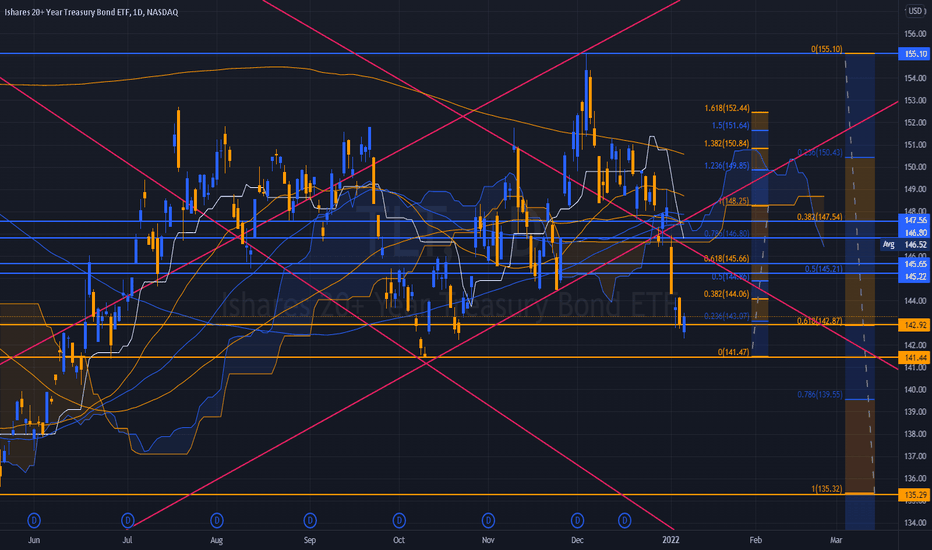

TLT - Daily / 3 Drives @ 149 and Fails

Currently the 10 Year Note Yield @ 1.725 -0.008 -0.47%.

What seemingly took a long time to begin to complete finally did.

__________________________________________________________

There is a great deal in the Wind with respect to TLT presently.

LArger Daily Gaps well below with Price Objectives extending to the

134 to 139 Levels - attendant Gap FIlls included.

It will depend on ZN's breakdown and whether Yeidls simply Sky to our

overhead Price Objectives 1.82 / 1.91 / 2.02 / 2.12 / 2.28 to 3.50

The Inflation Recalc will provide cover for a Retracement next week.

Exceeding the 2021 Highs will be a stark warning for the Bond Holders

who have been smoked for 1000 Bips in several Months.

Chasing Highs while the Inflation persistence was building in all Core

Data... generally unwise.

We have maintained that Wave 4 would be an Everything Must Go Sale.

SO far, so good, it's a THesis that time and again has proven to be correct

and how long it extends will depend on a number of factors.

We don't see a larger Equity Sell as supportive in a rising rate environment.

The SHort end of the Curve appears to be supportive as well.

_______________________________________________________________

McDonald's entered 2022 with 14.5% price increases across the Menu.

Big Mac's in Bonds give way to Filet o' Fish.

20yretf

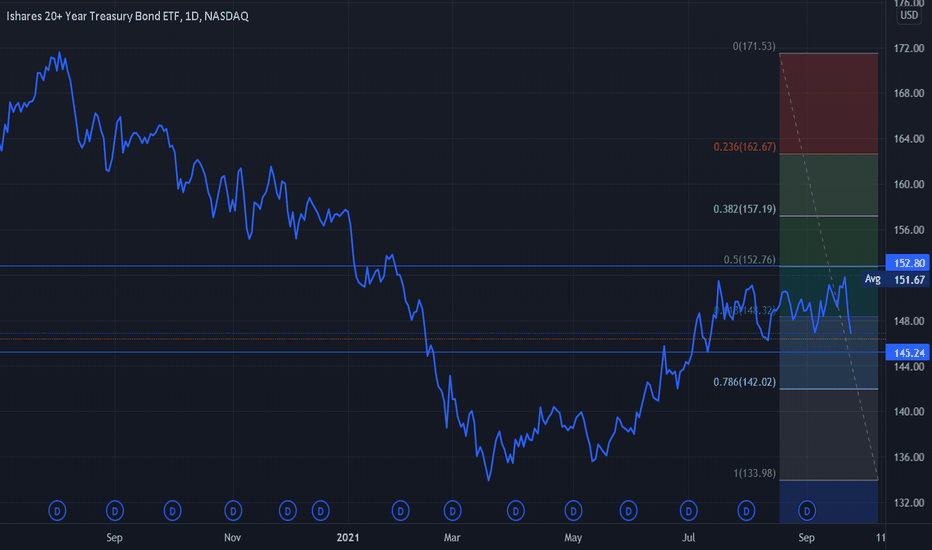

TLT - 145.25 and it's a confirmed Sell on >TFs.Book Clearing 9/27/2021

TLT Position Closures Today @ > 131.40 ZN

Closing 100 x 152 Puts

Closing 100 x 151 Puts

Closing 100 x 150 Puts

Open 100 x 151~

Open 100 x 149

Open 60 x 148

Open 60 x 147

Open 60 x 140

We will closely watch 145.24 Level for the Support Level, should it trade below the

trade is cast to 139s with a minor retracement to SELL the ETF.

Put ladders will be close in total and gains captured.

The 007's are yet to see the light and will Buy the Dip, we will oppose their ST Bid in

TLT.

Longer-term, TLT Structure looks Negative.

FED - What not to say this morning beginning @ 10 AM EST> 8:00 AM EST positioning will

provide the Micro Trend into Fed Reserve Bullhorns.

The attempt to calm the losing battle with YCC could see on more attempts at gaining the

upper hand.