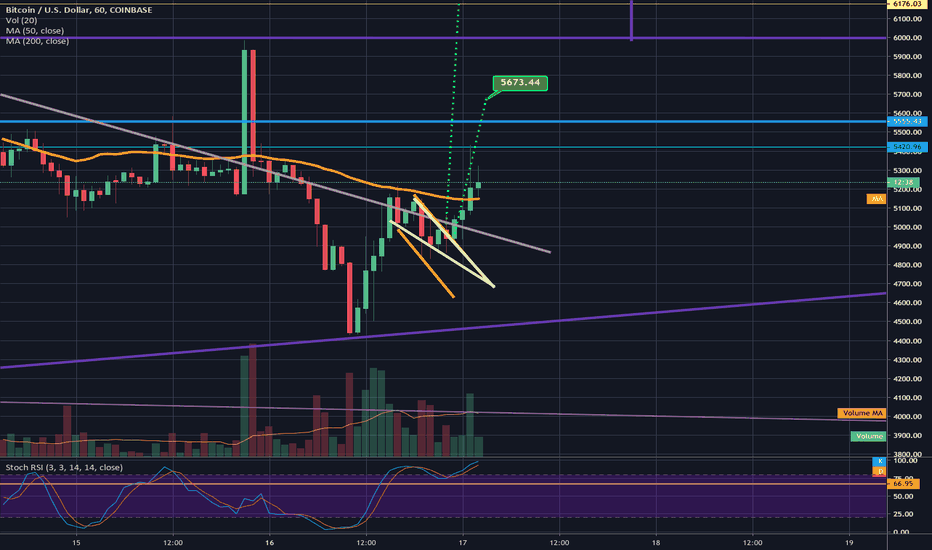

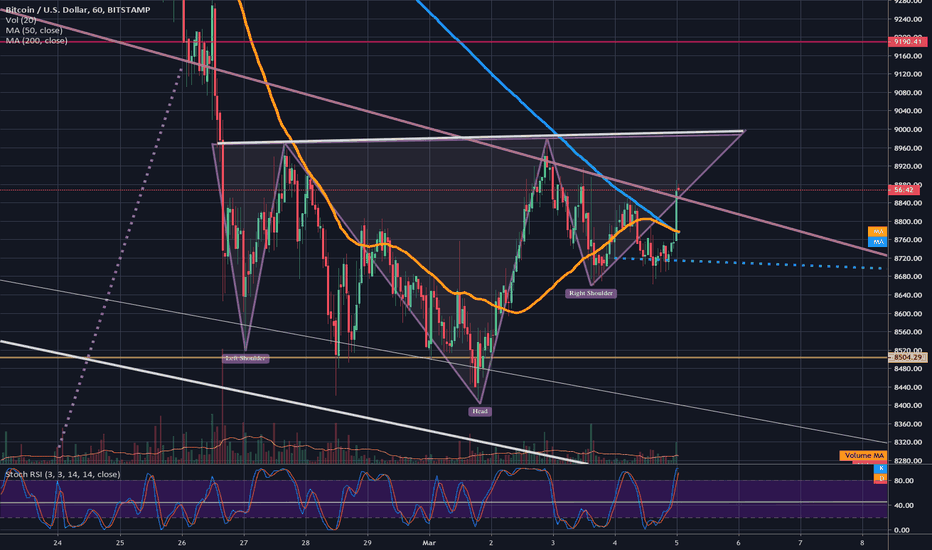

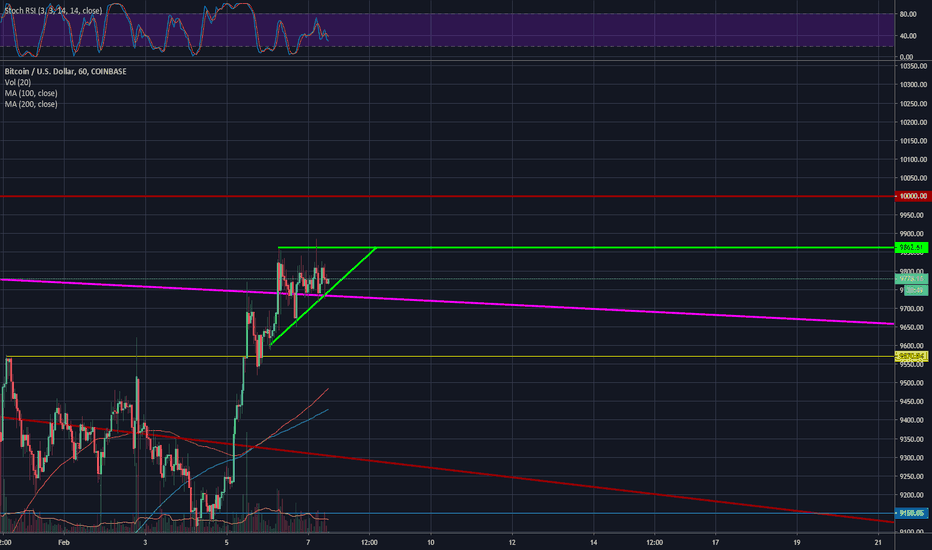

btcusd appears to be breaking up from 1hr inv head & shouldersif it confirms the initial target is 9374...which coudl be enough to trigger a breakout from the entire 1 day chart bull pennant which would then have a breakout target of 10.5k No full confirmation yet but probability is definitely favoring the breakout of at least the 1hr chart pattern

1hrchart

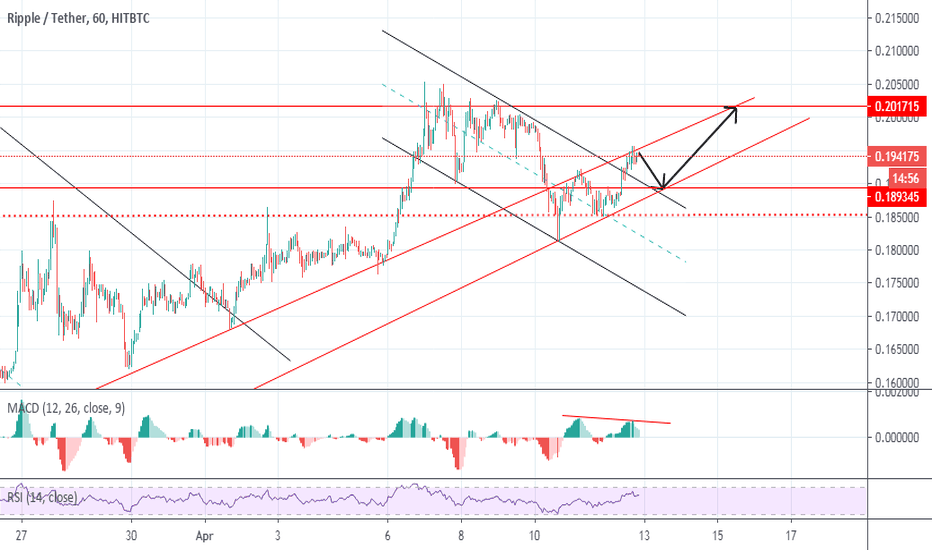

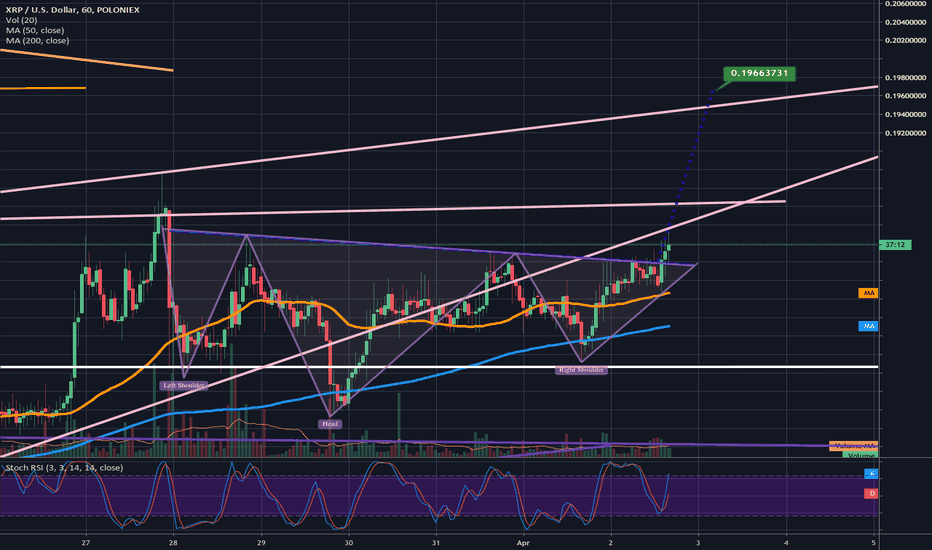

XRPUSD appears to be breaking up from 1hr chart inv h&salways wise to wait for bullish volume confirmation here but we can see the current 1hr candle retested the enckline and confirmed it as support...current resistance is the pink line directly above it if we can rise above that the inverse head and shoulders pattern will surely get validated. Initial target = 0.196 cents however should we reach that target odds are good that we will also trigger a breakout from the pink ascending triangle pattern on the 1 day chart which will inevffitably lead to more upside.

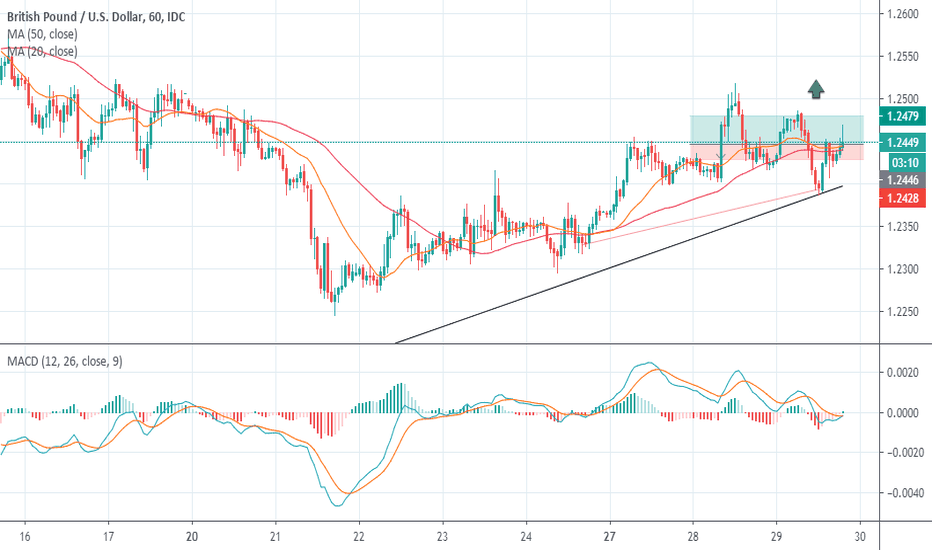

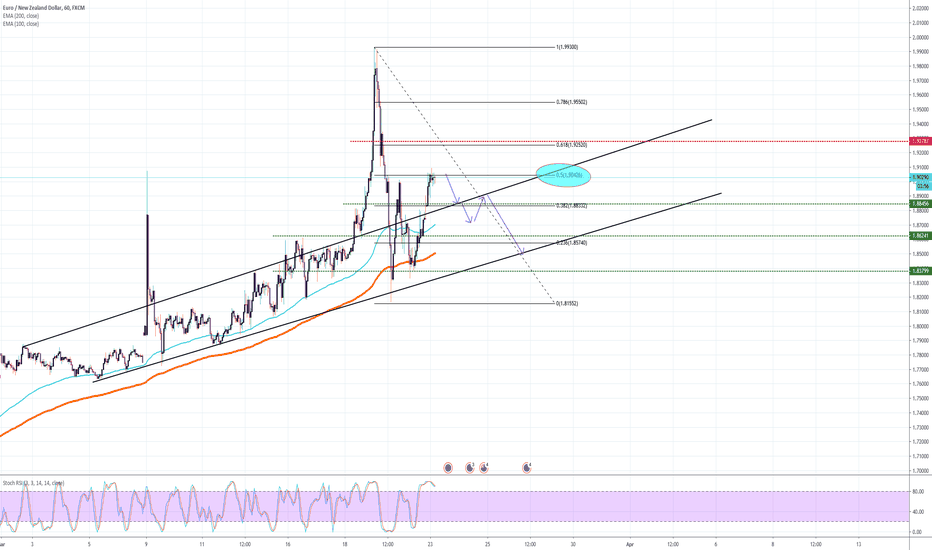

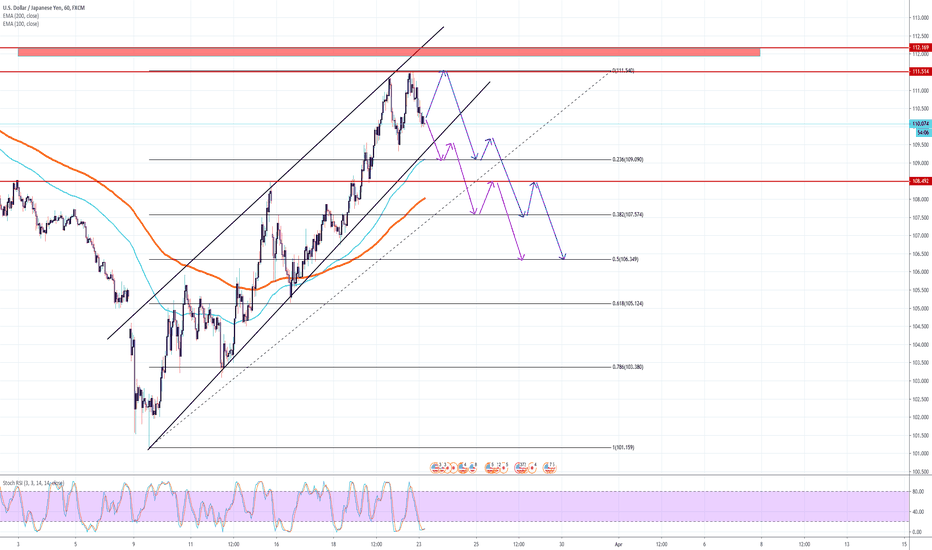

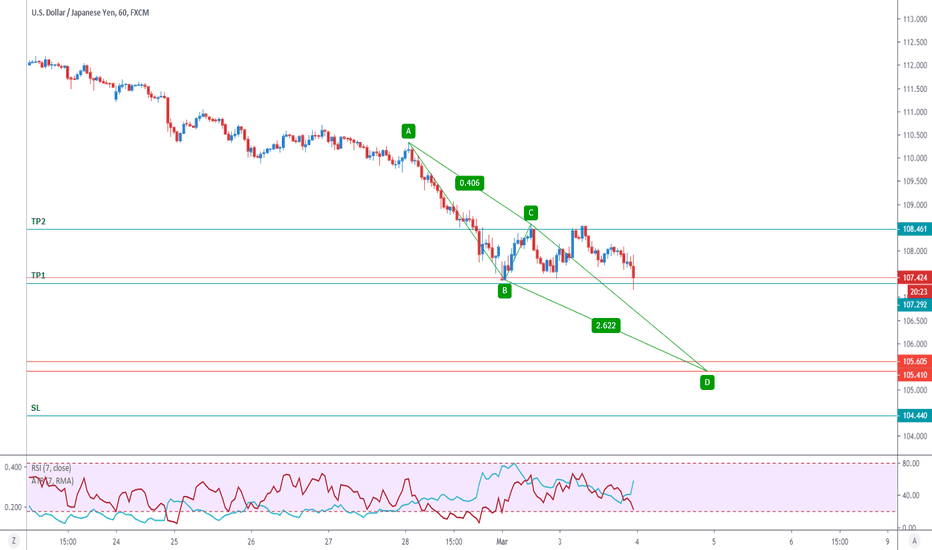

USDJPY 1h chart...possible reversalUsdJpy has made a strong push up and is now losing momentum. It has failed to make a higher high and I strongly fell will reverse soon, it might go for another retest but I highly doubt it. (stay updated on the coronavirus and the cure that is being made in the US )

Ascending Triangle on 1 hour - breakout up, but not 10k+ yet$BTCUSD Is trending up and breaking through resistance recently, currently in a brief pause with $9,850 the local resistance. My best bet is a break above $9,850 only to be rejected by strong resistance at $10,000. From there I think we keep moving sideways with downside support at $9,400. Fear/Greed is slightly greedy, but not excessively so. I'm thinking it needs to knock on the door of $10k a few times before breaking through.

I'm not a trader, I just like to watch and hodl so this is mostly to test my instincts. Not advice, not an expert. Let me know if I am way off missing something.

Guess there is always a chance of someone pumping/dumping too.

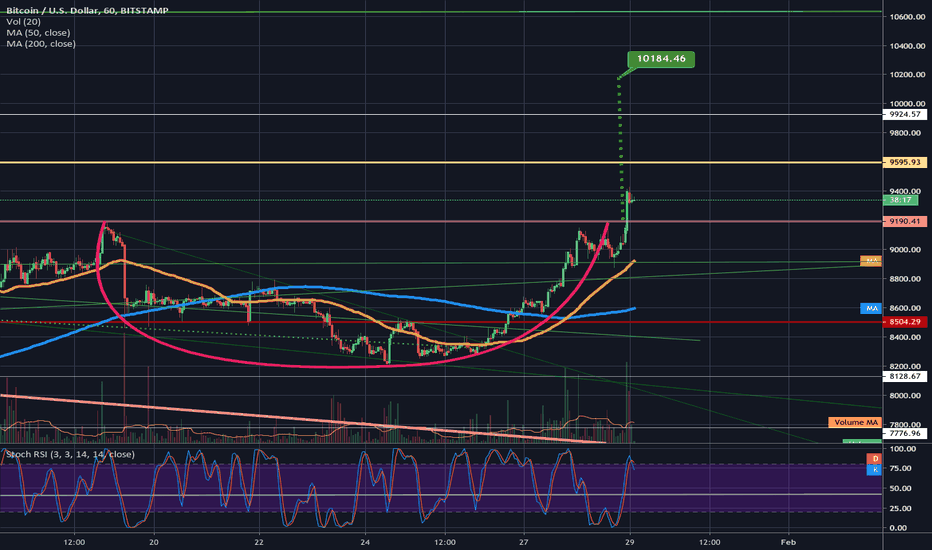

Double Top possibility eliminated Cup and Handle still in playThe double top possibility for the bears has been eliminated as Bitcoin has once against surged passed the double top zone into the 9300s. Leaving only the cup and handle left of the two options; a great sign for the bulls. of course we need to make sure that price action stays above the rimline(horizontal pink line) in order to trigger the cup and handle breakout...if we do trigger it however the target is just under 10200 which will have us well on our way towards the bigger falling wedges breakout target of 12k! The Cup and handle is a 1 hour chart pattern, the falling wedge with the 12k target is a 1 day chart pattern and speaking of the 1 day chart,. with this recent bullish surge the likelyhood of a 1 day golden cross sometime in february has increased exponentially meaning it is now very likely we will continue with the bull market . Of course any major massive crash in price could still change that but as of now its looking very very good...As far as this cup and handle pattern goes...I would definitely expect price action to come back down and try to retest the support of the rimline before finally triggering the breakout...but the way price action ahas been going the past few days it may just keep on continuing up with out the support retest.

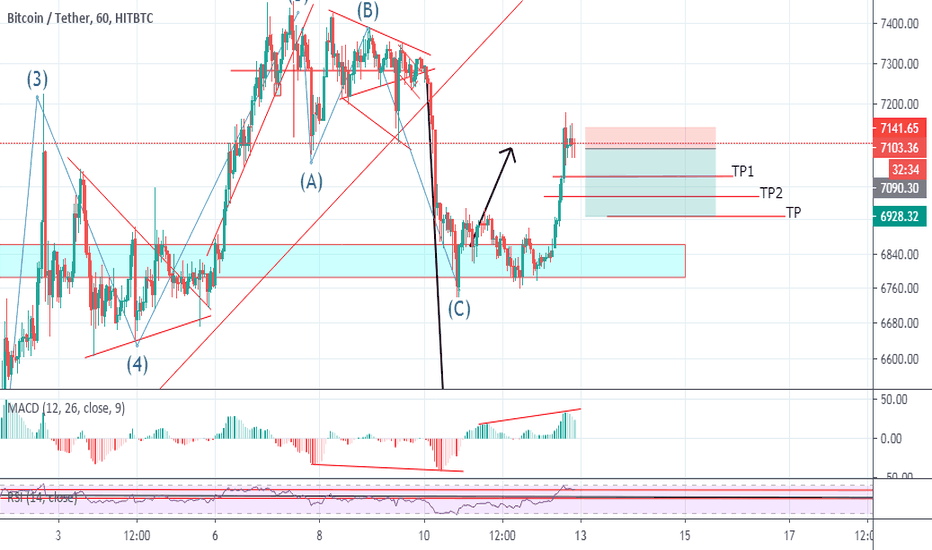

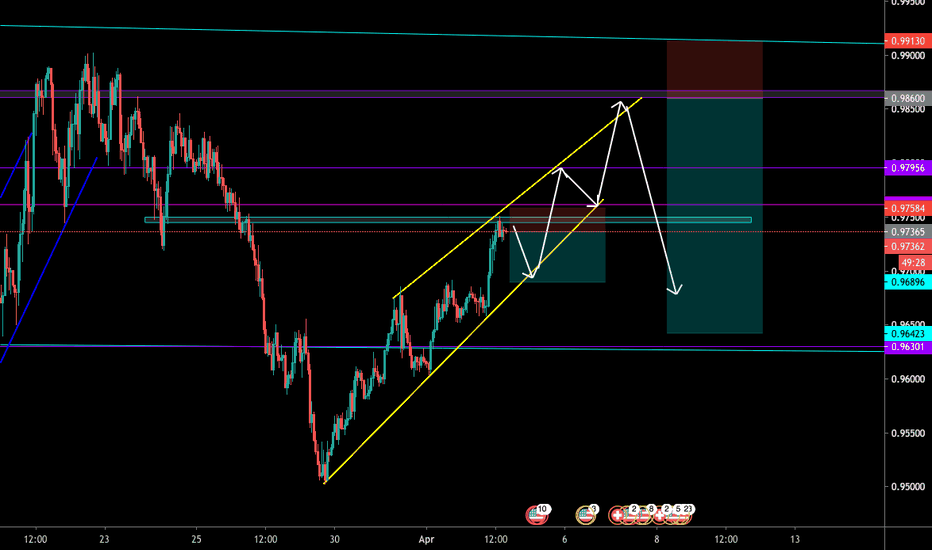

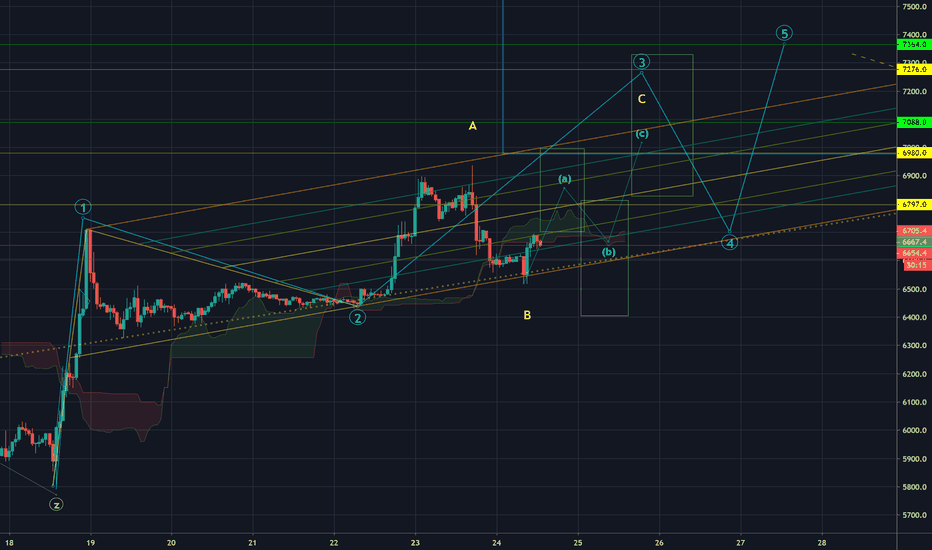

XBTEUR 1h chart: short term analysis 20121224Since we're in a big Flat correction, this final C wave of the big flat is a 5 wave up:

This analysis only about the 5 waves up.

Currently we're in wave C of wave 3 of the 5 waves up.

Wave 3 in itself is divided in sub (abc) waves.

The (abc) positions indicate the theoretical targets of each sub-wave. The rectangles indicate the maximum and minimum prices per sub wave.

However, no time analysis has been done. Thus do not consider the width of the rectangles nor the positioning in time of the waves.