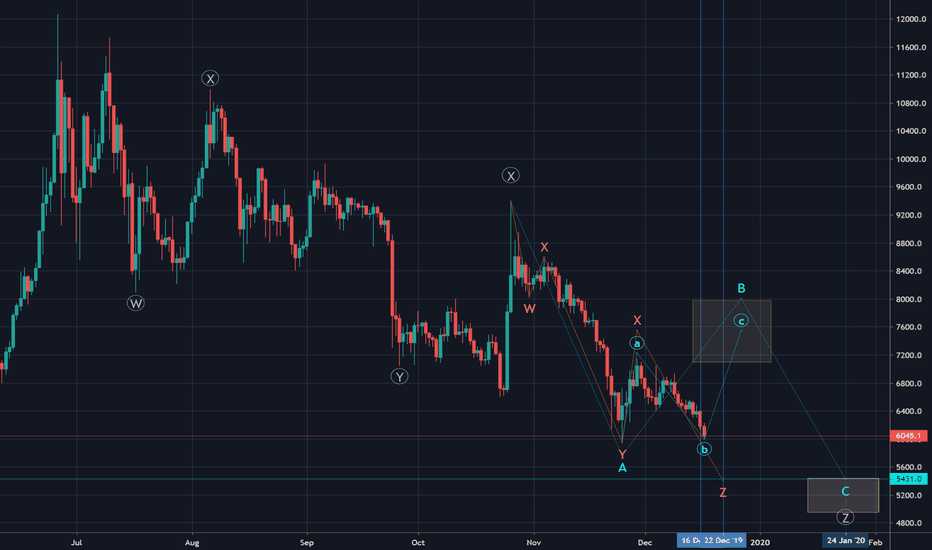

XBTEUR 1daychart: we're not in a zig zag... but a flat!This post is a correction of my previous post on the current wave postulating we're in a zig zag.

The proportions indicate clearly a flat, though wave A seems to contain 5 waves up.

Flat or zig zag, both will end with a 5 wave (up in this case).

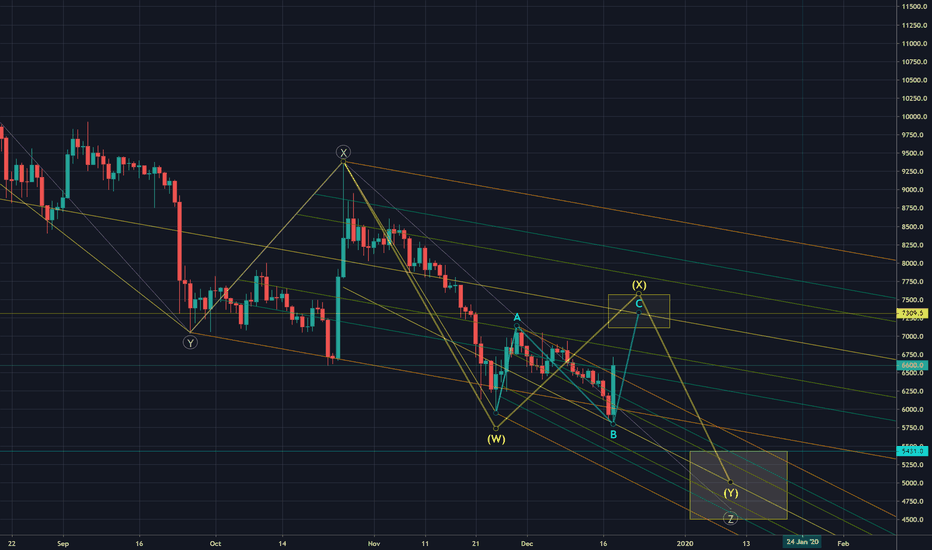

BTCEUR 1D chart: which scenario?Which scenario is most likely:

- the orange wave WXYXZ, where wave Z is 2/3 completed?

- the blue wave ABC, where smaller wave c is still to start?

Note the similarity of waves WXY with the sub-waves of Z is remarkable.

End of wave Z is plotted with the same proportions as waves WXY.

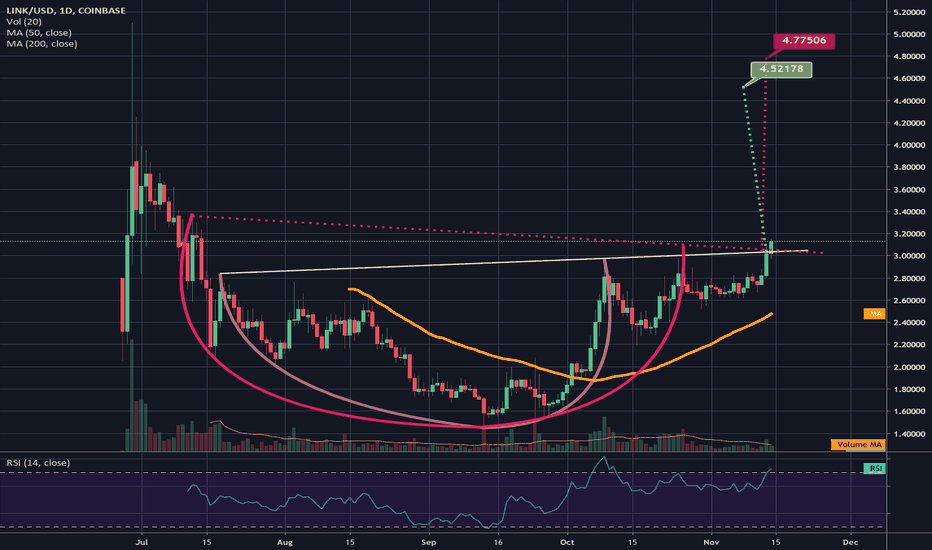

Link back above the rim of the cup&handle. Needs to close aboveIf we can get the current 1 day candle to close above the rimline and then have the followup 1 day candle to confirm the rim as solidified support we should finally see the breakout that I've been saying to keep an eye on in my ideas for at least 2-3 weeks now.

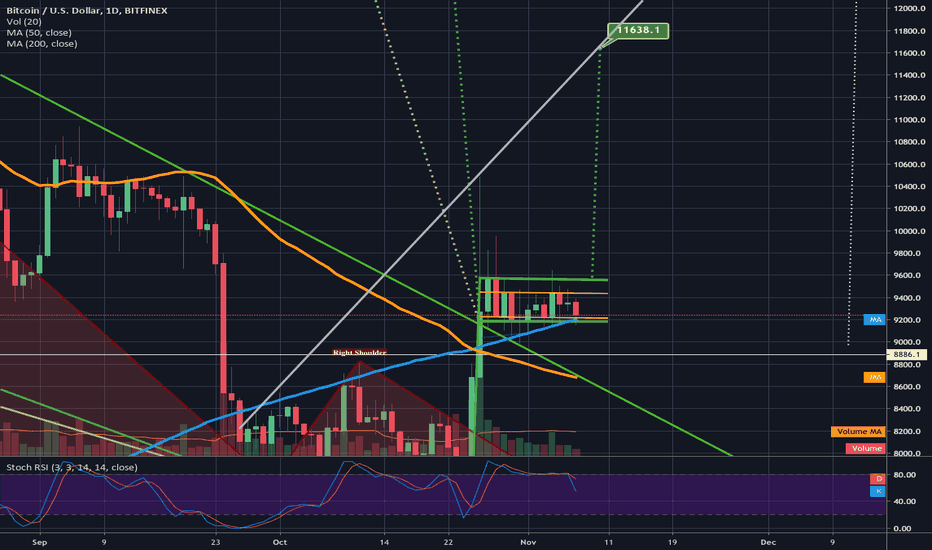

the dust has settled & only the 1 day bullflag remainsof the several potential patterns we've been watching over the past couple weeks, one by one has slkowly been eliminated from contention (most recently the adam and eve double bottom) and now we are left with only the standard 1 day bull flag. We just managed to confirm support on the 1 day 200ma after wicking below it which is clutch because flipping the 200ma back to solidified support at this point would likely mean the bull market will be put on hold indefinitely and we will swing back into a bear market so keeping support on the 200ma is key to saving the current bull market and having the current deathcross end up as a fakeout. If we do breakout the target for the bull flag breakout is the 11.6-11.7k area. I will leave this idea neutral and will await breakout or breakdown confirmation before I choose a side.

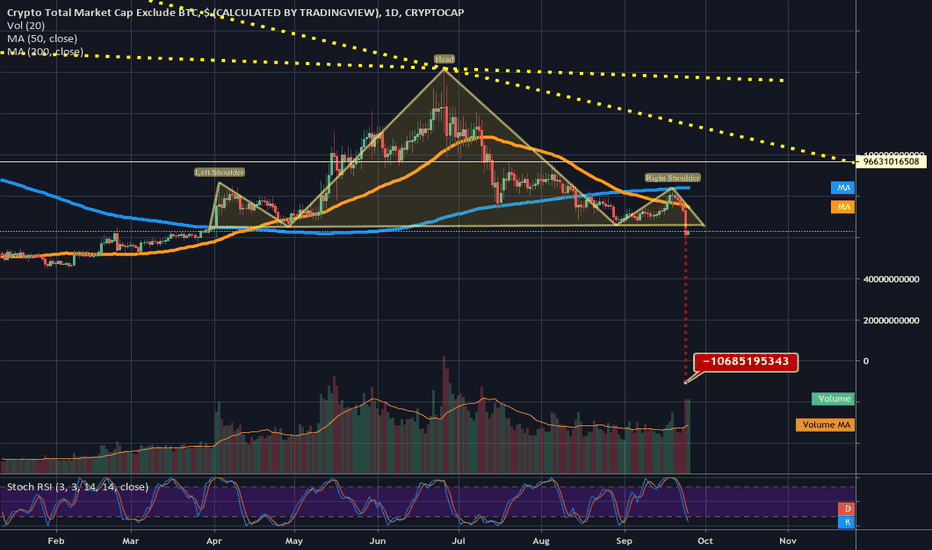

Why I still believe the Total2 chart h&s will be a fakeoutLook at the measured move drop target for the total2 1day chart head and shoulders pattern....no way is the entire alt market going down anywhere close to that far...that would involve all alt coins even top ones like ethereum, xrp, ltc, and bch going below zero. Of course h&s don have to hit 100% of their measured move target especially during a bull market but I think odds sill favor a fakeout...neutral for now though as we may see some more downside first.

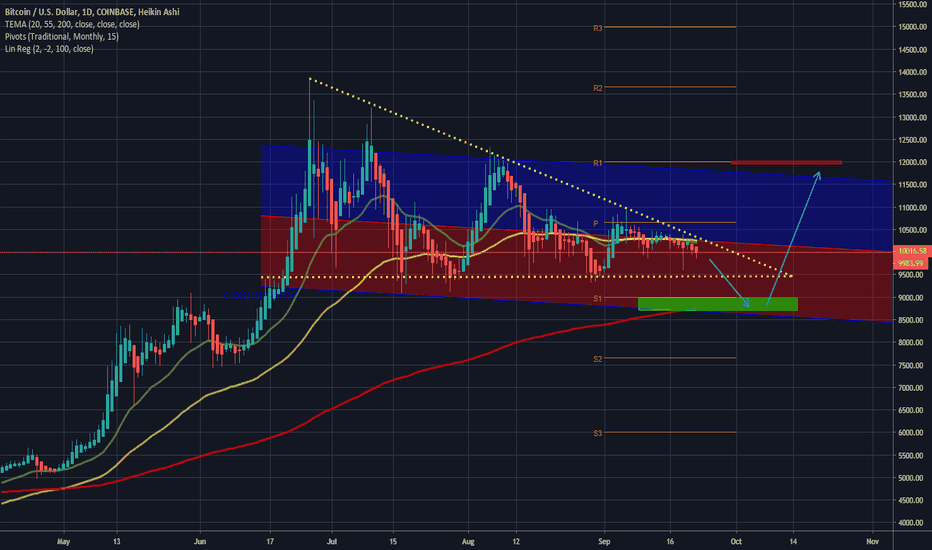

BTCUSD 1D - Expected Bear Trap/Pinbar into 1D 200EMA/Monthly S1COINBASE:BTCUSD

Price on the 1D chart is now just below 20EMA and 55EMA, also at the top of the triangle and mid-point of the channel, this suggests a move lower. Expecting a pinbar or bear trap into the zone that is between the monthly S1, the 200EMA and the lower part of the channel between 9000 and 8700. This would then be followed to move to the upside.

Not playing this move, waiting for the pattern to play out and direction to be confirmed on the 1 day chart, will then look for the next setup.