1govfxacademy

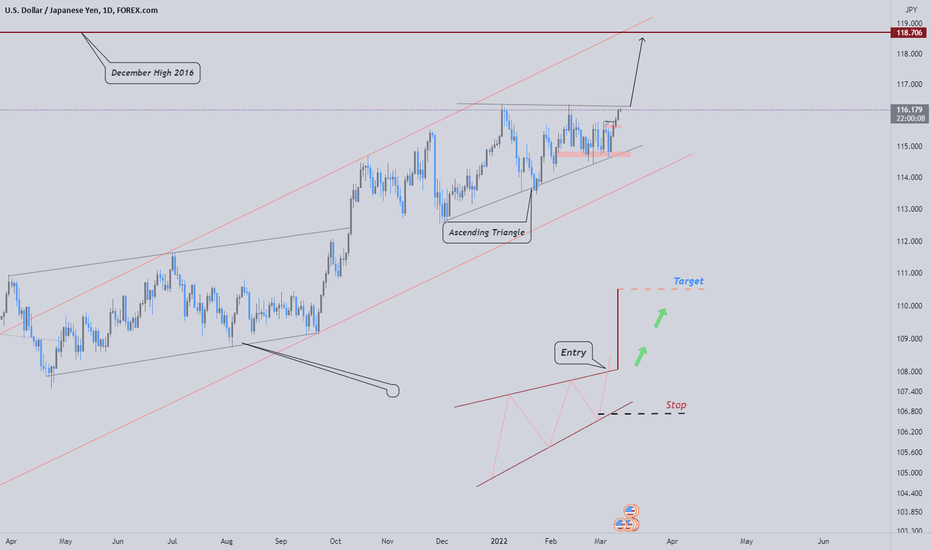

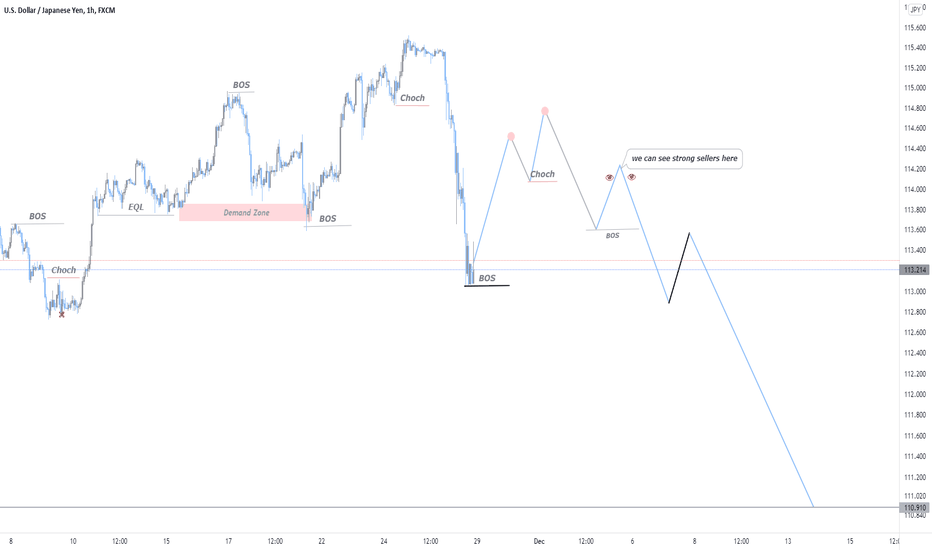

LONG POSITIONJAPANESE YEN, USD/JPY, US CPI, UKRAINE, FED, TECHNICAL ANALYSIS – ANALYST PICK

Japanese Yen may remain at risk to US Dollar despite Ukraine tensions

US inflation may continue surprising higher, keeping the Fed on the edge

USD/JPY faces an Ascending Triangle chart formation, watch for breakout

(FUNDAMENTALS)

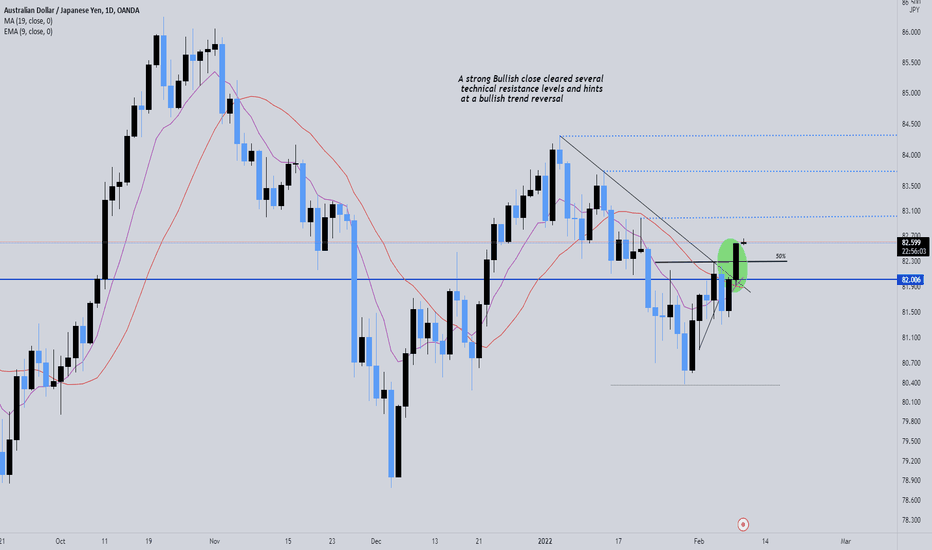

LONG POSITIONAUD/JPY hints at bullish trend reversal

The combination of Australia announcing a reopening of their international borders and a rebound of business confidence saw AUD/JPY as one of the strongest pairs yesterday. Price action also warns of a bullish trend reversal on the daily chart.

We can see on the daily chart that AUD/JPY opened at the session low and closed near its session high yesterday, clearing several technical resistance levels including the 19 and 9-day eMA and a descending trendline. Whilst this is against our initial bias (which failed to be triggered with a break beneath 81.28) it does put the counter-bias into focus which was discussed yesterday.

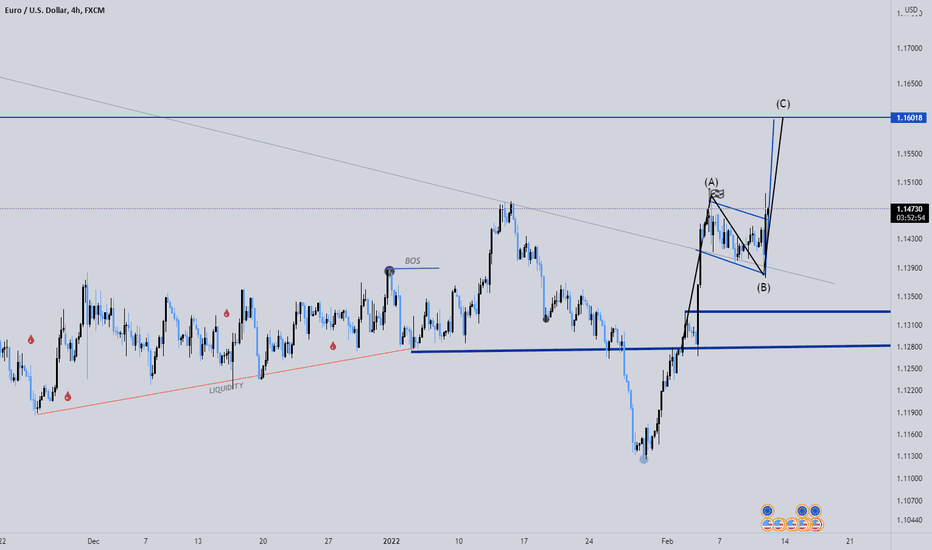

LONG POSITIONEUR/USD stayed within the flag after holding the support and reversed to the upside, breaking above the formation. However, price is approaching a resistance zone between 1.1482 and 1.1500. If EUR/USD can break above, price many be on its way to the flag target near 1.1575. First support is at the top trendline of the flag near 1.4455, then the bottom of the flag near 1.1376. If price breaks below there, horizontal support crosses at 1.1330.

The CPI data for January was strong, and markets were quick to recognize it! However, how much longer could inflation be sustained at this level? Will the Fed hike 50bps at the March meeting to help stem the rise of inflation? With the FOMC meeting a little over a month away, traders should also be prepared, just in case the Fed decides to “jump the gun” with an unexpected intra-meeting rate hike!

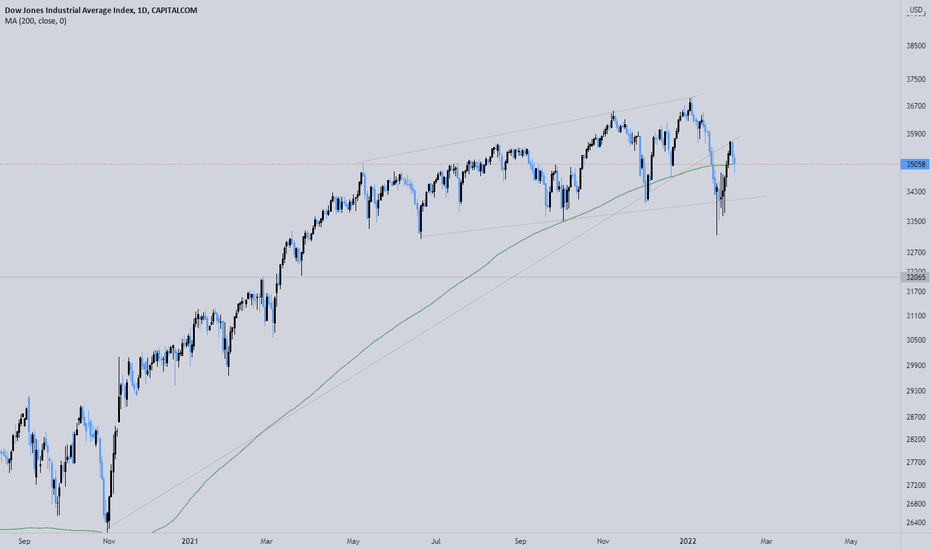

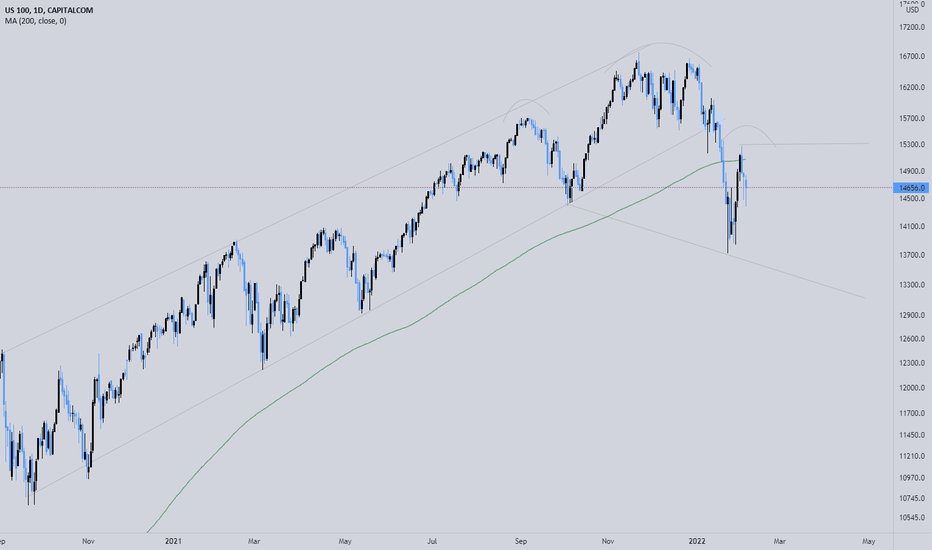

SHORT POSITIONThe Nasdaq 100 is starting to etch out a head-and-shoulders pattern like the S&P 500. This comes after breaking the bull channel dating to September 2020. It could be that price action is capped on the upside by the 200-day moving average just over 15k, but if not it isn’t viewed that the NDX will be able to climb over the underside parallel of the bull channel if the market is to eventually head materially lower.

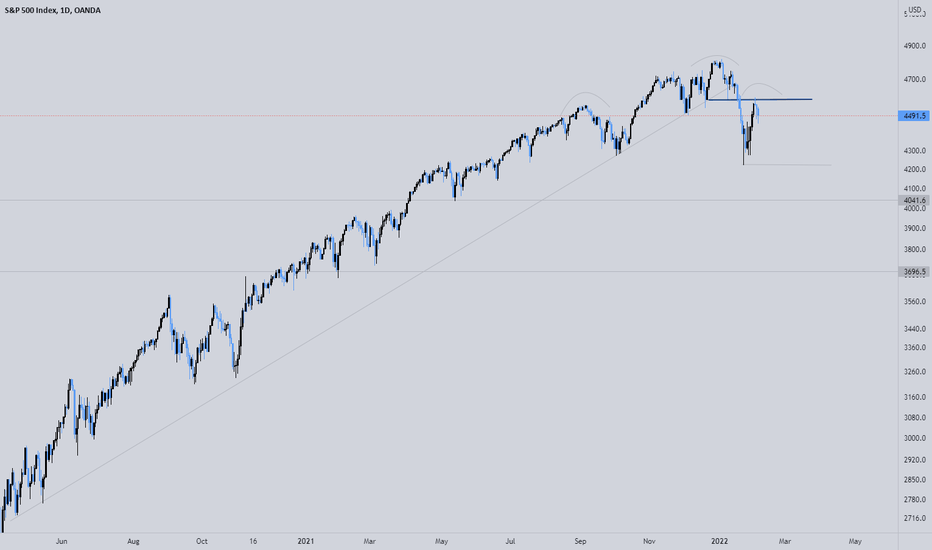

SHORT POSITIONThe S&P 500 continued its spring off recent lows, but found a bit of resistance around the January 10 low. What I will be watching for in the week ahead is if that recent high can maintain or at least maintain on a closing basis.

A close above 4595 could open up more room for further gains, but those gains will still be viewed through a skeptical lens as the broader technical picture has weakened quite a bit. In the week ahead we may not see the market have a meltdown, but rather bobble around as the market makes sense of the recent volatility.

In due time, though, risk looks high that we will see the market roll over in a meaningful manner that takes out the January low at 4222 by a wide margin. A head-and-shoulders top, with the left shoulder in September and head in January, could develop if we see recent highs hold or thereabout, creating the right shoulder.

It will take a sizable drop below the Jan low will need before triggering the pattern, but it is certainly a possibility . The right shoulder needs a little more time to mature for the sake of creating better symmetry on the pattern, hence the thinking that we may not be ready yet to roll over.

Overall, though, the general trading bias on this end leans neutral to bearish.

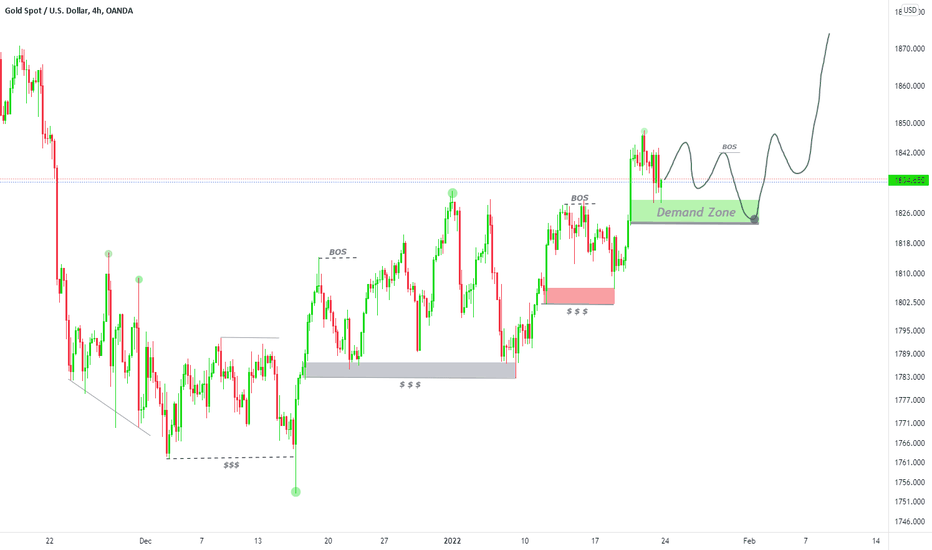

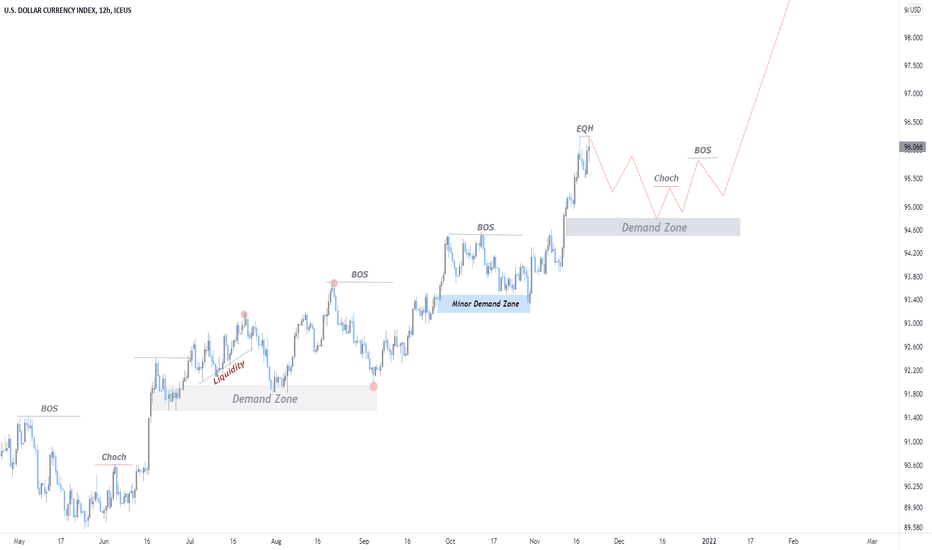

LONG POSITIONUS Dollar Technical Setup:

NEAR-TERM TECHNICAL OUTLOOK: TRADE SETUP ON DXY we can see some minor

pull back on the pair around $94.600 where we can see strong buyers.

If you find this helpful let us know your thoughts on the IDEA

Drop some feedback below in the comment!

Your Support is very much appreciated!

You leave a comment an, let us know how you see this opportunit

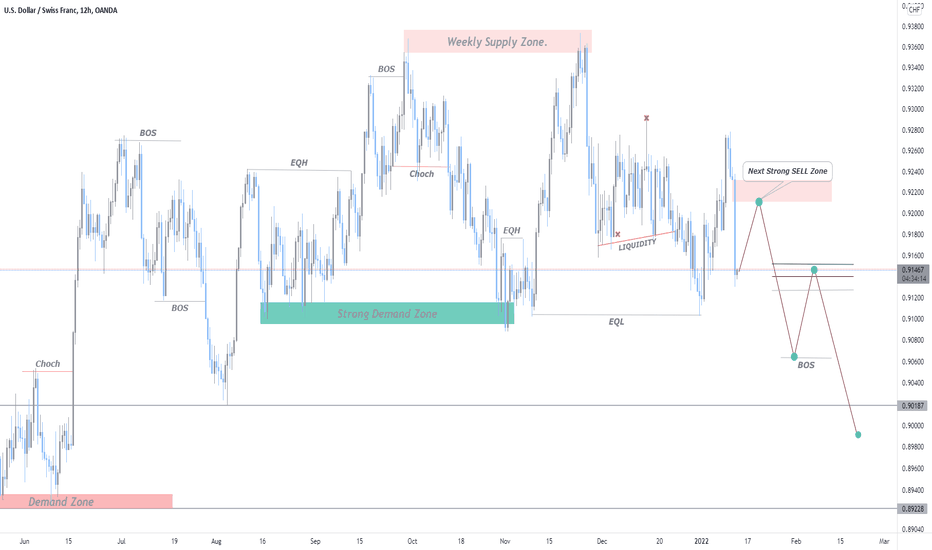

USDJPY SHORTUSDJPY HTF Structure has been changed and looking for sell as i expected.

Waiting for confirmation and sell..

If you find this helpful let us know your thoughts on the Idea by dropping some feedback below in the comment to let us know how you see this opportunity. Your support is very much appreciated!📊🙏🏾✨

Thanks

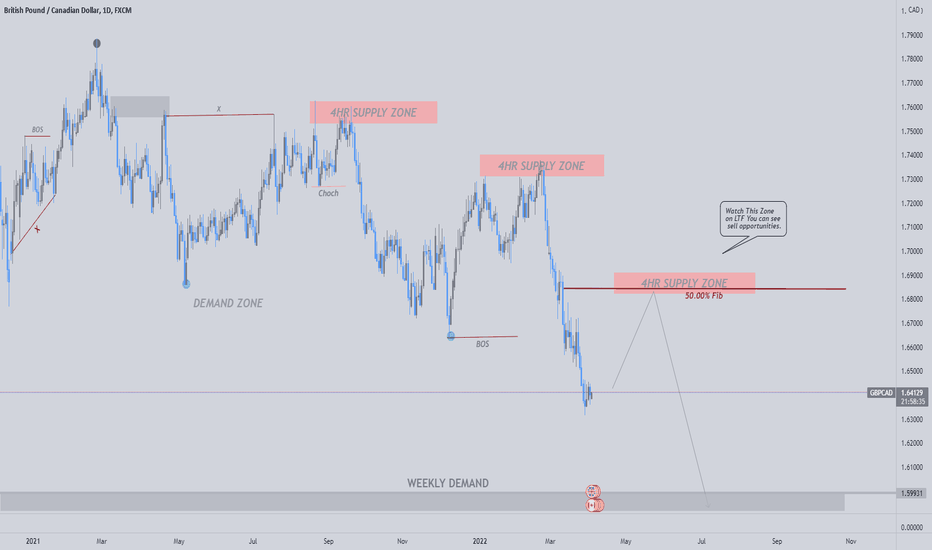

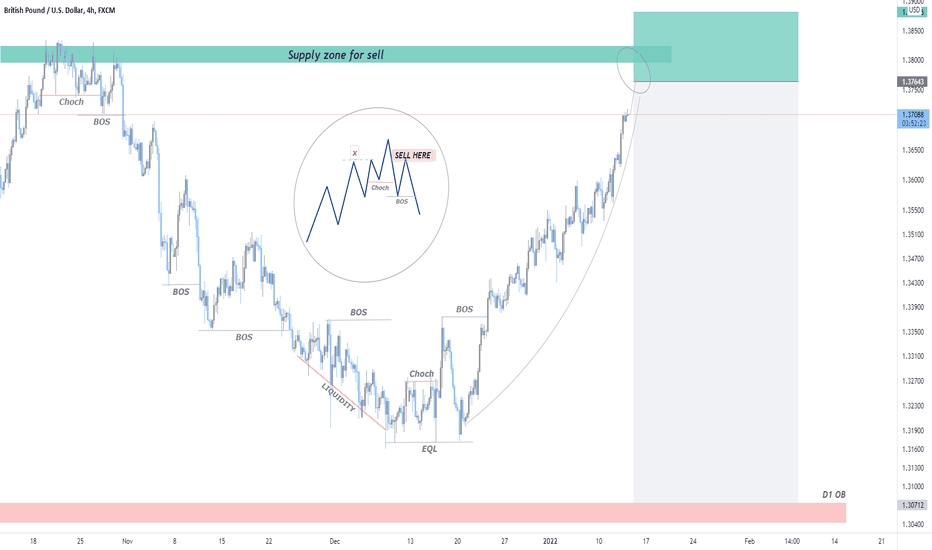

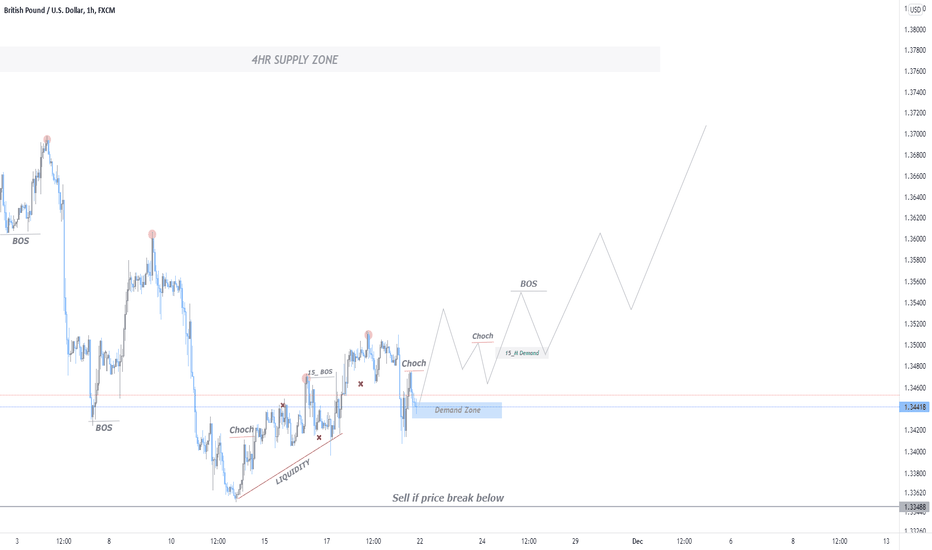

Market update UK BRITISH POUND TECHNICAL OUTLOOK: Short term buy back into $1.37 area to give us some LH confirmation before we see price lower.

If you find this helpful let us know your thoughts on the IDEA

Drop some feedback below in the comment!

Your Support is very much appreciated!

You leave a comment an, let us know how you see this opportunity